- The October inflation data highlighted a contrast between the US and Europe, with core price pressures easing materially in the US but staying stronger in the euro-zone and UK. We think this will be an enduring feature of relative inflation prospects in 2023. While core inflation looks set to fall in all DMs, the energy crisis and tighter labour markets in Europe are among the reasons why it should fall more slowly there.

- While the October CPI data came in below consensus expectations (but not ours!) in the US, they once again surprised to the upside in Europe. On Wednesday, we learned that UK inflation leapt from 10.1% to 11.1%, with the core rate staying at a more than 30-year high of 6.5%. And yesterday, it was confirmed that euro-zone core inflation hit 5%, with inflation in all the major product groups at or near record highs.

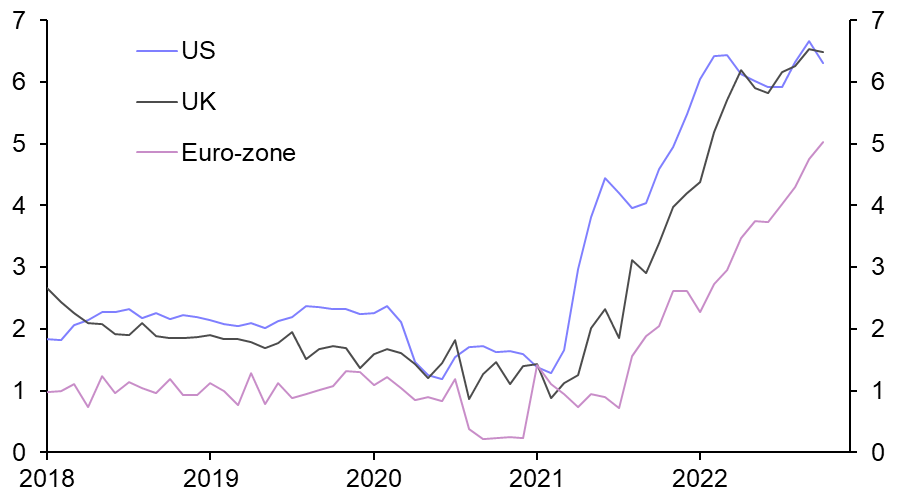

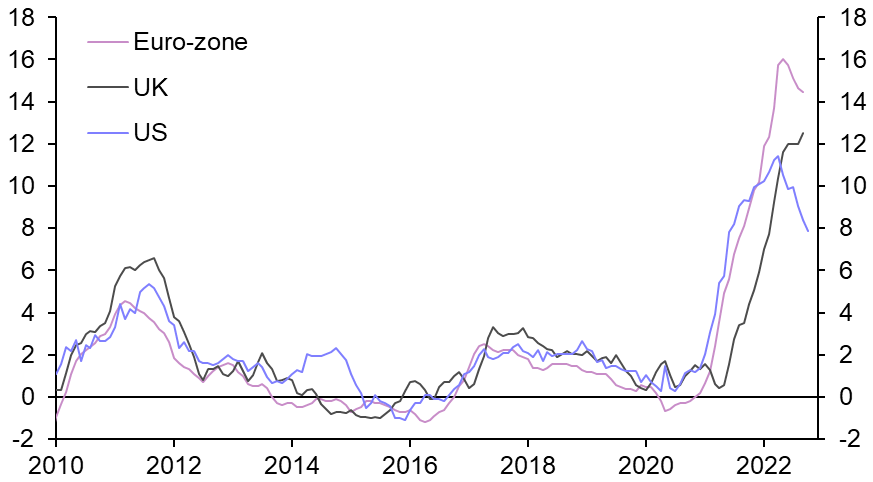

- Given that core inflation in the US surged, and has peaked, earlier than in Europe (see Chart 1), the good news in the US is partly a sign of things to come in Europe. Indeed, there are good reasons to think that core inflation will fall next year in both the US and Europe. For one thing, higher interest rates will take their toll on activity, which should relieve some of the imbalances underpinning domestic price pressures.

