Long-term forecasting is perilous ground for economists. Predictions of what will happen in the long run tend to revert to the mean, implying that trend growth returns to an average recorded over the previous several years.

It’s another way of saying that tomorrow will look a lot like today. It won’t.

Economies are complex systems in constant flux. Some economic changes are cyclical, but many are structural – and these don’t get captured by the straight-line approach to long-term forecasting. The world several decades from now will be very different to the one anticipated by forecasters.

Find and focus on the structural shifts

The trick to long-run forecasting is to identify those structural issues that will shape economies over the given timeframe. For example, climate change – and actions to mitigate its effects – is perhaps the central challenge of our time, and the green transition will have major implications for several commodity-producing economies in the coming decades. But for most economies, the overall macro consequences will probably be small.

Instead, our newly published Long Run Economic Outlook for 2024 highlights four key factors that we do think will fundamentally shape the global economy over the next 25 years. (We’re holding a Drop-In on the report this Thursday at 1000 ET/1500 GMT. Register here for the 20-minute online briefing.)

The first is the AI revolution. Our analysis largely supports the case for AI optimism. But it also shows how new technologies take time to be widely adopted. Any boost to productivity growth is therefore only likely to come through later this decade or in the early 2030s. More fundamentally, the scale of the subsequent boost to growth will vary substantially between different economies. In the US, we estimate that the AI revolution could lift productivity growth by up to 1.5%-pts a year in the decade after widespread adoption. In contrast the impact on the euro-zone and China will be significantly smaller and, for the next decade at least, the effects on most emerging markets will be negligible or even negative.

Global fracturing will also play a major role in shaping the long-term outlook. It is now widely accepted that the era of hyper-globalization is dead, but there is no agreement on what will follow. Our view is that the world is splitting into two blocs: one that aligns primarily with the US, and another aligned with China. Policy decisions and economic outcomes within these blocs will be shaped increasingly by geo-political considerations.

Fracturing as the big influencer

The form that this fracturing takes is probably the single most important factor affecting the global economic outlook over the next 25 years. It is also perhaps the most uncertain. Our forecasts assume a relatively benign form of fracturing concentrated primarily in sectors where national security concerns are greatest. The disruption in areas like batteries, biotech, data and chip-making will be wrenching. But this is not globalisation in reverse.

However, more malign forms of fracturing are possible. The blocs themselves could fragment, perhaps because the US turns inwards and embraces isolationism. This would undermine the US bloc’s current advantages of size and economic diversity. A second more malign form of fracturing would arise if it broadened beyond areas of national security, or if the two blocs came into direct conflict. In any of these cases, the hit to global activity would be substantially greater than we have assumed in our forecasts.

Irrespective of its form, one of the key conclusions of our analysis is that China has more to lose than the US from global fracturing. This is important because it will compound existing structural challenges facing China’s economy. This is the third key factor behind our long-run forecasts.

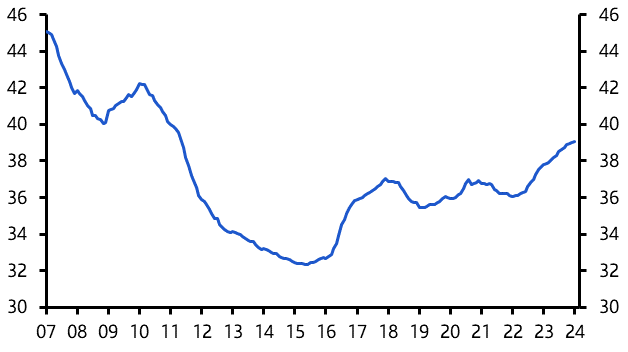

China’s demographic problems are well-documented – its population is contracting and we forecast it to fall by 10% by 2050. But the economy is also reaching the limits of its high-savings, high-investment model. Investing up to half of GDP is difficult at the best of times, but particularly when China’s capital stock is now relatively advanced for its level of development and the state is playing an increasing role in allocating capital. (See Chart 1.)

|

Chart 1: State Sector Share of Fixed Investment (%, 12m rolling) |

|

|

|

Sources: CEIC, Capital Economics |

This makes generating returns on investment extremely difficult. The current problems in China’s property sector are the most visible manifestation of this challenge. The counterpart to this is a drop in productivity growth which, when combined with demographic pressures, will continue to pull down long-run potential growth. By the end of this decade we think trend GDP growth in China will have dropped to around 2% a year.

The final theme of our long-run analysis is greater inflation volatility and higher real interest rates. The surge in prices in 2022-23 led many to declare the start of a new era of higher inflation. Our view is that, paradoxically, the sheer scale and speed of the rise in inflation over the past couple of years has lowered the chances of a prolonged period of higher inflation over the medium term. This is because it has spurred central banks into action.

The threat of higher inflation over the long run was greatest in the immediate aftermath of the pandemic when the Federal Reserve was embracing Flexible Average Inflation Targeting and others were also flirting with the idea of diluting inflation targets or adapting how they are interpreted. The experience of the past 18 months has reasserted the central importance of maintaining price stability.

