Emerging Europe Economics

Our Emerging Europe coverage provides detailed analysis, independent forecasts, and regional outlooks for the economies and financial markets across Emerging Europe. We offer rapid responses to new data and developments, along with in-depth coverage of key themes, current trends, and future economic dynamics.

Try for free

Experience the value that Capital Economics can deliver. With complimentary access to our subscription services, you can explore comprehensive economic insight, data and charting tools, and attend live virtual events hosted by our economists.

Explore Emerging Europe in data

Our new interactive Macro Dashboard gives you the historical data and Capital Economics forecasts you need to track Emerging Europe's economic outlook. Available for data subscribers now.

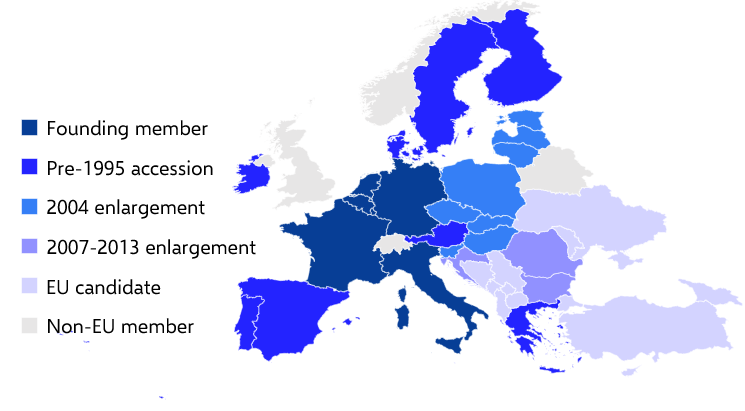

This service offers in-depth economic analysis of the outlook for economic growth, inflation, trade, currencies and policy rate trends and independent market forecasts for 13 countries: Russia, Turkey, Poland, Ukraine, Czech Republic, Hungary, Slovakia, Romania, Bulgaria, Croatia, Estonia, Latvia and Lithuania.

The subscription to this service includes 4-5 emailed publications a week, access to our online research archive and our economists, and the opportunity to attend our webinars, conferences and forums.

- Authoritative research by proven experts.

- Contrarian calls and thought-provoking analysis.

- Rapid responses, concise summations, detailed analysis, & independent forecasts.

Our Economists Recommend

The latest key insights, in-depth analysis, and thematic research collections

Key Regular Reports

The latest editions of our Weekly, Outlook & Chart Pack

In-depth Insights

Focus reports taking deep dives into topical issues

All Emerging Europe Economics Coverage

Featured Economists

-

Liam Peach

Senior Emerging Markets Economist

Liam Peach is a Senior Emerging Markets Economist leading our coverage of Emerging Europe and contributing to our Emerging Markets Overview service. Liam joined Capital Economics in 2017 and has developed a strong track record at forecasting the economies of Russia and Central and Eastern Europe. He regularly presents to clients and his views are frequently sought after by global media organisations, including the Financial Times, Bloomberg and the BBC. Liam previously worked as an economist at the UK Office for National Statistics. He holds a BSc in Economic and Econometrics from the University of Bristol and an MSc in Economics from City, University of London.

-

Nicholas Farr

Emerging Europe Economist

Nicholas has been with Capital Economics since September 2020 and sits on the Emerging Markets team. In his time at Capital Economics, Nick has researched and written extensively on financial market issues, ranging from the outlook for Chinese equities to how stocks and bonds have historically performed in times of war. Nick has been frequently cited by the world's leading media outlets, including The Times, the Australian Financial Review and Reuters. He is a graduate of the University of Bath.