- The latest IPF Consensus survey showed a significant upgrade to 2022 European office rent growth expectations, largely due to strong rent outturns in Q2 and Q3 this year. A slowdown is expected in 2023, but in our view the consensus is still too optimistic given the deteriorating economic outlook.

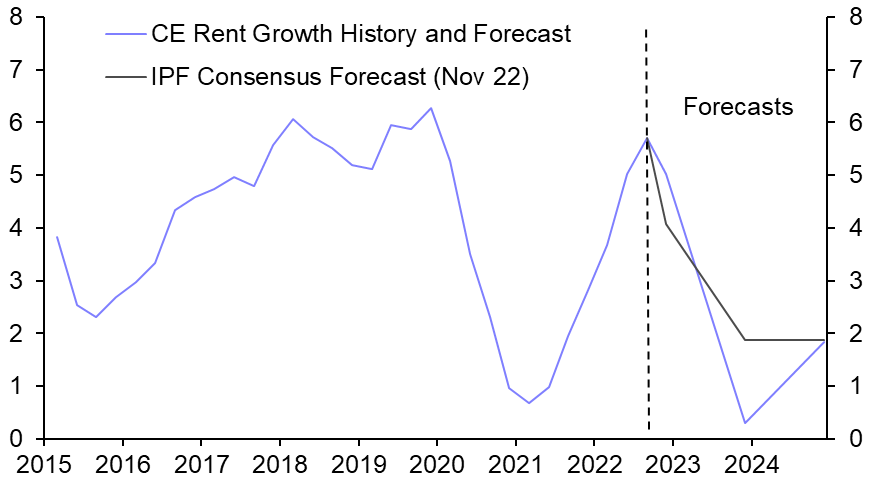

- The November IPF Consensus Survey showed an upgrade to forecasts for European prime office rents in 2022. Annual office rental growth in the euro-zone is now expected to be around 4% y/y, compared to a forecast of 1.9% y/y in the May survey. We were already more optimistic than the consensus in May, but have also revised up our 2022 forecast from 2.5% y/y to 5% y/y. (See Chart 1.)

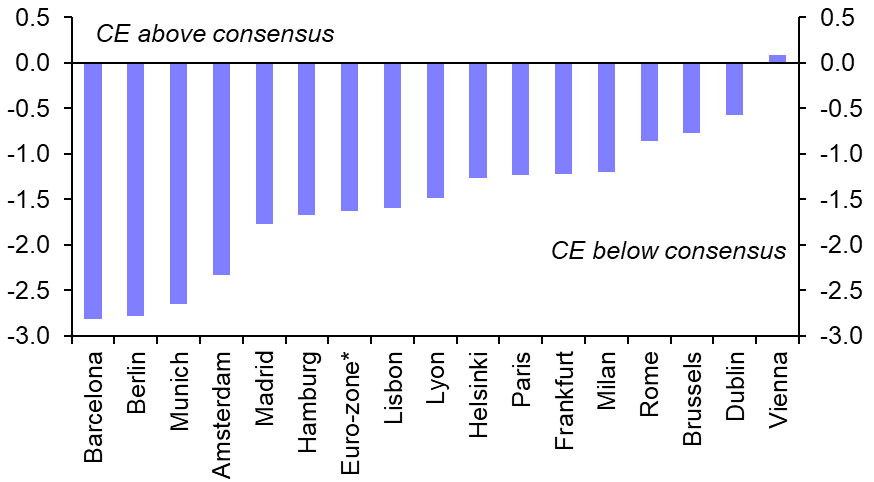

- The hefty upward revision to the 2022 consensus forecast is most likely due to the unexpected strength of recent data, rather than any significant exuberance about Q4 rent growth. Euro-zone office rents notched up gains of almost 2% q/q in Q2, and this momentum continued into Q3 with growth of 1.5% q/q. Indeed, one reason why our end-2022 forecast remains relatively more upbeat is that some respondents’ forecasts were made before release of the Q3 data. For example, our estimates exceed the consensus by more than 2%-pts in each of Milan, Brussels, Lyon and Prague – reflecting bumper Q3 rent growth in those markets.

- Beyond 2022, the consensus forecast was largely unchanged from the May survey, with average euro-zone rental growth of just under 2% y/y still expected in both 2023 and 2024. In May, we were slightly more optimistic than the consensus. However, we have since made significant downgrades to our 2023 forecast, owing to the weaker employment growth we now expect to take hold as much of Europe moves into recession. (See here, here and here.)

- This includes downward revisions to our outlook for euro-zone prime office rents, which we think will only rise by less than 0.5% y/y next year, before a 2% y/y rebound in 2024. (See here.) As a result, we are now significantly more pessimistic than the consensus about rent growth across almost all major Euro-zone office markets over 2023-24, driven mainly by our weaker 2023 forecast. (See Chart 2.) The variance is biggest in the German and Spanish markets, where the economic outlook is particularly bad, and where strong supply pipelines will further weigh on rental growth.

- Overall, the 2023 consensus forecast implies a moderation of rent growth in the next year. But we think the slowdown will be even sharper than this. This weak rental growth, combined with further rises in property yields, underpin our view of a 10-15% peak-to-trough fall in euro-zone all-property values.

|

Chart 1: Euro-zone Prime Office Rents (GDP-weighted Average, % y/y) |

Chart 2: Net Difference in Euro-zone Office Rental Growth Forecasts (2023-24, %) |

|

|

|

|

Sources: IPF, Capital Economics |

Sources: IPF, Capital Economics, *GDP-weighted average |

James McMorrow, Property Economist, james.mcmorrow@capitaleconomics.com