- Although the energy crisis in Europe has dealt a blow to the EU’s near-term green ambitions, a combination of economic incentives, NextGenEU funding, and geopolitical expediency will cause the bloc to re-double its decarbonisation efforts. However, bottlenecks in the supply of key materials needed for the energy transition are likely to stoke “greenflation” and so could complicate life for the ECB.

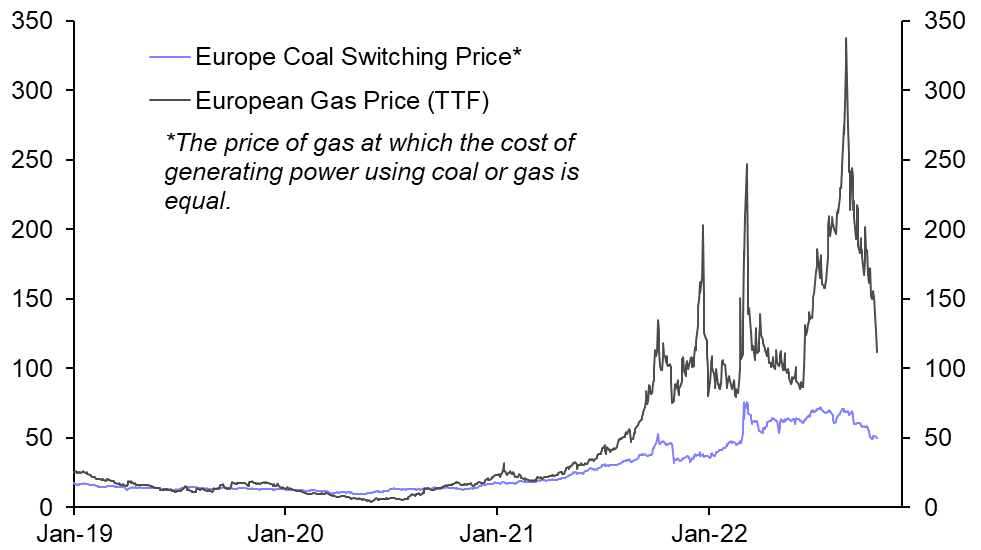

- The surge in the price of natural gas in Europe since mid-2021 has made coal and lignite (aka, brown coal) indispensable, and more economic, substitutes for electricity generation. This is true even after factoring in the cost of the additional carbon credits required for using coal and lignite, both of which are far dirtier than gas. Even though natural gas prices have fallen recently (see Chart 1), they would have to fall a lot further to make natural gas an attractive commercial alternative to coal again.

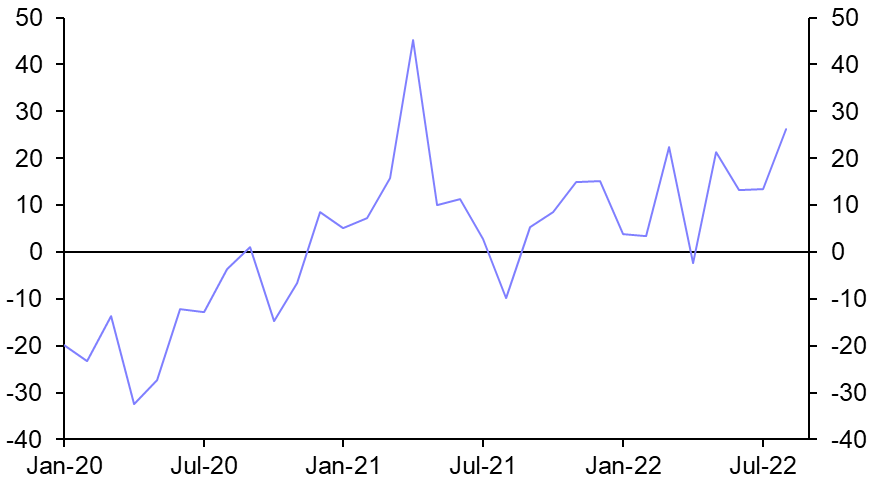

- Against this backdrop, the pivot back towards using coal as a power source in Europe is no big surprise. According to the EC’s latest quarterly report on electricity markets, the amount of coal-based electricity generation in the EU rose by 19% y/y in Q2, while gas-generation fell by 7%. Carbon dioxide emissions from the power sector in the EU rose by about 13% y/y in the first seven months of 2022. (See Chart 2.)

