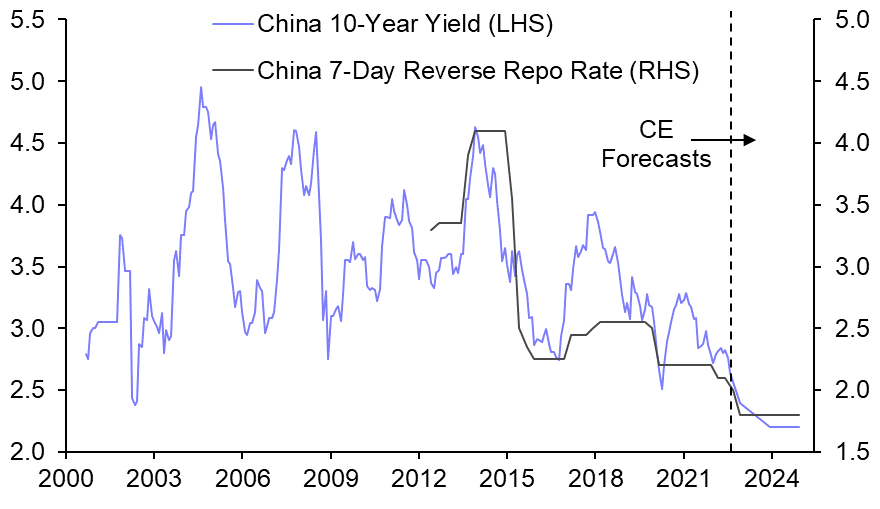

- We expect the PBOC to follow its recent policy rate cuts with further easing over the months ahead. This informs our decision to lower our forecasts for China’s 10-year government bond yield. But we don’t think further rate cuts, of the scale we anticipate, would have a major bearing on China’s stock markets.

- The PBOC unexpectedly cut some of its key policy rates last week amid weak activity data, and followed up with further cuts this week. With the central bank clearly lining up to provide support to China’s faltering economy, we now expect it to cut rates further in the coming months. (See our China service for more.) In this Update, we set out how our new policy rate forecasts affect our views on China’s bonds and equities.

- We now forecast China’s 10-year government bond yield to fall from ~2.65% currently to 2.40% by end-2022, and to 2.20% by end-2023 (previously 2.60% and 2.40%, respectively). That would take this yield down to historically low levels, largely as a consequence of the lower short-term rates. (See Chart 1.) But with the PBOC also keeping its quantitative credit controls fairly loose while demand for cash from the private sector seems to be weak, we suspect there will be some resultant demand for government bonds that will also push down on yields.

- Further rate cuts may not, however, move the dial much for China’s stock market. We think there are three reasons for this, which inform our view that equities in China will remain under pressure this year.

- First, the economic situation is China is bleak and we doubt that the additional 25bp of cuts to the 7-day reverse repo rate we anticipate will do much to improve it. Rate cuts will do little to address the near-term risk of shutdowns facing vast swathes of industry if the recent energy crunch in some areas spreads, nor the ongoing threat of periodic lockdowns due to the country’s zero-COVID strategy. Measures to help the housing market have been forthcoming but problems in that sector appear, to us, far from being resolved.

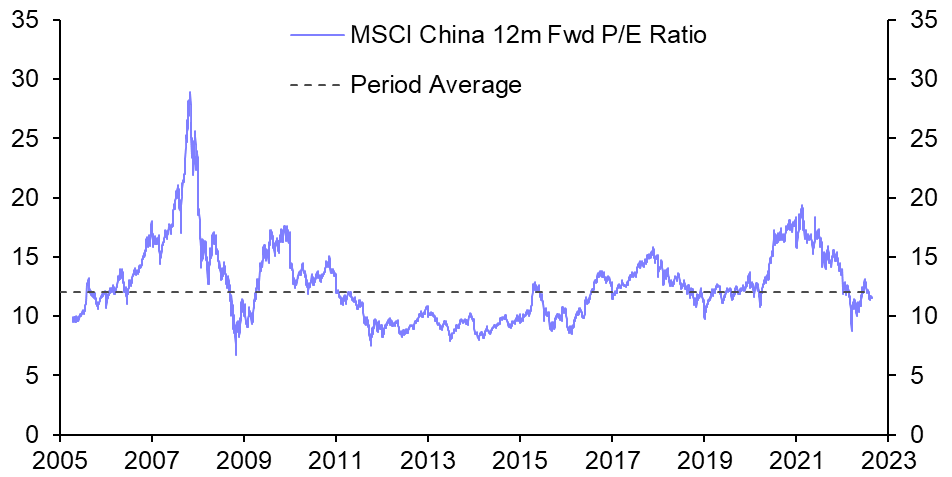

- Second, although we think long-term yields will fall in China, we think long-term real yields globally will remain high. So, while the valuation of, for example, the MSCI China Index has fallen sharply from its recent peak to below its long-run average (see Chart 2), we doubt it will bounce back anytime soon.

