The Weekly Briefing: 5% Treasury yields, geopolitics vs the Fed, China’s dollar dilemma, an AI stock bubble and more

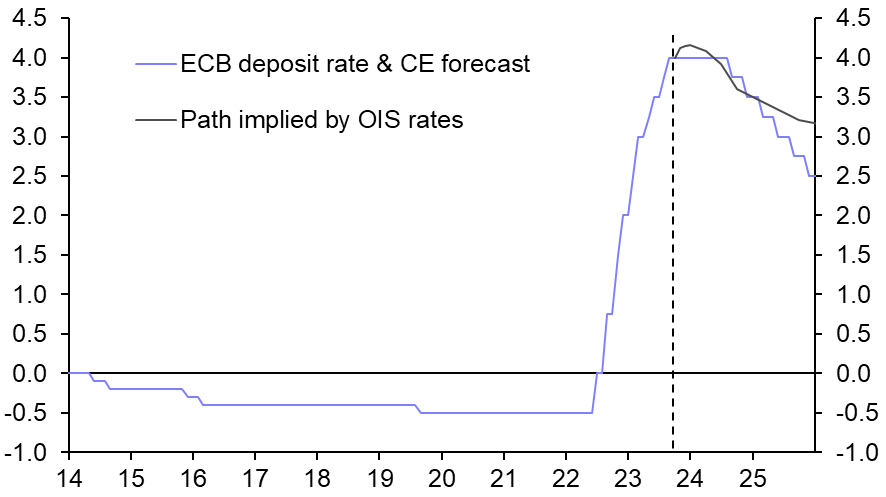

With the 10-year Treasury yield finally hitting 5%, Group Chief Economist Neil Shearing explains the macro risks around rising bond yields, telling David Wilder what this all means for central banks.

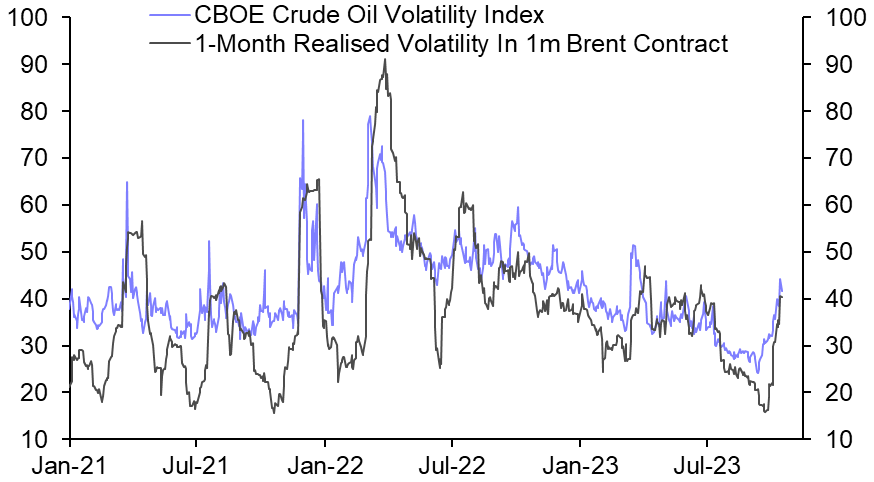

He also talks about how policymakers manage geopolitical uncertainty in light of Israel’s conflict with Hamas and talks about how events in the Middle East fit with the idea that the global economy is fracturing into US- and China-led completing blocs.

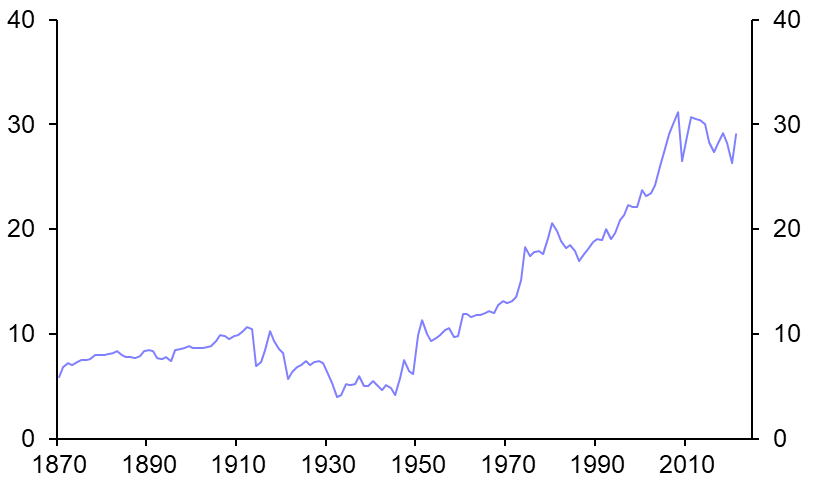

Plus, Mark Williams tackles market talk that China is dumping its dollars and Bradley Saunders discusses his recent analysis on whether AI hype is fuelling a bubble in stock markets.