Instead, we envisage a period of greater inflation volatility as the global economy becomes subject to more frequent supply shocks, including from fracturing and climate-related extreme weather events. Inflation is likely to average 2.0-2.5% in major advanced economies over the next couple of decades but with greater volatility around that average. The era of quiescent inflation is over.

Meanwhile, equilibrium real interest rates are likely to be structurally higher over the next decade or so. We expect them to average 1.75% in the US, 1.0% in the euro-zone and 1.5% in the UK in the 2030s. This predominantly reflects a rise in productivity growth and so is unlikely to cause significant problems in the real economy: they are a symptom of faster growth rather than a cause of economic weakness. However, they will create a radically different environment for investors. The “search for yield” will be easier in the next couple of decades than it has been over the past 10 years or so.

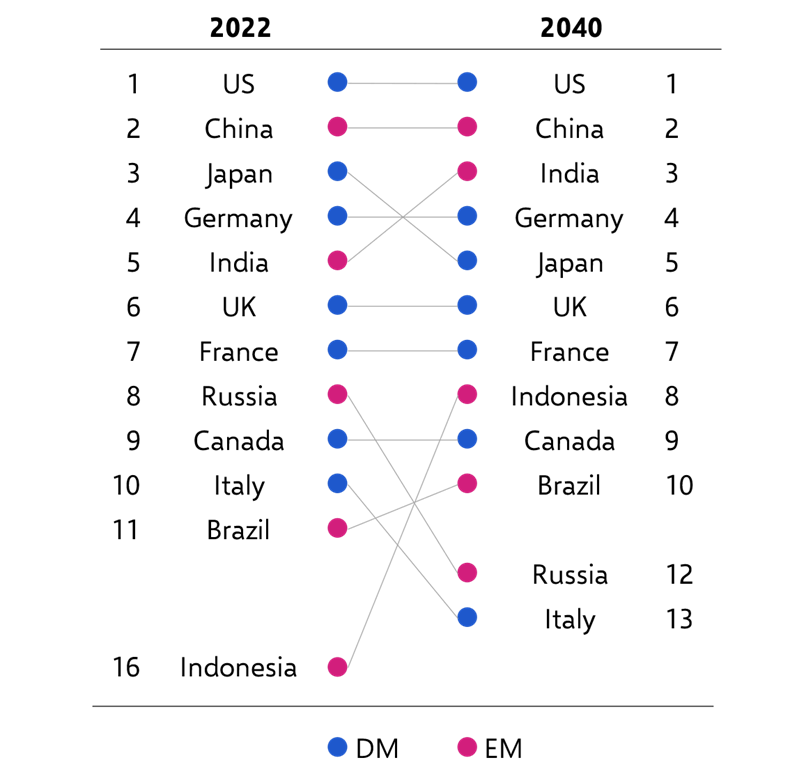

These themes feed important conclusions. Most strikingly, we do not expect China to overtake the US as the world’s largest economy when measured at market exchange rates. (See Chart 2.) It will get closest towards the end of this decade but then fall away as structural problems continue to bite and the AI revolution propels US growth. In advanced economies, the era of American exceptionalism will continue. We expect the US to continue to outperform the euro-zone over the course of our forecast horizon. We forecast that US GDP will grow by a cumulative 150% over the next two decades, compared to just 75% in the euro-zone.

|

Chart 2: CE World Rankings by Nominal GDP at $ Market Exchange Rates |

|

|

|

Source: Capital Economics |

Changing risks

Finally, the nature of risks facing the global economy will alter. Many argue that the threats facing the world economy are now greater than ever before, or that the outlook is particularly uncertain. In truth, the outlook is always uncertain. Rather, it is the form of these risks that is changing. The major event of the past 20 years was the Global Financial Crisis, which brought the global economy to its knees and left 15 years of perilously weak growth in its wake. However, the financial system is now on a stronger footing and private sector balance sheets look healthier. We expect that the bubble around AI stocks will continue to inflate, but do not expect that its eventual bursting will cripple the real economy.

Instead, the bigger risks over the next decade or so lie in the public sector, with governments in most major economies needing to undertake some fiscal repair work. The extent to which they do this voluntarily, or are forced into action by the bond market is a major uncertainty. More generally, most of the major risks and questions surrounding the long-term outlook are political rather than financial in nature. Will Europe have the political will to keep the euro-zone together? (Probably.) Will political and institutional shifts mean that the decades-long squeeze on labour’s share of income reverses? (Possibly, but on balance unlikely.) And most importantly, what form will US-China fracturing take? (Highly uncertain.)

The interaction between politics and economics is more important than ever.

What you may have missed:

Our preview of the Spring Budget shows the size of tax cuts that the UK Chancellor may announce, based on our proprietary model for estimating his fiscal headroom, while our election preview argues that, regardless of which party wins in the expected election this year, fiscal tightening looms.

Our US election page houses all of the key analysis related to the macro and market consequences of November’s vote. The latest explores how Japanese exporters would fare against a blanket 10% tariff on goods flowing into the US.

Matthew Pointon and Giulia Bellicoso explain in the latest UK Commercial Property Outlook why this year’s recovery will be only muted. Join our Drop-In on the UK market outlook this Wednesday at 1000 London/1800 Singapore.