How we help you

Economic insights that reveal tomorrow's value opportunities

The data and insights from Capital Economics help shape rigorous thought leadership for our firm and assist in building industry-leading investor confidence in our ability to identify investment opportunities and risk.

- Will McIntosh, Ph.D. Global Head of Research, Affinius Capital

Data Integrations

Power your models with our proprietary data

API Connect

Unlock deeper insights and enhance your workflows by connecting our trusted data directly to your systems. API Connect enables seamless integration of our proprietary data, forecasts, and indicators into your internal models and charting systems.

Excel Add-In

Access our real-time macroeconomic data, forecasts, and indicators directly within Excel. Empower your analysis, forecasting, and decision-making with an easy-to-use tool that gives you the most current data.

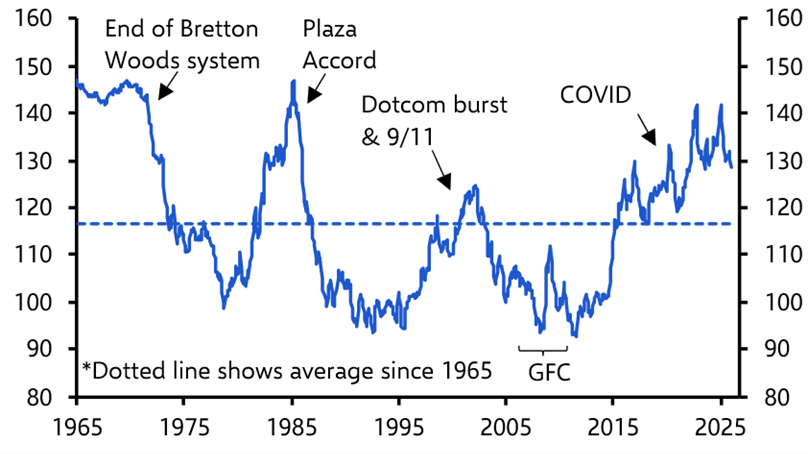

Custom Charting

Save time and communicate insights more effectively with bespoke chart packs and dashboards tailored to your business needs. Our expert economists deliver custom visuals that highlight critical macroeconomic data series and forecasts, empowering you to present complex information with clarity and impact.

Upcoming events

Gain the edge with exclusive in-person and online events

Channel partners

Partnerships that extend our platform to meet your needs

We integrate our economic intelligence into your preferred tools and systems. Our network of strategic partners extends our ability to deliver our capabilities to you, aligning with your workflows and providing solutions that directly address your business challenges.

Our Solutions

Choose your path to economic advantage

Gain immediate access to actionable macroeconomic intelligence. From rigorous analysis, to proprietary forecasts and direct economist interaction, we help you make smart decisions that outperform benchmarks.

Leverage our economic expertise for your specific challenges with tailored research and independent analysis. From credible impact studies to strategic counsel, our clear deliverables drive confident, informed decisions.