- Disruption from China’s reopening is fading faster than we had expected and we have revised up our forecast for growth there from 2.0% to 5.5%. This means that global GDP growth will be stronger than we had expected this year and energy inflation will be a bit higher. But we still think that the major advanced economies are heading into recession and inflation will fall sharply.

- We had expected disruption from China’s reopening wave of COVID infections to weigh heavily on activity well into Q1. But there is mounting evidence that the disruption is fading rapidly and there has been a shift toward more pro-growth policies, all of which means that we now expect China to grow by 5.5% this year compared to our previous forecast of 2.0%. (See our China Economics Update.)

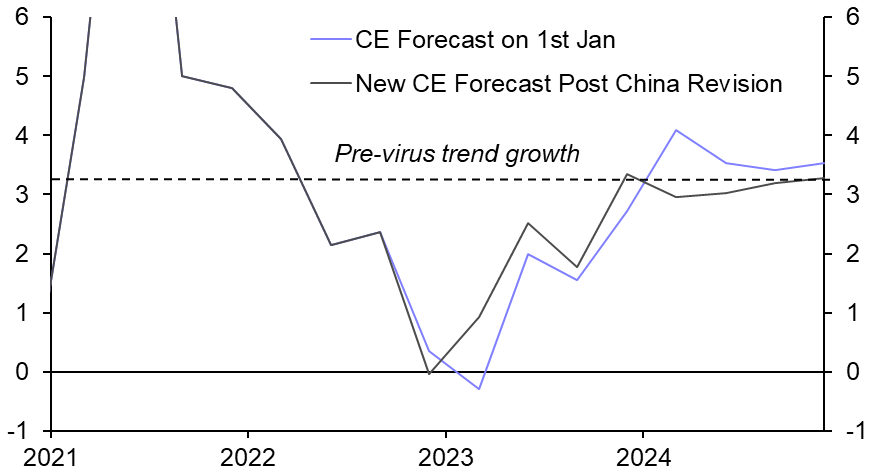

- The direct effect of this is to push our global GDP forecast for 2023 up from 1.5% to 2.2%. But as the recovery happens sooner, global growth will be lower in 2024 than we had previously anticipated. And for most of this year, growth will still be very weak by past standards. (See Chart 1.)

- The effects on activity elsewhere in the world will be limited since China’s recovery will be focused in services, which are not import-intensive. There will be positive ramifications for tourism in some economies including Hong Kong and Thailand and metals exporters will benefit from the revival of the property sector. But we still expect most advanced economies to fall into recession early this year, including the euro-zone and the US, although recent data from the former have struck a more positive tone.

- China’s more rapid rebound will influence global inflation, but perhaps not in the way you might expect. We disagree with the perception that supply problems in China have been a key cause of inflation in advanced economies, which instead mostly stemmed from a pandemic-related surge in demand for goods and then the Ukraine war. Accordingly, we doubt that either a reduction in supply due to COVID-related worker absences nor a pick-up in supply as the economy normalises will have a major impact on advanced economy inflation this year.

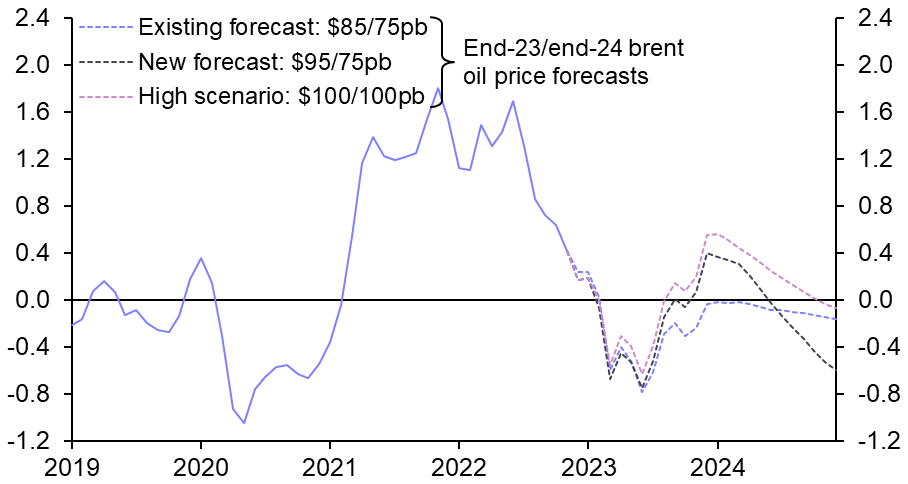

- However, the quicker pick-up in Chinese activity will boost the demand for energy and hence its price. We now expect the Brent crude oil price to rise to $95pb by the end of this year compared to our previous forecast of $85pb. (Our Commodities team will say more about this in an Update next week.) This implies that headline CPI inflation in advanced economies will be around 0.4ppts higher than we had previously assumed, at about 2.6% rather than 2.2% by year-end. (See Chart 2.)

- That is significant, but not sufficient to alter the picture of disinflation this year given that DM inflation is falling from a high rate of close to 8%. Central banks’ response will depend on how domestic core inflation is faring. If we are right that it will be falling as past policy tightening takes its toll, then slightly higher energy inflation will not be a major concern. But there is a risk that either China’s revival prompts a bigger rise in oil prices, such as that shown in Chart 2, or that the rise we anticipate stokes further increases in wage growth. In either case, central banks would be forced to keep interest rates higher for longer.

|

Chart 1: World GDP (% y/y) |

Chart 2: Percentage-Point Contribution of Fuel Inflation to Average Headline Rate in Major Advanced Economies |

|

|

|

|

|

Sources: Refinitiv, Capital Economics |

Jennifer McKeown, Chief Global Economist, +44 (0)207 811 3910, jennifer.mckeown@capitaleconomics.com