- The most measurable climate pledge made to date has been on climate finance – specifically the commitment by advanced countries to provide $100 billion each year to the emerging world by 2020 to fund adaptation and mitigation. With COP27 underway, this Update answers five questions on the topic.

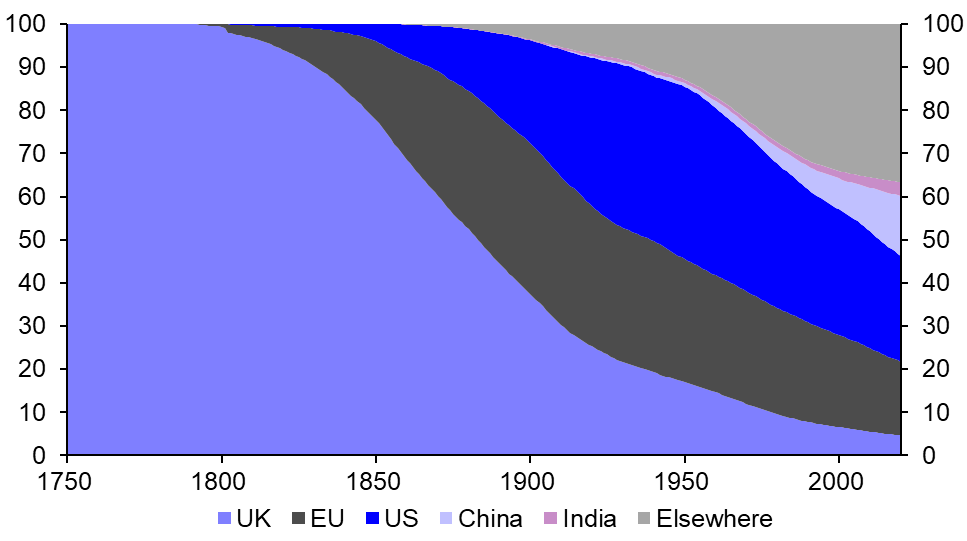

- 1) How did the $100 billion climate finance pledge come about? The initiative originated out of the chaotic 2009 UN Climate Change Conference and the tensions between developed and developing world leaders. In essence, the funding is a quid pro quo: rich countries – which account for the bulk of cumulative carbon emissions (see Chart 1) – would pay up in return for developing countries agreeing to reduce emissions.

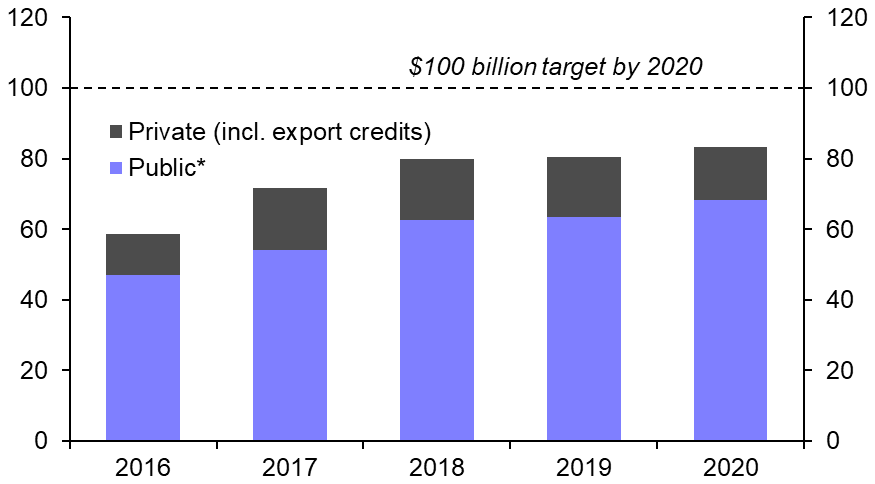

- 2) Has the commitment been met? In short, no, but opinions differ as to how far short of the target developed countries fell. For example, the OECD estimates that US$83 billion in finance was provided in 2020 (see Chart 2) but some argue that the “true” amount was much lower, at around US$25 billion.

- The scope for disagreement stems from the fact that key details such as what should be counted as climate finance have never been fully nailed down. While it was clarified in 2015 that both public and private funds were fair game to be counted, the definition of what constitutes climate finance is still open for interpretation. Critics of the OECD numbers argue that loans made at market interest rates should not qualify and that some countries incorrectly count some non-green development aid as climate finance.

- 3) Where is the money going? Based on the OECD’s statistics, about two thirds of climate finance in 2020 went towards mitigation projects – mainly in the energy and transport sectors – and one third to adaptation efforts, including upgrading water and sanitation infrastructure. Private funding flows have been skewed more heavily towards mitigation, which we suspect reflects the fact that commercial returns are higher.

- 4) Is US$100 billion a year a big number? It is certainly symbolic and now key for developed economies to keep up their end of the bargain, as it were. But there is nothing magic about the $100 billion figure. Indeed, the UN estimates that developing countries’ adaptation financing requirements alone could be “five to 10 times greater than current international adaptation finance flows”. Moreover, the long-term goal of reducing global greenhouse gas emissions will hinge more on technology that the flow of cash.

- 5) What will come out of COP27? Climate finance is high on the agenda for the COP talks in Egypt. Having been urged at COP26 to “at least double their collective provision of climate finance for adaptation from 2019 levels by 2025”, advanced economies could commit to more ambitious funding targets. That said, we doubt that anything tangible will be agreed on the even thornier issue of “loss and damage” – ie, “compensation” from rich countries to those already feeling the economic impacts of global warming.

- The key point is that disputes over money will remain a major fault line in the climate arena. And with the fracturing of the global economy accelerating the decline of multilateralism, the chances of more co-ordinated global actions to tackle the climate crisis are getting slimmer and slimmer.

|

Chart 1: Share of Global Cumulative CO2 Emissions (%) |

Chart 2: Climate Finance (US$ Billion) |

|

|

|

|

Sources: Our World in Data, Capital Economics |

Source: OECD *Bilateral plus multilateral |

David Oxley, Head of Climate Economics, david.oxley@capitaleconomics.com