- In response to a surge in withdrawals as pension funds rushed to secure cash to meet margin calls, several property funds implemented restrictions to prevent the need for a fire-sale of assets. To date no retail funds have had to impose similar restrictions, which points to technical factors being the primary driver rather than a rapid deterioration in the property sector outlook. That said, retail withdrawals are increasing, and a rise in property asset sales will put further downward pressure on capital values over the next year.

- One consequence of the market turmoil following the mini-Budget was large institutional withdrawals from property funds. The surge in gilt yields meant pension funds needed collateral to meet margin calls, and they turned to property funds for cash. In response, several funds gated withdrawals to allow time to liquidate assets. Nevertheless, property funds will eventually have to sell assets to meet redemption requests, putting further downward pressure on capital values. Is a repeat of what happened following the Brexit vote, when almost £1.5bn was swiftly withdrawn from retail funds, a possibility?

- The good news is that the surge in redemption requests looks to largely reflect technical factors, rather than a rapid deterioration in the property sector outlook. Indeed, open-ended retail funds, usually the source of instability, have not needed to gate withdrawals. And with the Bank of England responding quickly to the crisis with a £65bn intervention in the gilt market and a short-term lending facility designed to ease strains on pension funds, property funds need to rapidly sell their assets will have diminished.

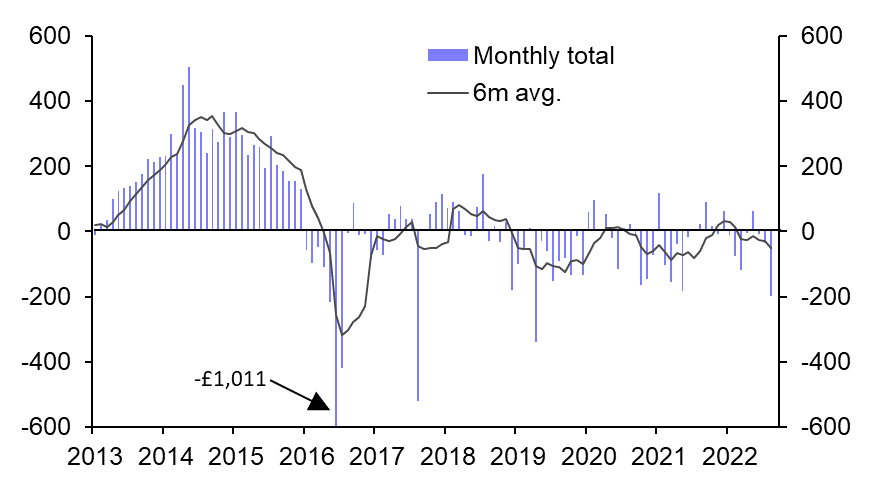

- That said, the deterioration in the property outlook due to higher interest rates and weaker growth (see here,) means retail funds will see increased outflows. Indeed, hikes in interest rates prior to the mini-Budget led to a rise in retail property fund outflows in August. Data from the Investment Association showed net sales out of retail property funds of £200m in August, the largest monthly outflow since April 2019. (See Chart 1.) And Calastone reported £100mn was withdrawn from property funds in the 10 days following the mini-Budget, almost eight times the volume withdrawn over the previous three weeks.

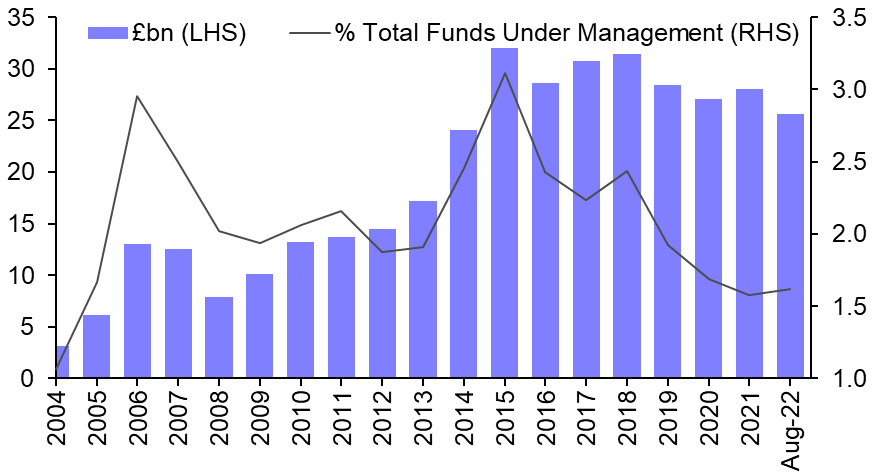

- But that doesn’t mean a repeat of 2016 is on the cards. Unlike then, there has not been a prolonged period of strong inflows into funds prior to the shock. Rather, retail property funds have seen net outflows in every year since 2019. The upshot is that open-ended retail property funds had £25.6bn of funds under management as of August, down from £32bn in 2015. And property funds now make up just 1.6% of all retail funds. (See Chart 2.) The past two occasions that saw a large withdrawal of funds, 2008 and 2016, were both preceded by property funds rising to close to 3% of the total.

- Combined with gating, that argues against a large-scale fire-sale of property assets. But property funds will eventually have to dispose of some assets, and that will put downward pressure on capital values.

Matthew Pointon, Senior Property Economist, +44 (0)20 3974 7422, matthew.pointon@capitaleconomics.com