- The Chancellor claimed that this was a plan for growth. But unless the Chancellor’s gamble pays off and the government’s fiscal policy boosts GDP growth by 0.5-1.0ppts per annum, the risk is that once the near-term boost to GDP fades, the legacy of the government’s fiscal plans will be higher interest rates and a higher public debt burden. The market reaction, which included a jump in gilt yields means higher borrowing costs are already here.

- Today’s tax-cutting bonanza is a big deal. The long list of tax measures (including the reversal of April’s national insurance tax on 6th November, the cut in the basic rate of income tax from 20p to 19p in April 2023 rather than April 2024, the cancellation of next April’s corporation tax rise, the cancellation of the scheduled cut to the annual investment allowance, the cut to stamp duty and the cancellation of the planned rises in alcohol duties) adds up to a loosening in fiscal policy relative to previous government’s plans of £44.8bn (1.8% of GDP) by 2026/27. That was a bit bigger than the £30bn package we had expected. Meanwhile, this package of tax cuts will come on top of the huge support for households (the Energy Price Guarantee) and businesses (the Energy Bill Relief Scheme) already announced. The latter two could cost up to £150bn (5.7% of GDP) over 2 years. (See here.)

- As widely leaked, the Chancellor also attempted to meet his new 2.5% long-term real GDP growth target and fulfil his claim that the mini-budget would be “unashamedly pro-growth” by promising to simplify planning laws, increasing infrastructure and creating 40 “investments zones” to stimulate growth.

- There are two direct implications for the economy. The first is a short-term boost to growth. We previously revised up our 2023 GDP growth forecast by 0.5 percentage points (ppts), from 0.0% to 0.5%, after the utility price freeze and in anticipation of some of these measures. But these extra measures might add an extra 0.1-0.2ppts to GDP growth in 2023.

- However, with the policies more focused on boosting demand, rather than supply, our hunch is that this package will not make a big difference to the economy’s long-run potential GDP growth rate. After all, this is not the first time the government has launched a growth plan. Some policies sounded remarkably similar to the government’s Growth Review launched a decade ago in 2011. And the Chancellor’s really bold ambitions on the supply side, remain only that. The government has published a list of infrastructure projects to be prioritised and will publish a review of the UK’s planning restrictions, but it is not yet ready to act.

- The second implication for the economy is higher inflation and higher interest rates. By adding to price pressures, this fiscal expansion supports our existing view that the Bank of England will raise interest rates to a peak of 4.00% and won’t pivot to interest rate cuts until 2024. The bigger-than-expected package means it is possible that rates will need to rise above 4.00%. Investors are now pricing in rates peaking at 5.25%, just 50 basis points shy of the peak reached prior to the Global Financial Crisis in 2007.

- As the fiscal expansion is not fully funded by tax rises/spending cuts elsewhere, borrowing will surge. Rather than falling from £134bn (5.6% of GDP) to £99bn (3.9% of GDP) in 2022/23 and to £37bn by 2024/25 (1.3% of GDP) as the OBR forecast in March, public borrowing looks set to increase to £236bn (9.3% of GDP) in 2022/23 and will only fall to £108bn (3.9% of GDP) by 2024/25. (See Table 1.) This is big. At 9.3% of GDP in 2022/23, borrowing would not be far off the level it reached in 2009/10, of 10.1% of GDP.

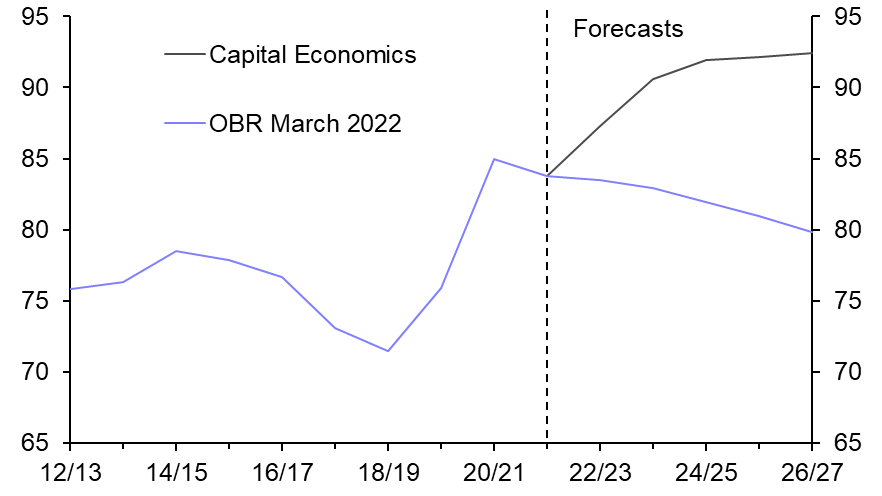

- The result is that the Chancellor’s headroom against the previous fiscal mandate (that the underlying debt ratio is falling in three years’ time, i.e. in 2024/25) would probably have been breached by about £37bn (1.3% of GDP). The OBR wasn’t asked to assess the government plans so won’t form a judgement on what they mean for the fiscal rules until the budget in November. And rather than fall to 80% of GDP by 2026/27 as the OBR expected in March, the government’s plans look set to put the underlying debt to GDP ratio on a decisive upward path. We now expect the debt ratio to reach 92.4% by 2026/27. (See Chart 1.)

