Trump's second term

Take a trial of our services to see how our economists are helping global institutions navigate the macro and market implications of the second Trump administration

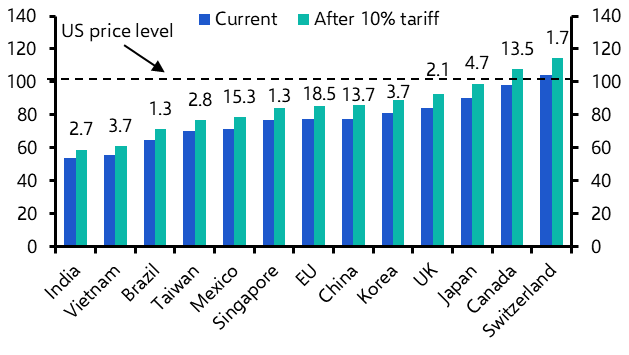

Trade Hub – Data tools to navigate Trump's tariffs

Tariff models, high-frequency trade stress indicators and more to guide you through the volatility

Trump's second term: FAQs

See more key reports below, and click the green button for full coverage.