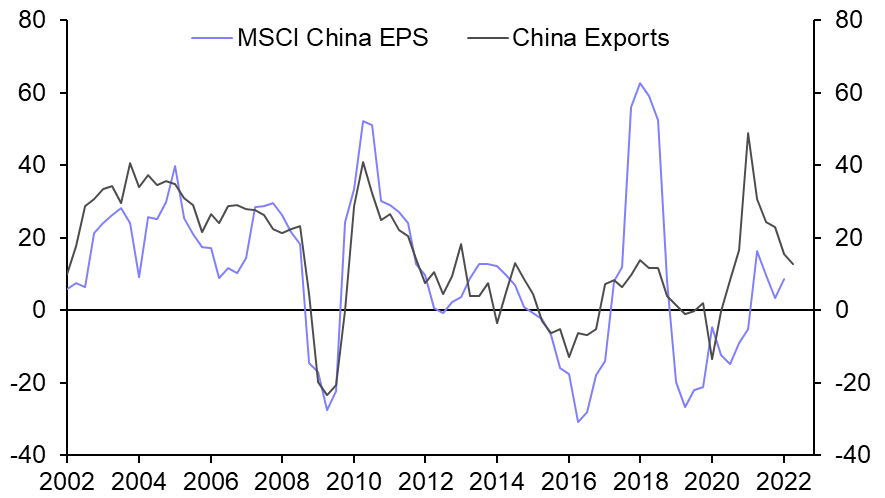

- Third, we doubt equities are set to get a boost from export growth. The renminbi has weakened ~1% against the dollar since the initial rate cuts and we think it will fall further. But against a backdrop of weak global economic growth and a shift in consumption patterns from goods to services, we doubt a weaker currency will prevent export growth from slowing, which bodes poorly for earnings growth in China. (See Chart 3.)

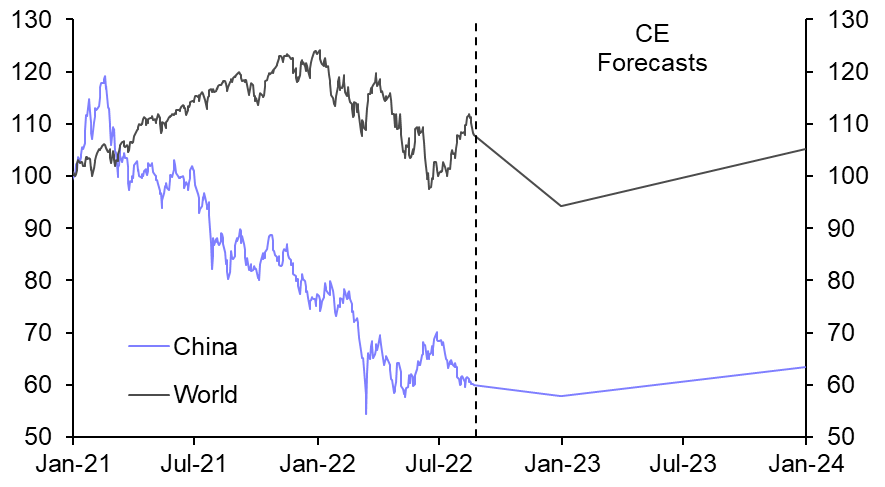

- These factors, as well ongoing concerns about the country’s regulatory crackdown and “decoupling” from the US, mean we are sticking with our forecast for the MSCI China Index to fall ~3.5% over the rest of this year, before recovering a little in 2023 as global appetite for risk rebounds. (See Chart 4.)

|

Chart 1: 10-Year Government Bond Yield |

Chart 2: MSCI China Price/12M-Forward Earnings Ratio |

|

|

|

|

Chart 3: MSCI China Index Trailing 12M Earnings Per Share & China’s Exports (% y/y) |

Chart 4: MSCI China & World Local Currency Indices |

|

|

|

|

|

Sources:Refinitiv, MSCI, Capital Economics |

James Reilly, Assistant Economist, james.reilly@capitaleconomics.com