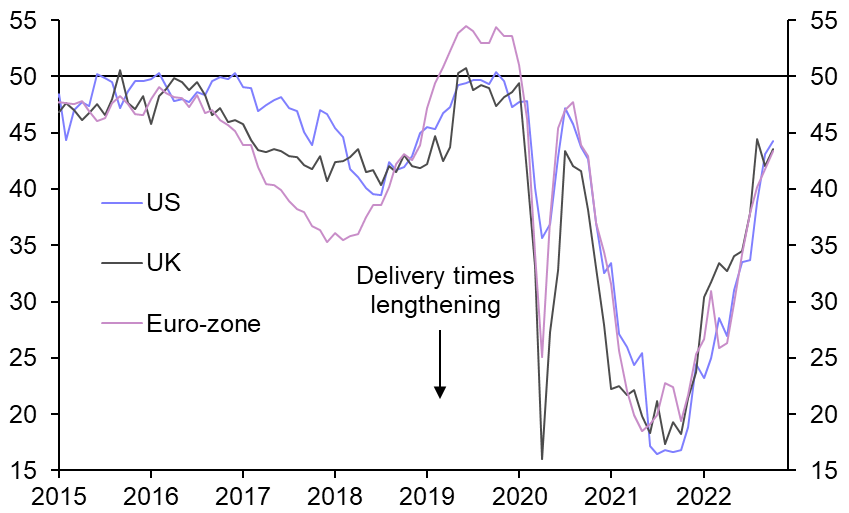

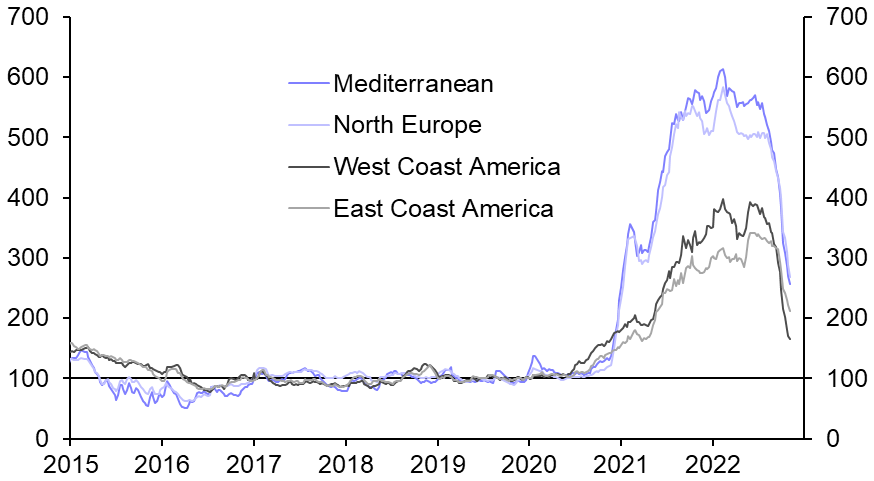

- What’s more, both the US and Europe should see core goods inflation fall in response to the alleviation of problems in global supply chains. The S&P Global manufacturing PMI surveys contain plenty of signs that product shortages have eased this year, with backlogs of work falling, supplier delivery times improving (see Chart 2), and manufacturers’ stocks of finished goods replenishing. Other surveys in Europe and hard data in the US show that retail inventories relative to sales have been normalising, and auto production has been recovering recently as chip shortages have abated somewhat. Meanwhile, container shipping costs have plunged. (See Chart 3.) And some spot sea freight rates have almost returned to their pre-virus levels.

- That said, there are three reasons why core inflation is likely to fall more slowly in Europe than in the US.

