Markets are starting the week braced for what happens when the 90-day reprieve on Liberation Day tariffs expires on Wednesday. But even as the next phase of Donald Trump’s tumultuous trade agenda begins to unfold, it’s increasingly clear that deeper forces are reshaping the global economy.

They can be seen in the provisions designed to curb trade with China that form part of US agreements with both Vietnam and the UK. They show that what we are witnessing is no passing trade war started by a president intent on taking American trade policy back to the nineteenth century – rather, it is the manifestation of a deeper, more durable superpower rivalry between the world’s two largest economies.

The integrated global economy of the post-Cold War era is splintering, giving way to a more fractured world of competing economic blocs centred on the US and China – and forcing other countries to choose a side. We’ve entered what I’ve termed in my new book The Fractured Age.

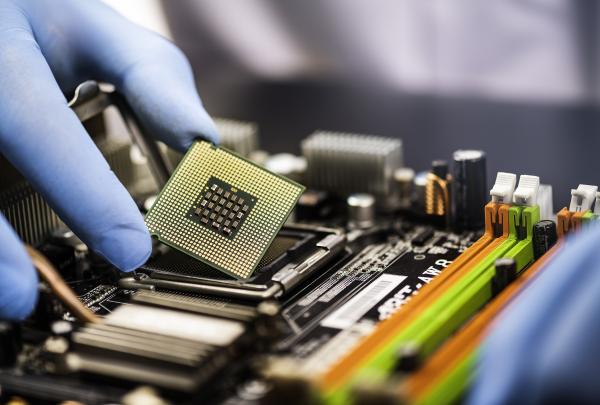

This isn’t the end of globalisation, but its reinvention. Apple’s decision to start shifting iPhone production to India, beyond the reach of US tariffs on China, is perhaps the most prominent illustration of how firms are adapting to new geopolitical realities. Trade flows are not shrinking – they’re shifting. Meanwhile, Beijing’s restrictions on rare earth exports reinforce how control over critical minerals is part of a country’s strategic arsenal. Add in the US’s ‘America First’ investment agenda, with its explicit objective of drawing in capital from allies even as investment from China is restricted, and you begin to see the contours of a world increasingly shaped by geopolitics.

The primary focus for now appears to be on anything that compromises supply chain security, national security or technological leadership. But where this ends up is still uncertain. A deeper and broader economic split between the blocs is still possible. Alternatively, it is possible that the blocs fail to hold. One of the greatest risks for the US position is that Donald Trump alienates its allies, the size and economic diversity of which are a major strength in a fractured world. In a fractured world alliances matter. An altogether more serious threat for all is that an ever-deepening rivalry brings the US and China into conflict.

But Apple’s India decision also shows that, while the world as a whole will be worse off as a result of a more fractured system, there will be benefits for some.

In all this, there are seismic implications for investors, from identifying the countries and sectors poised to benefit from shifting trade patterns, to positioning portfolios for a global economy marked by more volatile inflation and commodity prices. Policymakers must confront critical vulnerabilities in supply chains, capital flows and strategic mineral dependencies, while also finding ways to preserve globalisation’s core benefits. And for corporate leaders, challenges include building geopolitical resilience and ensuring supply chains are agile but – above all – understanding where their future lies in a fractured global economy.

We addressed these issues and more in an in-depth project of analysis and data three years ago. At the time, fracturing – or fragmentation, as institutions such as the IMF have come to call it – was considered a low-risk probability relative to ongoing integration, if it was considered at all.

Trump’s return to the White House – and his understanding of American power and how to wield it – has forced global attention onto a process that had been largely overlooked. Once-fringe questions have moved mainstream: could a third European bloc emerge to counter US and Chinese dominance? Is there scope for a US-China strongman-style ‘Grand Bargain’? Or do today’s fissures run deeper, pointing toward a more disruptive and dangerous fracture in the global order?

We’ll be publishing fresh analysis and data on how global fracturing is evolving under Trump later this year. This project revisits and reframes our 2022 work, updating clients on how both risks and opportunities are shifting as the administration settles in and challenges long-standing norms in global economic relations. We’ll also be hosting a series of in-person events around the world to brief clients, answer your questions, and continue the conversation. You can register for events in New York, London, Hong Kong and Singapore here.

In case you missed it:

Our Trade Hub remains the go-to for interactive data about how Trump tariffs are reshaping global trade, from high frequency monitoring across the trade cycle to the macro impact of tariffs to Chinese rerouting.

Ashley Webb assesses the damage after a grim week for the UK Labour Party, outlining why there’s now a greater risk of tax rises, but also the chance for the Chancellor’s fiscal bill to fall if gilt yields fall as we expect.

We’ve been continuing the launch of our regular coverage of Asia-Pacific commercial real estate with six key takeaways from the team’s initial analysis, forecasts, and last week’s client briefing – watch the recording of that session here.