We held a series of roundtables in Singapore and Australia last week, discussing our views on the global economy with clients and answering their questions. It was striking how often the same questions kept coming up – though they were unsurprising given the rapid shift in the near-term outlook for the region’s dominant economy, and the worrying trends in its geopolitical narrative:

Are Chinese consumers going on a massive spending spree to run down savings accumulated during the pandemic?

This was the most frequently asked question — and the short answer is “no”, not least because we don’t believe that there was a large accumulation of savings during the pandemic. In fact, our analysis suggests that household net wealth in China fell last year for the first time in at least two decades.

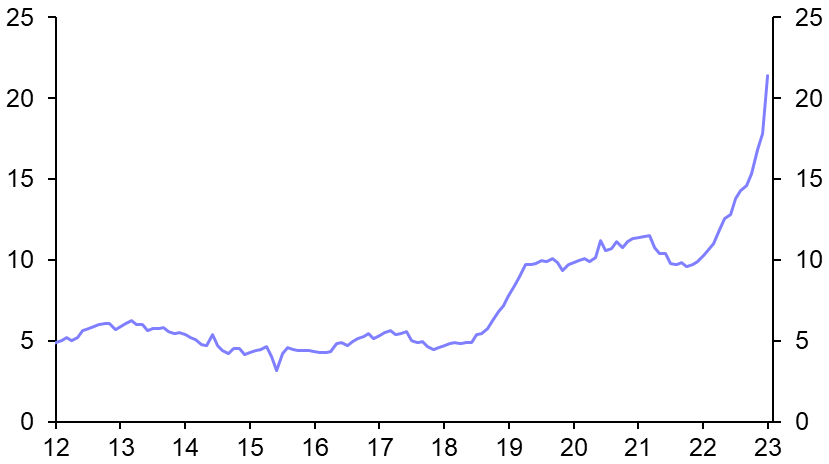

Those arguing that there has been a large increase in savings tend to point to the sharp rise in household deposits over the past year. (See Chart 1.) But this reflects a shift in funds within the household sector caused by a crackdown on wealth management products – that vast array of financial products which had been aggressively marketed to retail investors – at the start of last year. A similar rise in household deposits occurred during a previous crackdown on such products in 2018.

|

|

|

|

| Sources: CEIC, Capital Economics |

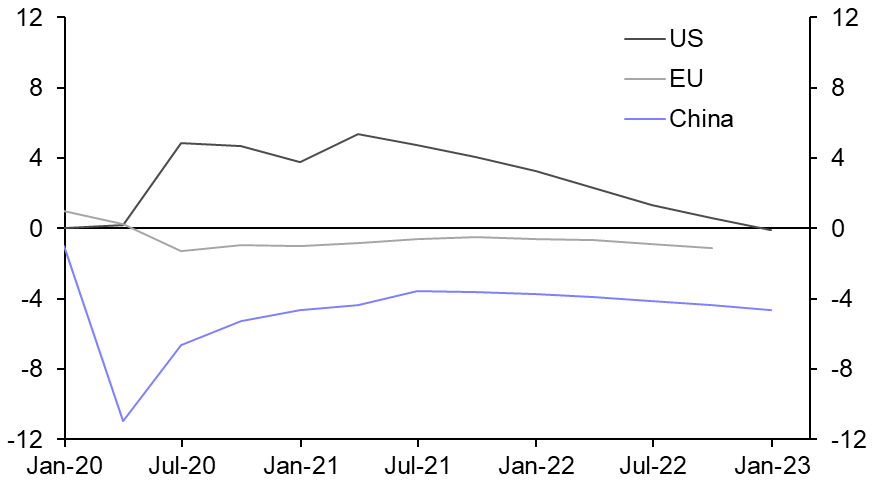

The best way to assess what happened to consumer balance sheets during the pandemic is to look at changes in household net wealth. The Chinese Academy of Social Sciences, a leading state research institution, publishes a series on this but the latest data point is for 2019. However, by reconstructing the series and extending it to last year, our China team shows that last year household net wealth actually fell (you can read more about their work here). This reflects a drop in house prices as well as weakness in the equity market. The absence of fiscal transfers during the pandemic, similar to those seen in advanced economies such as the US and EU, has also weighed on household finances. (See Chart 2.)

|

Chart 2: Household Disposable Income – Cumulative Deviation from Pre-Pandemic Trend (%) |

|

|

| Sources: CEIC, Capital Economics |

The upshot is that there is no large wall of savings that is about to be unleashed in China. We expect the economy to rebound faster than most anticipate but, unlike in developed economies, the post-pandemic recovery in consumer spending will not be sustained by a drawdown of accumulated savings.