|

Chart 1: Core CPI Inflation (%) |

Chart 2: S&P Global Mfg. PMI: Supplier Delivery Times |

|

|

|

|

Chart 3: China Sea Container Freight Costs (2019 = 100) |

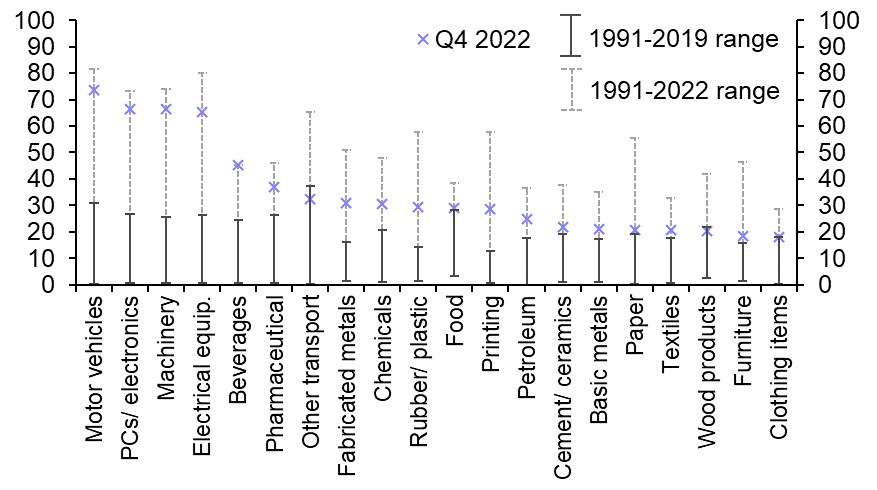

Chart 4: % of E-Z Firms Citing Shortages Limiting Output |

|

|

|

|

Sources: Refinitiv, S&P Global, WIND, EC, Capital Economics |

- First, while goods shortages have eased globally, they remain acute in many industries in Europe, suggesting that goods price pressures will remain more resilient there in the months ahead. Admittedly, the complaint that shortages are a constraint on production is not as prevalent as it was late last year, when supply-chain problems were at their worst. But according to the latest surveys, shortages still afflict 54% of industrial companies in the UK, and almost all manufacturing sectors in the euro-zone are suffering from more widespread shortages now than they ever experienced before the pandemic. (See Chart 4.) Combined with far higher energy prices, a greater prevalence of shortages might explain why pipeline goods price pressures have been much stronger in Europe – especially in the euro-zone – than in the US. (See Chart 5.)

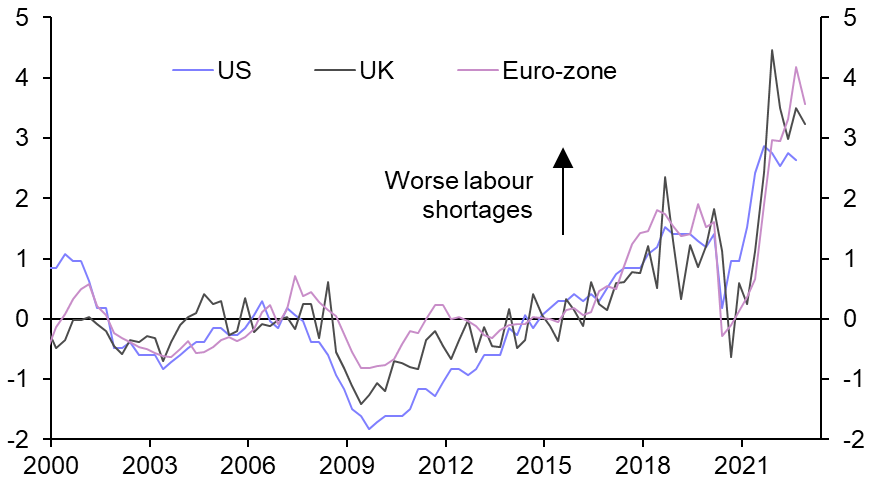

- Second, labour markets look tighter in Europe than in the US. Hourly earnings growth has already slowed in the US, while regular pay growth in the UK has crept higher. And in the euro-zone, the Indeed wage tracker suggests that offered pay growth for new hires has shot up from below 2% y/y to over 5% so far this year. True, job vacancy rates and firms’ hiring intentions have come off the boil in both the US and Europe. But worker shortages are seemingly worse in the latter. (See Chart 6.) And worse shortages in 2022 mean that employers in the euro-zone and UK could be more reluctant than their US peers to scale back hires or lay off workers when economies weaken in 2023. Against a backdrop of higher inflation expectations, and with stronger trade unions, tighter labour markets in Europe mean that pay pressures could prove more persistent.

