- A shift away from zero-COVID would be positive for China’s economy over the medium term. But the immediate disruption of reopening would probably exceed the cost of keeping the policy in place, especially if vaccine coverage among the elderly hadn’t risen substantially ahead of any shift. If China were to abandon zero-COVID now, that would warrant a lower not higher GDP forecast for next year.

- Rumours that officials planned to shift away from the zero-COVID policy (ZCP) by next March led to a sharp rally in Chinese equities last week. We already discussed why we are sceptical of the rumours and doubt that a shift will happen so soon. But it’s still worth considering what would happen to the economy if the ZCP were abandoned.

- A shift could come as part of a planned transition towards living with the virus as happened in Singapore, Australia and New Zealand. But it could also happen in an unplanned manner, should containment efforts fall short. That was the case in Hong Kong, where the failure to suppress a large virus wave earlier this year led the city to abandon its elimination strategy. A similar scenario in China isn’t out of the question given the difficulties the authorities now seem to be facing containing the virus.

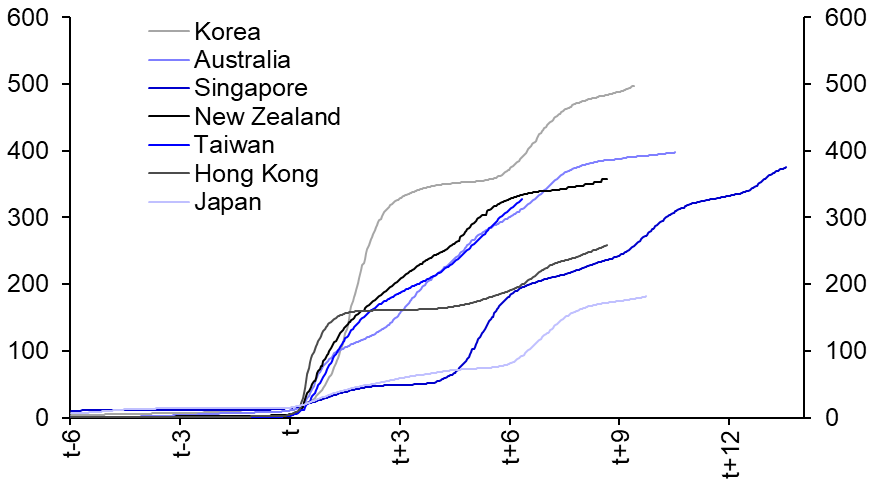

- Some are expecting a gradual shift away from zero-COVID. But that ignores the reality of how the virus spreads. COVID outbreaks are either quashed early on or they keep expanding until large swathes of the population have been infected. There is no stable equilibrium between these two outcomes. The experience of other countries that transitioned from suppression towards living with the virus suggests that any step back from trying to eliminate outbreaks would be followed by a surge in cases. (See Chart 1.)

|

Chart 1: Total Cases per Million |

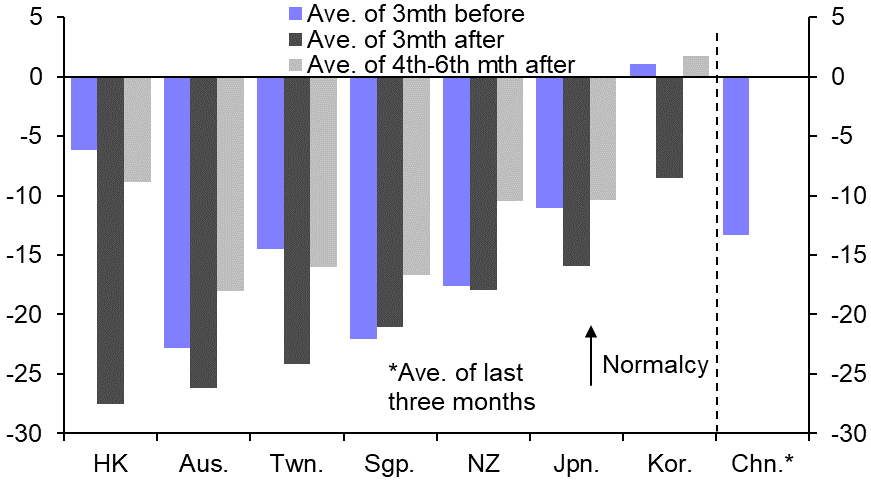

Chart 2: Mobility Before & After Switch to Living with COVID (%-change from pre-pandemic level) |

|

|

|

|

Sources: OWID, Capital Economics |

Sources: CEIC, WIND, Google, Capital Economics |

- It would also be impractical to try to move away from zero-COVID in some parts of the country but not others. Preventing cases from slipping across the country’s tightly-monitored international borders has already proven difficult even with passenger numbers a fraction of the pre-pandemic norm. Maintaining internal borders would require a huge expansion of quarantine facilities and cause massive disruption to supply chains.

- Once the virus started to spread widely throughout the population, the healthcare system would come under strain. To manage this, some social distancing restrictions would still be needed to slow the spread and flatten the infection curve. These wouldn’t be as extreme as the lockdowns used to maintain zero-COVID but they would need to be put in place more widely across the country. One advantage of the ZCP is that, at any given time, most of China has not been facing outbreaks, with daily life in these areas largely unaffected by the pandemic. Even now, with the virus situation the worst it’s ever been, the areas dealing with outbreaks are responsible for less than half the country’s GDP. But once the ZCP is abandoned, the whole of China will face outbreaks concurrently.

