A cartoon doing the rounds during the early days of the pandemic showed a series of waves poised to hit a city. The first, and smallest, was marked ‘COVID-19’, while the last – and much larger wave – was labelled ‘climate change’.

This was a neat way of contextualising the magnitude of these risk events. But from a macroeconomic perspective, the suggestion that climate change is just a much larger version of the pandemic – with similar economic outcomes requiring similar policy responses – is wide of the mark.

Both the pandemic and climate change are what economists call “exogenous shocks”. They lie outside of our usual models for forecasting the economic outlook, yet they can (and do) have significant economic effects.

However, climate change differs from the pandemic in at least three important respects, and understanding these differences will be crucial for investors to successfully navigate the risks and opportunities presented by this global challenge.

The first relates to timeframes. The pandemic produced a short but extremely deep recession. Most advanced economies experienced a peak-to-trough fall in GDP of around 20-25%. This was the sharpest fall in output in recorded history. But by the same token, output was quick to rebound. Three years on, the only major economies yet to return to their pre-COVID levels of GDP are Germany and the UK (both 0.5% below). In contrast, the macro consequences of climate change – and measures to counter it – will take place over years, if not decades.

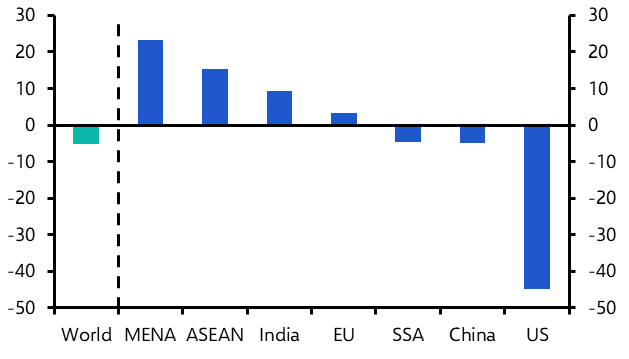

Second, the ways that the economic effects of the pandemic and climate change are distributed are radically different. Most countries experienced a similarly large fall in output as a result of the pandemic and – given the scale of the decline – a relatively rapid rebound. In contrast, the economic effects of climate change will differ significantly both between and within countries.

At a country level, the economic costs of climate change are likely to be greatest in India and south-east Asia where the most-exposed agricultural and tourism sectors account for comparatively large shares of output and employment. Meanwhile, developed economies such as the UK, US, and the euro-zone are less vulnerable to the effects of climate change, largely because services activity, which is less vulnerable to a warmer world, accounts for a greater share of activity. Some countries at northern latitudes such as Sweden and Norway might even reap some benefits from warming.

Finally, the nature of each shock is fundamentally different. In economist-speak, it was a classic example of what Keynes called “radical uncertainty” – who had ‘global pandemic’ on their market risks bingo cards going into 2020?

In contrast, the climate threat is well-known, with broad agreement on its key parameters within the scientific community. The challenge here is therefore not about a threat coming from leftfield, as with COVID-19 – it is mustering the political courage to enact domestic policies to accelerate the green transition, and trying to build a cross-country consensus to tackle what is the ultimate collective action problem.

The scale and complexity of this challenge prompted the launch of our Climate Economics service late last year.

Whether it was to understand the vulnerabilities to commercial property, to accurately assess country risk or to gauge China’s role as the problem and solution around rising global emissions, clients spoke of a need for insight into the physical and transitional risks around climate to build into their macro and market thinking.

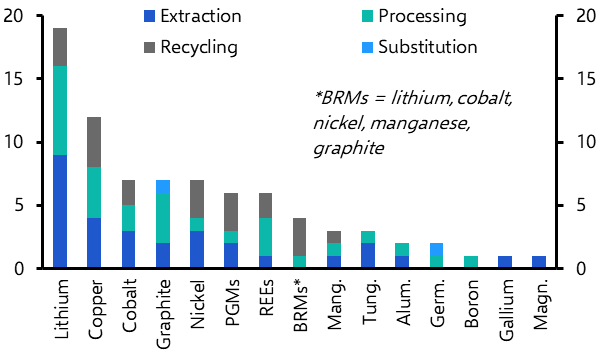

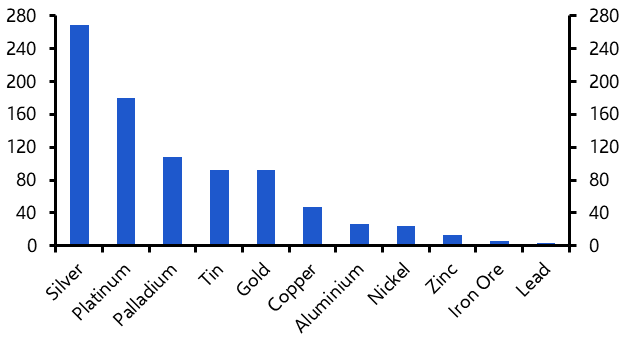

Central to our analysis is our view that technological improvement and the rollout of renewables will help reduce global emissions over time without hindering economic growth. Our Green Transition Chart Book, produced in collaboration with our Commodities team, provides quarterly updates on how this is developing.

Our analysis is also accompanied by extensive data resources which allow CE Advance clients to incorporate our climate forecasts and assumptions directly into their workflows. This includes our scenario model, showing how relatively small changes to the carbon intensity of GDP can have a large impact on emissions, which in turn will determine macroeconomic outcomes.

This is no supersized pandemic. With its potential to shape macro and market outcomes in radical ways, the climate challenge is a global risk that must be addressed on its own terms.

If you would like to learn more about our Climate Economics coverage, click here or drop a line to me or David Oxley, the service head.

In case you missed it

- UK headlines are dominated by news of surging mortgage rates. Our UK macro and housing teams will be briefing on the rates outlook after the BoE meeting this Thursday. In the meantime, Chief UK Economist Paul Dales explored the rise in rates in the context of the broader inflation fight.

- The optimism around AI that’s currently driving the S&P 500 could push the benchmark even higher than we’d been expecting by the end of 2024 – but not before recession takes some heat out of the stock market later this year.

- The plunge in the naira is the most visible sign that Nigerian economic policy is heading in the right direction after years of mismanagement. But Jason Tuvey, our Deputy EM Economist, warns there’s no guarantee that policy U-turn will stick.