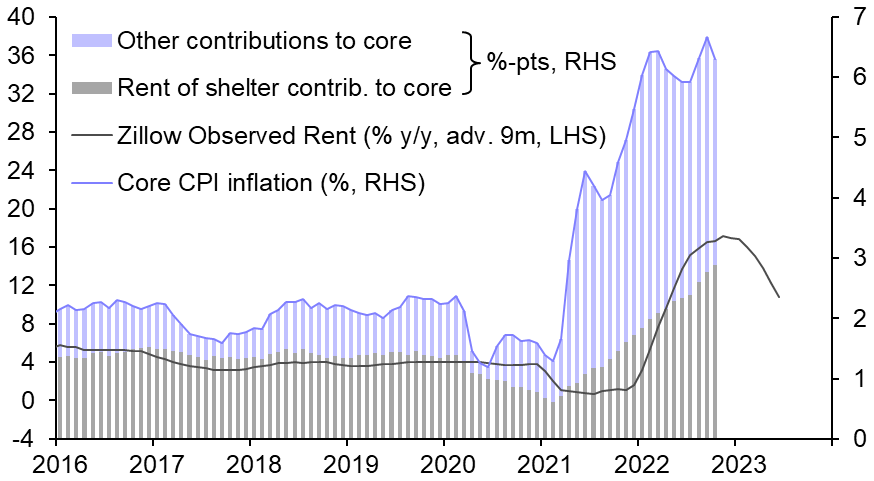

- Third, there are various quirks in the CPI data in the US – that the UK and euro-zone do not share – which mean that much of the coming decline in US core inflation is ‘baked into the cake’. For a detailed analysis of the idiosyncrasies that will pull down core inflation in the US next year – such as outright deflation in health insurance and used cars prices – see our US Focus. The most consequential difference between the US and Europe is that rents are a big driver of inflation in the US but they barely move the needle in Europe. (For an explanation, see here.) So, given that timely private sector measures of rents have weakened markedly in the US, this should prove to be a major drag on core inflation there that Europe won’t replicate. (See Chart 7.)

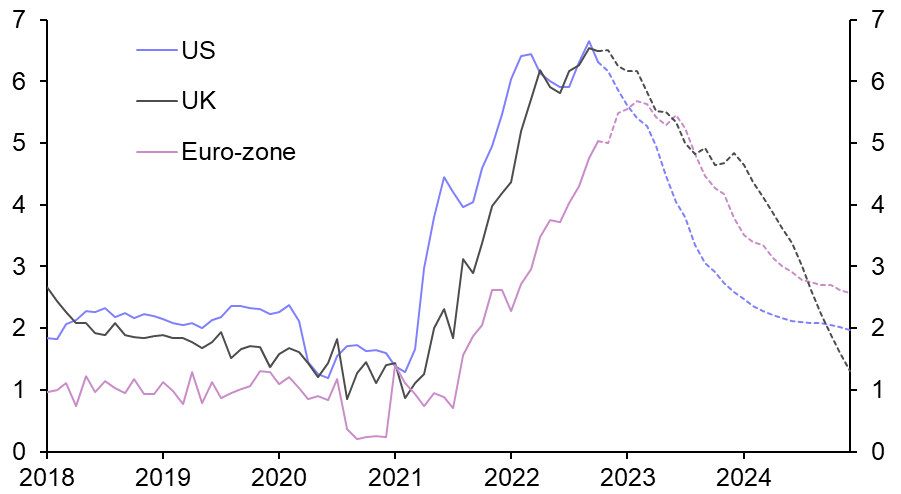

- All in all, while we think that core inflation in Europe will fall in 2023, as in the US, the big falls will come later in the year in the euro-zone, and not until 2024 in the UK. (See Chart 8.) As core inflation drops back in the next few months in the US, we suspect that it has further to rise in the euro-zone, ultimately settling at a higher level by the end of our forecast horizon in 2024, as we argue in more detail in our Euro-zone Focus. Higher core inflation in Europe is one reason why we expect the Bank of England and ECB to pivot towards rate cuts later than the Fed, which we think will start cutting rates as early as Q3 next year.

|

Chart 5: Goods Ex. Energy Producer Price Inflation (%) |

Chart 6: Surveyed Labour Shortages (Z-Scores) |

|

|

|

|

Chart 7: US Core CPI Inflation & Private Rents |

Chart 8: Core CPI Inflation (%) |

|

|

|

|

|

Sources: Refinitiv, Zillow, Capital Economics |

Simon MacAdam, Senior Global Economist, +44 (0)207 808 4983, simon.macadam@capitaleconomics.com