Will China’s reopening add to inflationary pressure in advanced economies?

There are two ways in which some analysts have argued that China’s reopening could add to inflation pressures in advanced economies. Neither are very convincing.

The first way relates to developments on the supply side of China’s economy. The idea here is that as China reopens it is likely to experience the new waves of the virus, which in turn might lead to worker absences and supply bottlenecks that push up the price of exported goods. However, the virus has now largely passed through the population without causing widespread and sustained worker shortages. More fundamentally, there is greater slack in global supply chains compared to a few years ago. Chinese manufacturers now appear to be sitting on large amounts of inventory and global demand for China’s exports is now substantially weaker than was the case at the height of supply chain problems in 2021. Accordingly, a supply-driven surge in inflation caused by China’s reopening looks unlikely.

There is also a belief that demand-side developments around China’s reopening could be inflationary for others. The concern here is that as Chinese spending rebounds it could add to price pressures in the global economy. However, the rebound in Chinese spending will be focused primarily on domestic services, which have a low level of imported inputs. Chinese consumers flocking back to restaurants and cinemas are unlikely to push up inflation in other economies.

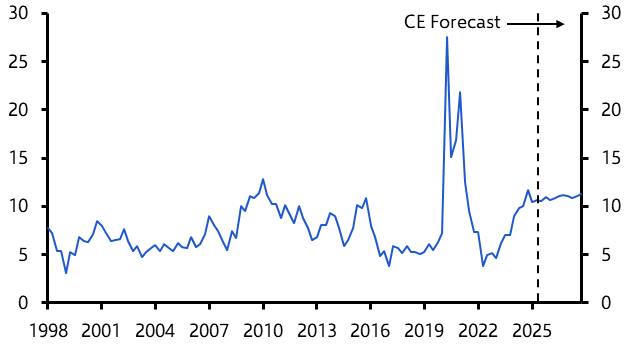

Instead, the biggest risk to global inflation is that the Chinese reopening causes a surge in prices of global commodities, particularly energy. However, while China’s energy demand will rebound this year, demand in other major economies will be held back by weak growth and/or recessions. In our view, this will check the rise in global oil prices.

Our base case is that Brent crude will rise to $95pb by the end of this year. This is still consistent with the contribution of energy to headline inflation in advanced economies falling sharply. However, if China’s reopening is to be inflationary for other economies, it is most likely to be because energy prices rise further than we anticipate, and that this slows the pace of disinflation in other economies that would otherwise have occurred.

How do geo-political tensions affect the global economic outlook?

Beyond the near-term outlook, the question we were asked most frequently last week was how geopolitical developments will shape economic outcomes over the coming years. The question itself is revealing: it is now widely accepted that the era of globalisation is over, and that geopolitical considerations are becoming an increasingly important driver of policy decisions. This takes economists out of our comfort zone, but the macro and market consequences will be significant. It is therefore important to have a framework for thinking through these issues.

We set this out in our Spotlight report last year. In brief, we believe that the global economy is splintering into two blocs — one that aligns with the US and one that aligns with China. And we believe that policy choices within these blocs will be shaped increasingly by geo-political considerations. We called this process “global fracturing”.

Fracturing is not a challenge to be overcome, as some commentators have suggested. Instead it is something that many policymakers on both sides are actually pushing. This is also why a period of outright deglobalisation is unlikely to follow: there is no geopolitical justification for relocating production of most consumer goods. Instead, fracturing will proceed in areas that are most geopolitically sensitive. This includes batteries, biotech, some commodities and technology.

One final point to stress is that fracturing will not split the world down the middle: the US-aligned bloc is likely to be larger and more economically diverse than the China-aligned bloc. This means that the US bloc will be better able to adapt to the challenges posed by fracturing. In contrast, the China-aligned bloc will find it harder to adjust.

The global economy as a whole will be worse off as a result of fracturing — but, as we argued in our meetings last week, China has the most to lose.

In case you missed it:

- In our latest Long Run Asset Allocation Outlook, our Markets team explained why they think a 60:40 portfolio of US equities and Treasuries will deliver middling real returns over the next decade.

- The Russian economy’s second year of war will be marked by the increasing drag on public finances from a widening budget deficit, said Senior EM Economist Liam Peach.

- Bradley Saunders on our Commodities team showed why we think a falling European population from 2030 will weigh on global wheat consumption.