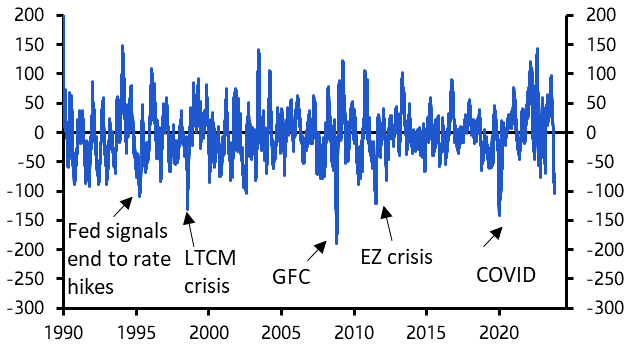

The Fed-triggered financial market exuberance which ended 2023 hasn’t carried into the new year, with yields rising and equities struggling. Group Chief Economist Neil Shearing explains what’s changed – and what hasn’t – to explain this mood shift.

He also talks to David Wilder about the latest euro-zone inflation numbers, the contradictory tone in press reports covering them, and what they mean for the start of ECB rate cuts. Neil also previews the coming week’s US CPI release and its potential market impact. And with Houthi attacks continuing to disrupt shipping in the Red Sea, he delves into the inflationary risks around conflict in the Middle East.

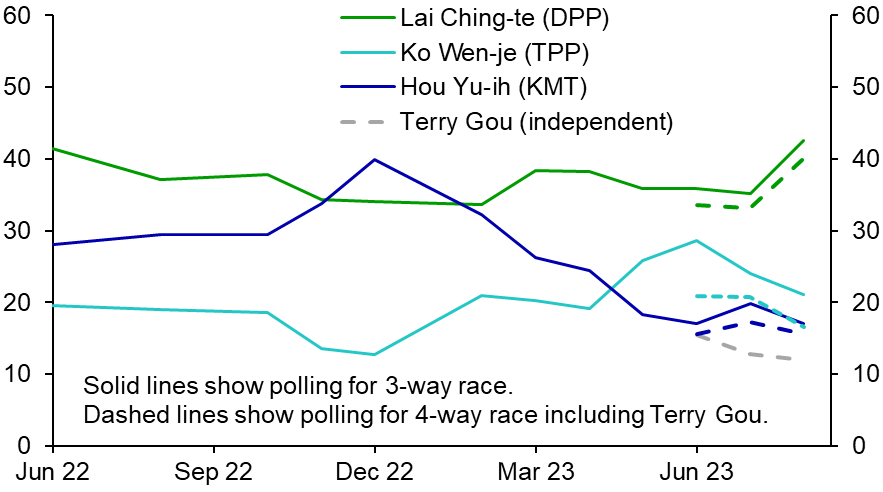

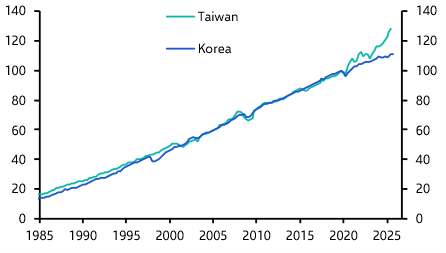

Plus, with Taiwan’s presidential election less than a week away, Chief Asia Economist Mark Williams talks about potential outcomes. With Taiwan’s status as probably the key flashpoint in a deteriorating US-China relationship, this election is likely to be one of the most consequential for the global economy. In his conversation with David, Mark profiles the three candidates for the presidency, talks about the potential direction of relations between Beijing and Taipei and explains the consequences for the Taiwanese and global economies.