Last week we published our latest Global Economic Outlook (you can read it here). Detailed analysis of the prospects for individual countries and regions can be found on our separate country services (see here). But three themes emerge at a global level.

The first is that world GDP growth is likely to be weaker than most anticipate over the next year or so. We expect the global economy to expand by 3.0% in 2019 and 2.8% in 2020. To put that into perspective, it is considerably weaker than the rate of growth expected by the IMF, which also released new forecasts last week. Despite pulling down its projections and presenting them with plenty of gloomy rhetoric, the Fund still expects the world economy to grow by 3.4% next year.

Most of the relative weakness of our forecasts is due to the fact that we’re more downbeat on the prospects for advanced economies. This is especially true of the euro-zone, where the Fund expects growth to rebound next year but we expect it to slow further. Our forecast for aggregate EM growth is also weaker than the consensus, but that’s due in large part to our view that China’s economy will slow. In contrast, we think growth will edge up in other EMs, including Brazil, Mexico and India, as policy stimulus gains traction.

Even so, the net result is that we think the world economy will record its slowest rate of expansion since 2009 next year – and the second slowest rate of expansion since the aftermath of the dot-com crash in the early 2000s.

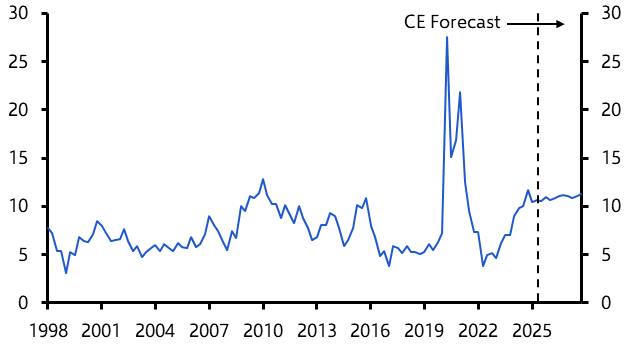

The second theme of our forecasts is that, with weak growth, will come weak inflation. This is particularly the case in advanced economies. In fact, we expect average inflation in 2020 to be below the central bank’s target in every G7 economy. If this were to happen it would be the fourth year out of the past six in which inflation in every G7 country has undershot its target. Low rates of inflation are becoming increasingly entrenched.

The third and final theme is, perhaps unsurprisingly, that weak growth and low inflation will result in further policy loosening. However, it’s likely that central banks – rather than governments – will continue to shoulder the burden of providing policy support. Of the world’s major central banks, we expect further rate cuts by the Fed and additional loosening by the PBOC. We also expect the ECB to provide further support in the form of further interest rate cuts and additional asset purchases – but not until a much-anticipated review of monetary policy concludes early next year. Other central banks are also likely to step into the world of unconventional monetary policy. In a piece published last week, our Senior Asia-Pacific economist, Marcel Thieliant, argued that the Reserve Bank of Australia will be the next central bank to embrace QE (you can read more here).

All of this leaves any fiscal response notable only by its absence. Of the world’s major economies, the UK is the only one where we anticipate a significant fiscal relaxation in 2020. In contrast, countries with strong budget and external positions, and thus the greatest fiscal space (notably Germany), will remain reluctant to loosen the purse strings. Unless or until this changes it will be difficult to take a significantly more positive view of the outlook.

In case you missed it:

- We have published further pieces in our series assessing the causes and consequences of peak globalisation. You can read them here.

- Our UK team have covered the various twists and turns in Brexit over the past week in detail. You can read all of our publications here.

- Finally, congratulations to Abhijit Banerjee, Esther Duflo and Michael Kremer, who were announced as the joint winners of this year’s Nobel Prize in Economics. But as our Senior Europe Economist, David Oxley notes, the prize money isn’t what it used to be…