- That said, despite the bad optics and near-term damage to the EU’s climate credentials, there are good reasons to think that the pivot to coal will be short lived. Three points are worth making.

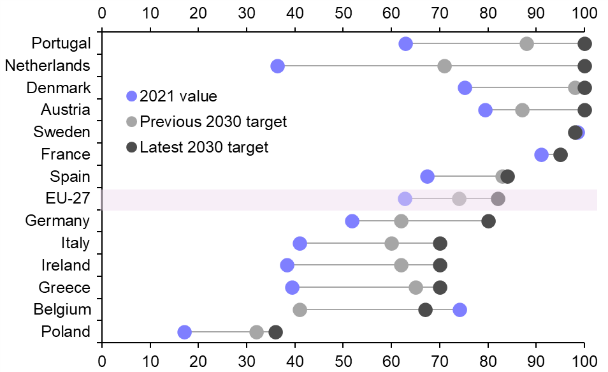

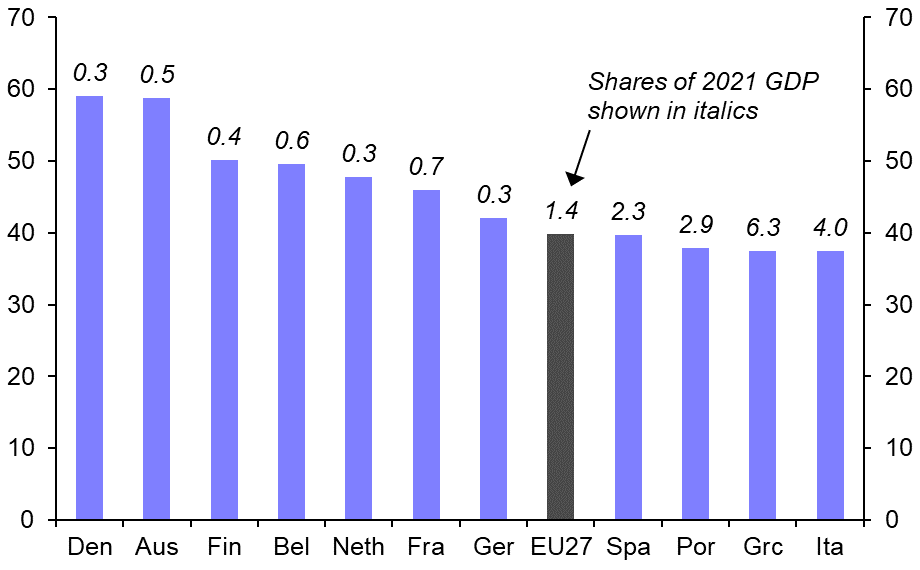

- First, it is encouraging that no countries in Europe have rowed back on the pledges to stop using coal altogether by 2030; in fact most have recently raised their targets for “clean” electricity generation by the end of the decade. (See Chart 3.) While such targets should be viewed with a healthy dose of scepticism, the fact that boosting renewables will also help with the geopolitical goal of increasing energy security should provide governments with some added motivation to meet the aims.

