- Gazprom’s decision to shut Nord Stream 1 indefinitely has added to the risks facing Germany’s economy, but the size of the economic damage is still highly uncertain. And the €65bn fiscal package announced by the government will soften the blow to activity and limit the upward effect on inflation. We expect the ECB to press on regardless with a 75bp hike on Thursday.

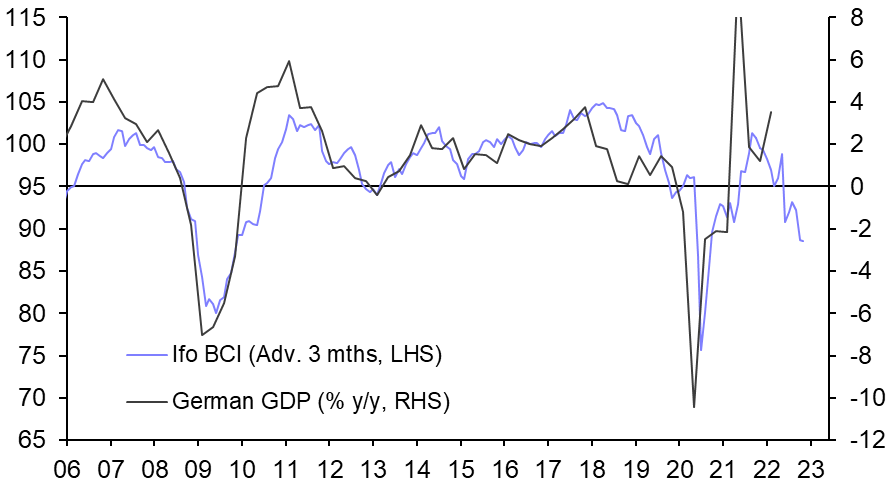

- With Gazprom announcing the indefinite shutdown of Nord Stream 1, more of the downside risks to Germany’s economy are materialising. (See here.) That said, there is still significant uncertainty about the impact the shutdown will have on energy consumption and the economy. While rationing has become more likely, it could still be avoided, for example if the winter were warmer than usual. The business surveys are already exceptionally weak (see Chart 1) and we are forecasting a fairly deep recession in Germany in the coming quarters. That now looks even more likely.

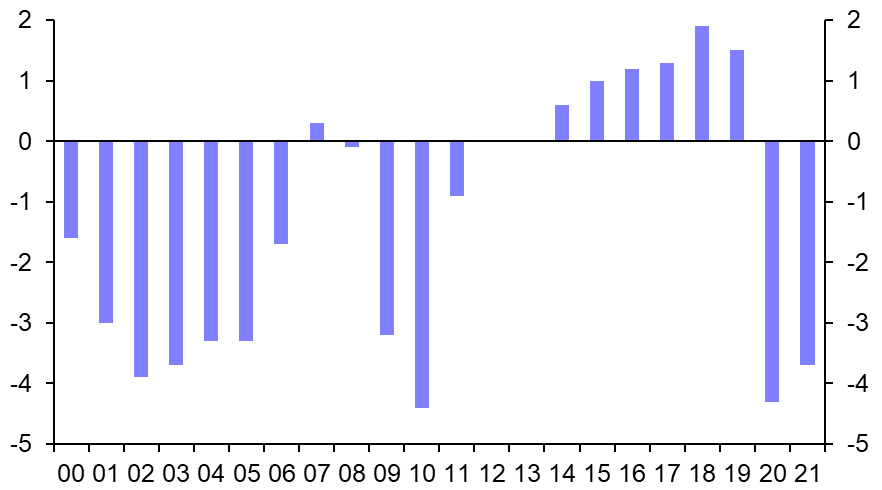

- The shutdown also adds to fiscal risks. (See Chart 2.) Admittedly, the €65bn fiscal package announced by the government at the weekend will be financed by a windfall tax on energy producers’ profits and therefore won’t have a direct impact on the budget position. But a weaker economy would lead to a wider deficit if higher energy prices force companies to close and furlough workers. What’s more, further fiscal measures are possible, and governments might need to provide further support to struggling energy companies.

- All else equal, the jump in European natural gas prices this morning will add to price pressure. In the past, a 10% increase in natural gas prices has been typically associated with around a 1% increase in Germany’s electricity and gas HICP over time. So if the ≈30% increase in gas prices this morning were sustained, it would add around 3% to electricity and gas HICP. Since electricity and gas are about 8% of the inflation basket, this would add 0.2ppts to headline inflation. There will also be some feed-through to core inflation.

- But there are some offsetting measures in the government’s fiscal package. Low-cost travel tickets, which had been due to end in September, will be extended. If they had come to an end, higher transport services inflation would have added about 0.7ppt to headline inflation this month. And January’s CO2 price increase has been cancelled. That increase might have added about 0.3ppt to headline inflation. More significantly, there will also be some form of price cap for electricity producers which do not use gas to produce power. The details are yet to be announced, but it looks consistent with the recent proposal by the European Commission. We might learn more this week, perhaps following Friday’s meeting of EU energy ministers.

- Even if the net effect of these measures is to push German inflation down slightly, we don’t think it will change the ECB’s plans for Thursday, when we expect a 75bp rate hike. (See here.) While downside risks to activity have risen, upside risks to inflation have increased too. And with the euro-zone’s headline rate likely to breach 10% before the end of the year, policymakers will have little choice but to press on with monetary tightening.

|

Chart 1: German GDP & Ifo BCI |

Chart 2: German Government Budget Balance |

|

|

|

|

Source: Refinitiv |

Sources: Refinitiv, Capital Economics |

Jack Allen-Reynolds, Senior Europe Economist, jack.allen-reynolds@capitaleconomics.com