- Recent revisions to our euro-zone interest rate and bond yield view suggest there is upside risk to our forecasts for prime commercial property yields. With the deteriorating economic outlook also set to weigh on rental growth, this suggests the peak-to-trough fall in euro-zone all-property capital values by end-2023 is looking increasingly likely to be closer to 10-15%.

- As highlighted in our recent Outlook, concerns about higher inflation posed a downside risk to our euro-zone property view. The recent upgrade to our forecast for the ECB policy rate confirmed this. (See Update.) We currently expect the policy rate to peak at 3% early next year and remain there throughout 2023, up from our previous forecast of 2%. Importantly for property, this means 10-year Bund yields are now expected to reach 2% by year-end (up from our previous forecast of 1.50%), and then fall to 1.75% by the end of 2023 (1.25% previously).

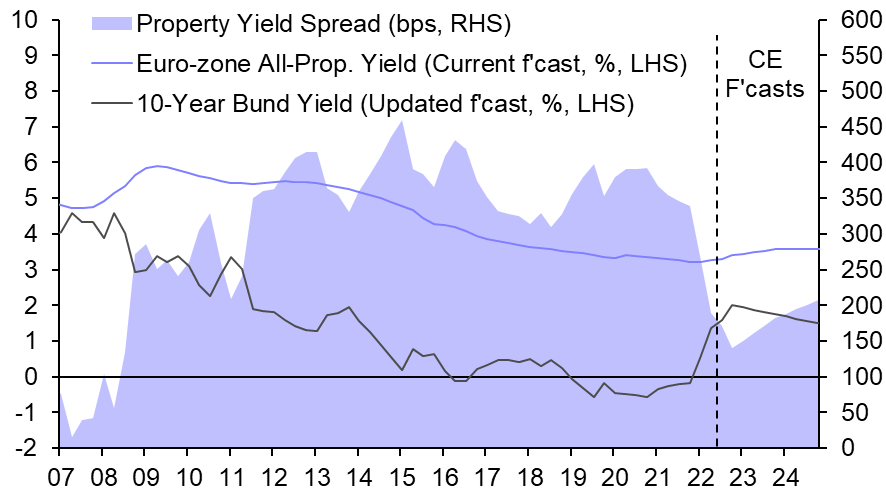

- This updated bond outlook adds upside risk to our euro-zone prime property yields forecasts, which we had already revised up in our recent Outlook. Indeed, a rise in bond yields will stretch already-squeezed valuations. With our current forecasts, the property-to-bond yield spread would fall below 150bps in the coming quarters. (See Chart 1.) Admittedly, this would still be similar to levels over the 2000-06 period. But it would be below the 250bps we think the spread should trend towards in the future, and also well-below the post-GFC average of 350bps.

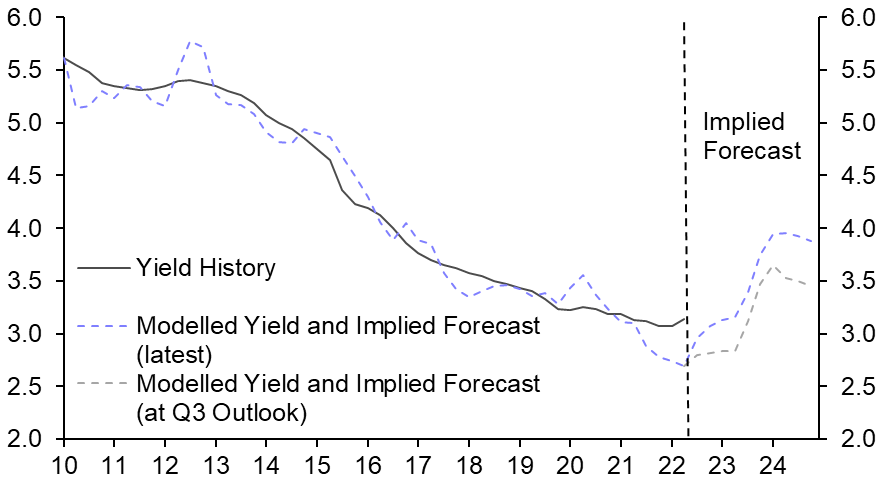

- In addition, our office yield model, which incorporates the outlook for the economy as well as bond yields, points to euro-zone prime office yields peaking around 30bps higher than it predicted before our last Outlook. (See Chart 2.) While we are cautious about using the precise model estimates, we think an upward shift to our yield forecasts on the back of our new bond yield outlook is likely.

- What’s more, CBRE data suggest that prime yields were generally below the cost of debt in Q2, and in some markets by as much as 50bps-80bps. The rise in five-year swap rates from 1.8% then to almost 3% in Q3 also suggests a significant repricing is necessary.

- Given recent higher-than-expected inflation outturns and growing weakness in the global economy, the downside risks to our economic and rental growth forecasts are also building. And there could also be more upward pressure on interest rates. The upshot is that it now looks like euro-zone prime yields at the all-property level could see a peak-to-trough rise of around 50bps, with a corresponding fall in capital values of around 10-15% by end-2023, much more than the 5% fall in our current forecasts.

|

Chart 1: Property-to-Bond Yield Spread |

Chart 2: Euro-zone Prime Office Yields (%) |

|

|

|

|

Sources: Refinitiv, Capital Economics |

Source: Capital Economics |

Amy Wood, Senior Property Economist, +44 (0)20 7808 4994, amy.wood@capitaleconomics.com

James McMorrow, Property Economist, +44 (0)20 7808 4052, james.mcmorrow@capitaleconomics.com