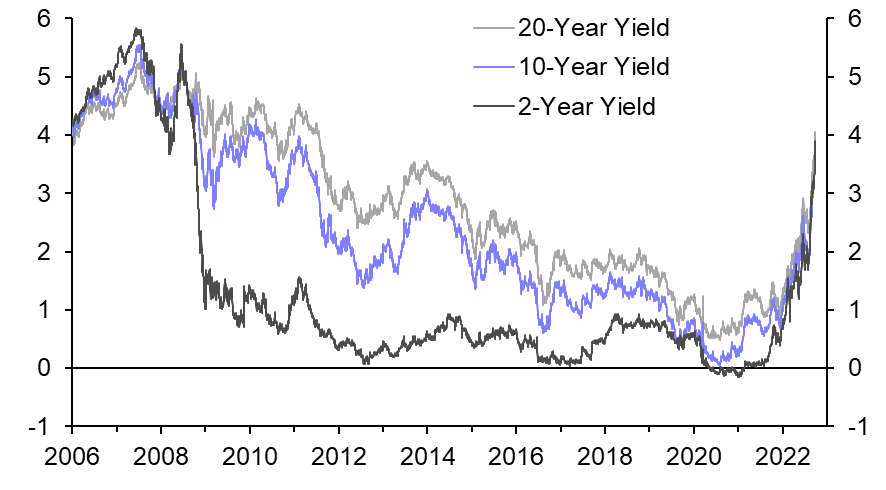

- The Chancellor did say that he viewed fiscal responsibility as “essential” and the Bank of England’s independence as “sacrosanct”. But gilt yields rose by between 23-40 basis points across the curve, as it was announced that the cost of the package will be financed by additional gilt sales of £62.4bn in 2022/23, taking the total financing requirement to £234.1bn. (See Chart 2.) This suggests the markets are growing ever more concerned about the longer-term fiscal outlook.

- What is crucial for fiscal sustainability is the relationship between nominal GDP growth and nominal interest rates on government debt. If the rate of nominal GDP growth is higher than nominal interest rates on government debt, then debt will rise at a slower rate than GDP and, over time, the debt to GDP ratio will shrink. But if, for instance, the 20-year gilt yield were to stay at its current rate of 4.07% and nominal GDP growth were to come in closer to our current forecast of 3.8% in the medium term (real GDP growth of 1.8% rather than the government’s 2.5% target, plus inflation of 2.0%), then the trajectory of debt is unlikely to be sustainable. And this assumes that the primary budget is kept in balance (i.e. the government is neither adding to, nor reducing the debt). But the government’s plans are for a primary budget deficit which will add more to the debt ratio.

- If the Chancellor’s gamble pays off and the government hits its 2.5% real GDP growth target then with a bigger economy comes more tax revenues and an improved fiscal position. However, today’s announcement feels very risky. It would not be difficult to imagine GDP growth turning out much weaker than 2.5%. Without a major boost to the supply-side, today’s fiscal package just means more inflation, higher interest rates and a higher debt ratio in the future. If so, then at some point the Chancellor, Kwasi Kwarteng or a successor, will need to take action by raising taxes elsewhere/cutting spending to stabilise the debt ratio.

|

Chart 1: Public Sector Net Debt (Excluding Bank of England, % of GDP) |

Chart 2: Gilt Yields (%) |

|

|

|

|

Sources: Refinitiv, OBR, Capital Economics |

Sources: Refinitiv, OBR, Capital Economics |

|

Table 1: Public Sector Net Borrowing (PSNB ex.) Forecasts (£bn) |

|||||

|

22/23 £bn |

23/24 £bn |

24/25 £bn |

25/26 £bn |

26/27 £bn |

|

|

99.1 |

50.2 |

36.5 |

34.8 |

31.6 |

|

+24.6 |

+40.6 |

+17.2 |

+11.5 |

+10.4 |

|

123.7 |

90.8 |

53.7 |

46.3 |

42.0 |

|

+112.0 |

+71.7 |

+53.8 |

+39.4 |

+44.8 |

|

Of which: |

|||||

|

May 2022 cost of living package |

10.3 |

- |

- |

- |

- |

|

Energy Price Guarantee |

22.5 |

45.0 |

22.5 |

- |

- |

|

Energy Bill Relief Scheme |

60.0 |

- |

- |

- |

- |

|

Growth Plan |

19.2 |

26.7 |

31.3 |

39.4 |

44.8 |

|

235.7 |

162.5 |

107.5 |

85.7 |

86.8 |

|

Sources: OBR, Capital Economics. |

|||||

Ruth Gregory, Senior UK Economist, +44 (0)20 7811 3913, ruth.gregory@capitaleconomics.comk