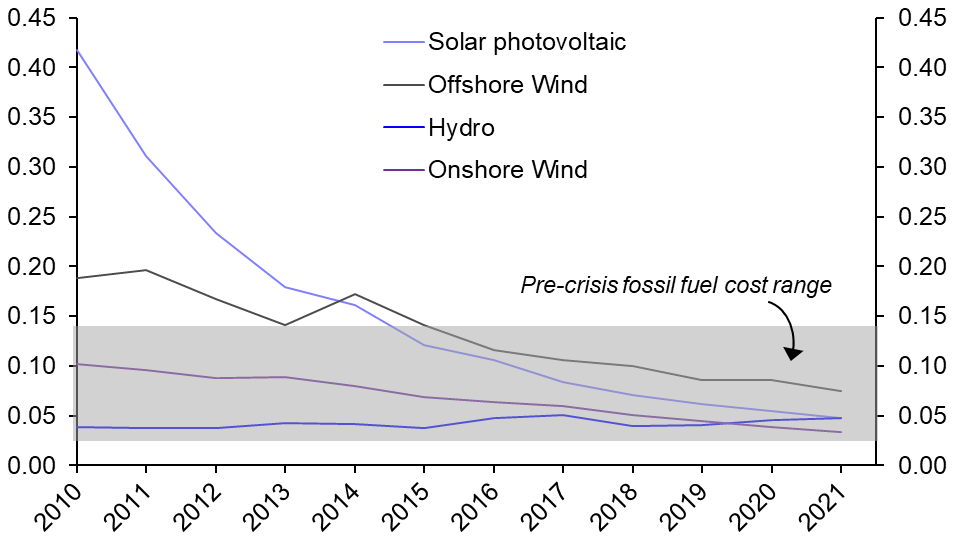

- Second, the economic incentive to decarbonise will only become stronger as renewables become cheaper. Note that renewables were already competitive with fossil fuels before the crisis. (See Chart 4.) In the meantime, the sky-high price of gas means that gas-powered plants are only about as competitive as solar was a decade ago. Meanwhile, the cost of producing electricity using coal is more sensitive than other sources to changes in carbon prices (see here), which are set to rise in Europe over time.

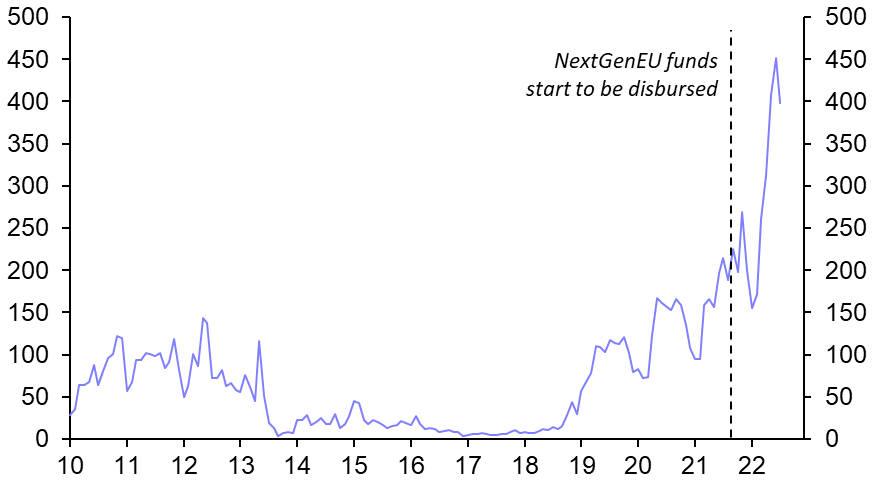

- Finally, there are plenty of funds available under the NextGenEU plan ready to be used for green projects. The scheme dictates that at least 37% of countries’ spending has to be used to support the green transition, and spending equivalent to about 1.3% of EU GDP is planned by the end of 2023. (See Chart 5.) This seems to be filtering through to the real economy: imports of solar panels and LEDs to the EU from China have more than doubled since NextGenEU funds started to be disbursed, in August 2021. (See Chart 6.)

- One party that will be looking on with interest is the ECB. At the very least, government spending on renewable infrastructure will run counter to the direction of monetary policy and complicate life in the near term. More generally, “greenflation” is likely to become more prominent over the coming years. Isabel Schnabel expressed her concern over the subject in a speech earlier this year, saying that “the faster and more urgent the shift to a greener economy becomes, the more expensive it may get in the short run”.

- The focus of “greenflation” tends to be on potential pinch-points in the supply of battery metals and rare earths – particularly given China’s dominance in the supply of these key materials. (See our recent Spotlight report for more details.) However, the prices of less exotic industrial metals such as copper and aluminium are also likely to come under upward pressure from the green transition given that they are widely used in renewable technologies and electricity networks. We will write in more detail on “greenflation” in the near future. But once the post-pandemic-related inflation issues have faded, it seems likely to be another source of upward pressure on prices for policymakers to contend with later this decade.

|

Chart 1: Natural Gas (€ per MWh) |

Chart 2: Carbon dioxide emissions from EU Power Sector (% y/y) |

|

|

|

|

Chart 3: Share of Electricity Generated by Clean Sources* (% of Total, Selected Countries) |

Chart 4: Levelised Costs of Electricity |

|

|

|

|

Chart 5: Share of NextGen EU Spending Plans |

Chart 6: Imports of Solar Panels and LEDs |

|

|

|

|

*Renewables & Nuclear. |

Sources: Ember, IRENA, NGEU Tracker, Comtrade, Eurostat, CE |

David Oxley, Head of Climate Economics, david.oxley@capitaleconomics.com