- The cost-of-living crisis will have an impact on UK high streets for much of the next year. That will not be helpful for retail property rents, although given they are starting from a low base, we think the sector will avoid the meltdown of the pandemic period when it was by far the worst performer.

- The 2022 Q3 MSCI data painted a gloomy picture of UK commercial property, with the biggest drop in all-property capital values since 2009. But within this, retail slightly outperformed as rents held up for only the second quarter in four years.

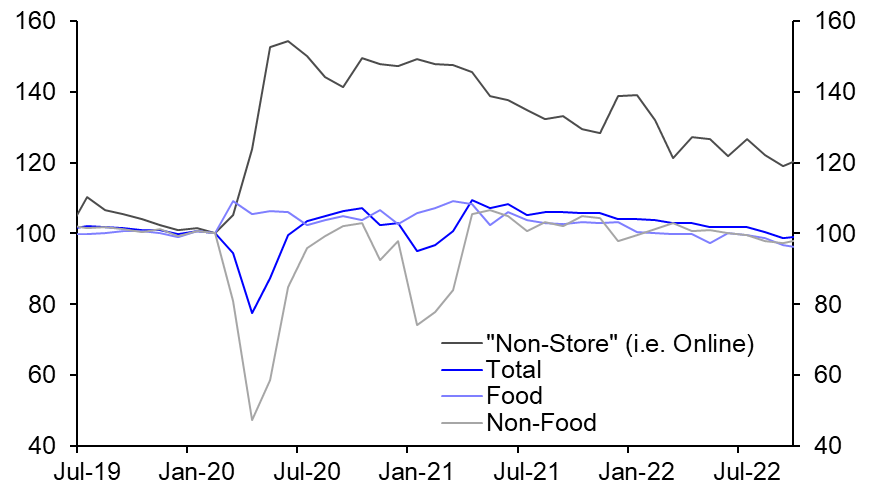

- This seems odd given the bleakest consumer background in decades, highlighted by the latest retail sales data. While October’s 0.6% m/m rise was better than expected, there has been a 5% drop in volumes so far this year, as spiralling inflation has pushed demand back below pre-pandemic levels. (See Chart 1.)

- And the macro environment is not getting any better. There has been more unwelcome news on inflation (after the removal of the energy price cap in October), another Bank Rate hike and the Chancellor’s latest fiscal package (albeit that most of the tightening will not be felt until after 2025). So it looks unlikely to be a bumper Christmas trading period and we expect consumer spending to fall by 1.5% during next year’s recession, leaving retail sales flat at best.

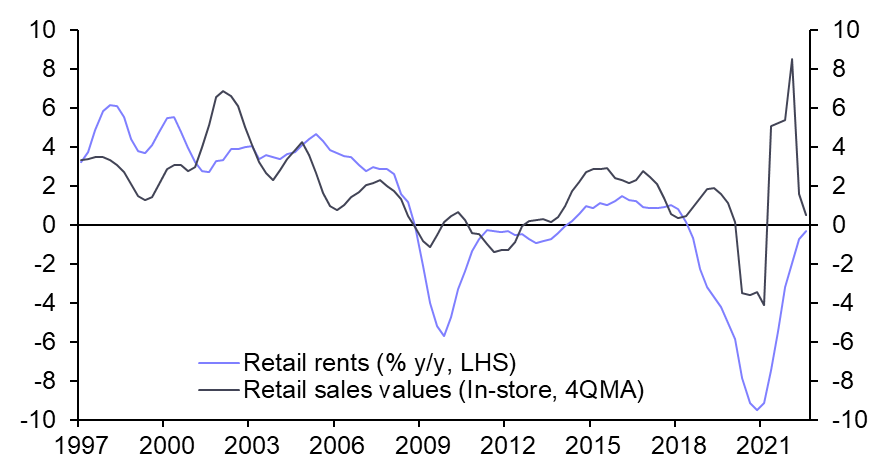

- So why has retail property been relatively resilient so far and will this persist? For one, the sector is starting from a lower base this time. Retail rents were falling before COVID-19 and stood about 25% below their 2017 peak when they stabilised in mid-2022. (See Chart 2.) That largely reflected the shift of some physical sales to online, which implied a permanent reduction in the level of retail rents. No one knew how big that would be, but there have been signs that rents have found a floor again over the last six months. And if the worst of the structural correction is over, a more normal pattern in rental growth can be expected in future.

- In addition, the recent slowdown in retail sales has been led by online demand as UK high streets reopened and shoppers reduced their online purchases. (See again Chart 1.) And as the ecommerce share remains above its long-term trend, it may fall a little further, providing a cushion to in-store demand next year.

- Finally, the relationship between retail spending and rents was never that strong and appears to have broken down in recent years, even allowing for online leakage and the extreme volatility over the pandemic. (See again Chart 2.) We think this is likely to reflect a number of changes, including the greater use of turnover rents and CVAs, and the distorting impact of widespread arrears at the height of the pandemic. Whatever the reasons, sales provide less and less clear guidance as to the course of retail rents.

- In summary, the economic headwinds imply that demand will contract and more occupiers will fail, so we expect rents to drop again over the coming quarters, but not as fast as in 2020-21. We forecast a 1% y/y drop in all-retail rents next year, stalling the mid-2022 revival, but broadly in line with other sectors.

Andrew Burrell, Chief Property Economist, 020 7811 3909, andrew.burrell@capitaleconomics.com