- The need for stricter social distancing measures across much of the country during the reopening wave, coupled with behavioural changes due to fears of contracting the virus, would mean that in-person activity would likely weaken rather than strengthen in near-term. The countries that shifted from a containment strategy toward living with the virus nearly all had lower mobility during the three months following reopening than in the three months prior. (See Chart 2.) Even two quarters out, mobility was still far from back to normal – the cross-country average was still 10% below pre-pandemic levels, which is not much different from the current situation in China due to the ZCP.

- The implication is that it would take at least six months before a shift away from zero-COVID started to bear fruit. In the interim, in-person activity would likely be weaker than if the ZCP were kept in place.

- The strictness of social distancing measures during the transition and the scale of economic disruption will depend most of all on vaccine coverage and healthcare capacity. China’s overall vaccination rate is high but there are two major caveats. First, the Chinese vaccines require three doses to achieve a similar level of protection as two doses of the mRNA jabs used elsewhere. Second, vaccine coverage is lowest amongst the elderly, who are most at risk of severe illness.

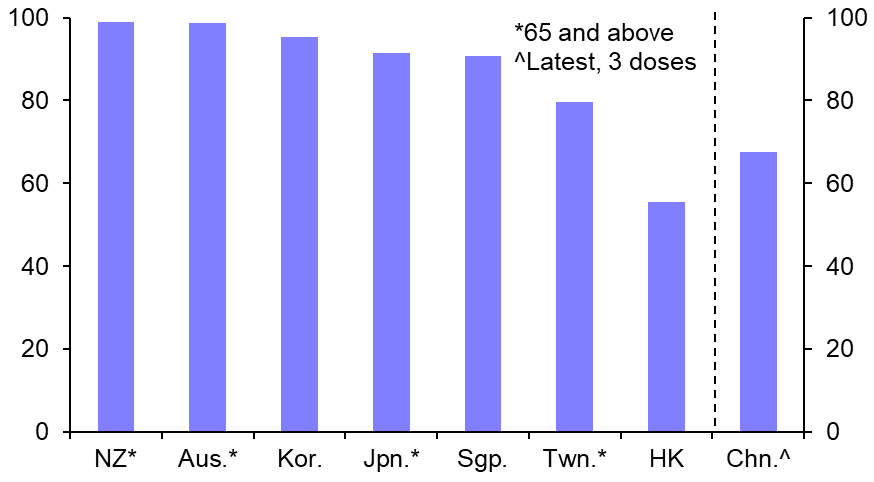

- Most of the countries that shifted from containment to living with the virus only did so when their elderly vaccination rate was far higher than it currently is in China. (See Chart 3.) That reduced the strain on their healthcare systems from the reopening. A key exception is Hong Kong, which serves as a cautionary tale of the risks of shifting strategy prematurely. Its low elderly vaccination rate meant that it had to resort to tight social distancing measures during the reopening wave to prevent hospitals from being overwhelmed. This led to a sharp economic contraction in the first half of this year.

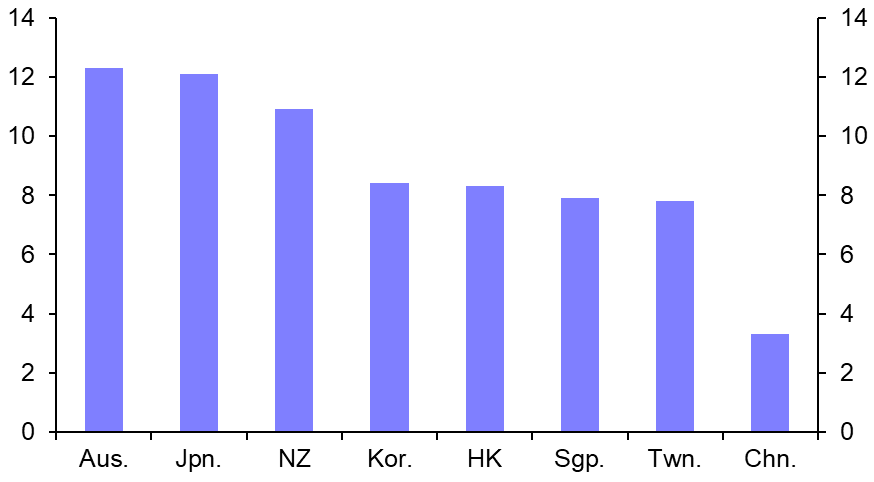

- China’s elderly vaccination rate is now slightly higher than Hong Kong’s was when cases soared. But given that more time has passed since initial vaccination for many, protection may have waned. And the mainland’s healthcare capacity is not as developed as Hong Kong’s, with far fewer ICU beds and nurses per capita. (See Chart 4.) What’s more, Hong Kong’s death rate – more than three times that of Singapore, Japan and New Zealand – would be seen as unacceptable on the mainland. China’s leaders have made much of the fact that the ZCP policy has kept deaths far lower than elsewhere. They will go to greater lengths than the Hong Kong government to keep deaths low during the reopening wave.

- All told, it will be hard for China to avoid a short-run economic hit from moving away from the ZCP – even the best-prepared countries experienced some disruption during their reopening waves. And if China were to shift away from the zero-COVID policy in the near future, with the elderly vaccine coverage still relatively low, that would result in a very challenging and costly transition. An imminent shift away from the ZCP would brighten the economic outlook for 2024 and beyond. But compared with the status quo, the net impact on activity next year would be negative.

|

Chart 3: Share of Over-60s with 2 Doses at Switch (%) |

Chart 4: Nurses per 1,000 (Latest) |

|

|

|

|

Sources: Various CDCs, Capital Economics |

Sources: OECD, MOH SG, Health Bureau HK, Capital Economics |

Julian Evans-Pritchard, Senior China Economist, julian.evans-pritchard@capitaleconomics.com