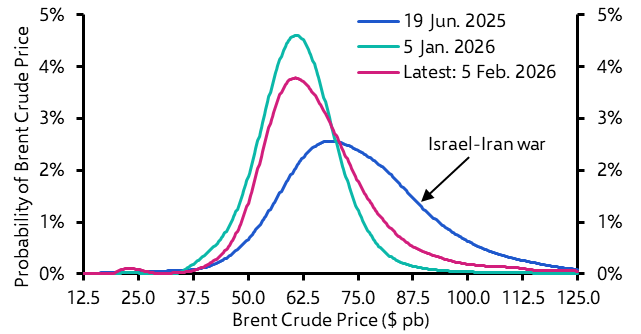

Reports suggest that Israel has fired missiles into Iran in response to Iran’s strike on Israel last weekend. Details remain unclear, but the key questions for markets relate to the scale of the attack and the damage caused, and the likelihood of retaliation. Iranian state media appears to be playing down the attack and flight restrictions imposed overnight have been lifted. This might indicate that the attack was at the more moderate end of the spectrum. Having spiked from $87pb to $90pb on news of the attack, Brent crude has now fallen back to around $88pb. The attack – and the threat of retaliation to it – has increased the risk to physical supply of oil, but the response this morning suggests that some of that risk has already been priced in. We will monitor the situation closely and will update clients as events become clear.

Through the course of this week, we’ve analysed the geopolitical and macroeconomic consequences of the conflict. These can all be found on our website and include:

- Our initial response on Sunday morning to the Iranian drone and missile strike;

- Assessments of the implications for global oil markets and for inflation and interest rates in developed markets;

- Our Capital Daily on Monday which made the case that the Fed – not the Middle East – remains the bigger worry for markets;

- A look at the impact Iran’s strike might have on Israel’s economy and Israel’s response.

- The latest MENA Weekly, which assess how the Gulf states will align amid Israel-Iran tensions.

We’ve also written in-depth pieces that assess the major economic consequences from geopolitical risks:

- Our Global Markets Focus that analyses the financial market impact of the Israel-Hamas war, how this may change, and what the lessons from previous geopolitical shocks can tell us about how this – and future ones – will play out.

- A MENA Focus from 2019 that assessed the implications for the global economy of a war between the US and Iran, and an Energy Focus that looked at what that could do to oil prices..