Global Housing Boom to Bust

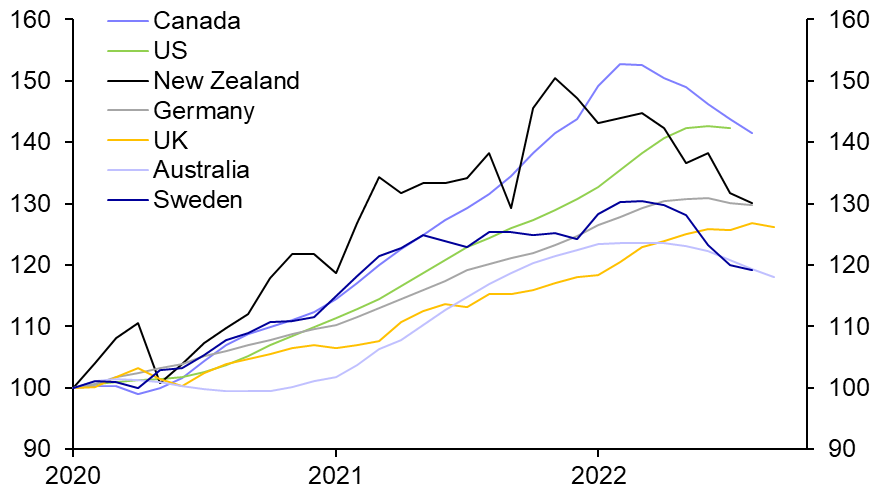

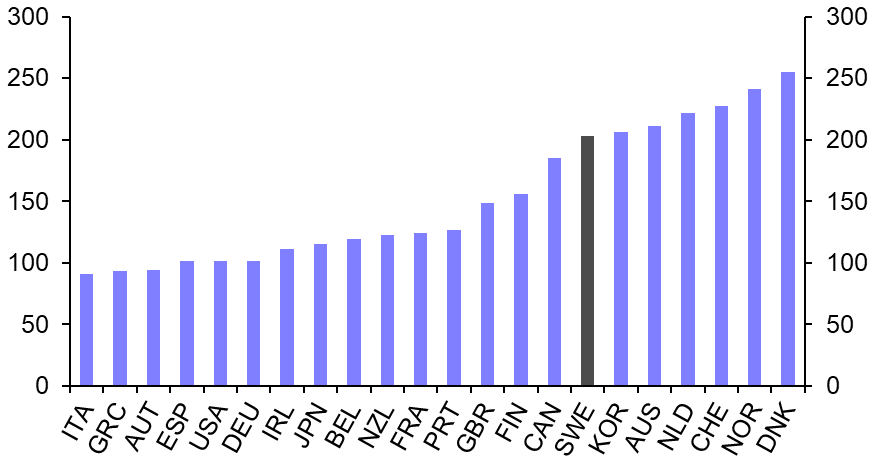

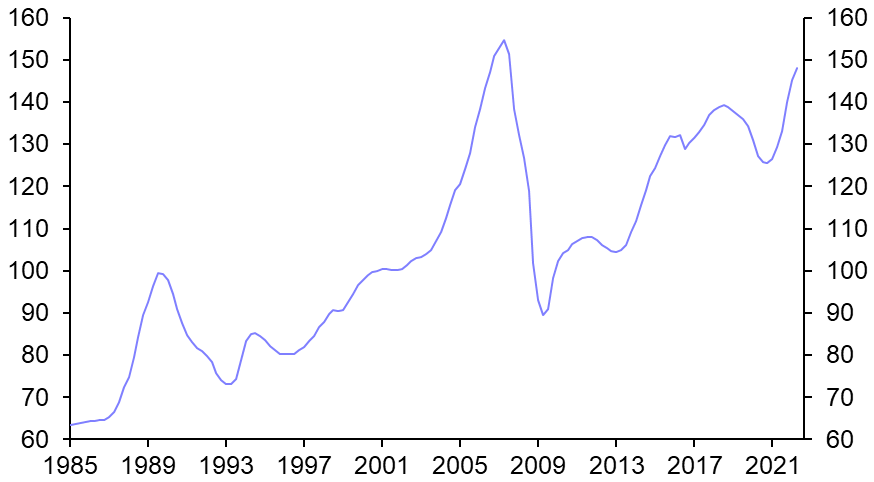

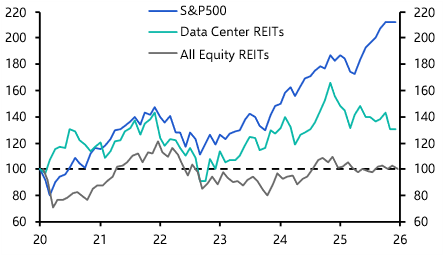

How monetary tightening is calling a halt to the record surge in global house prices – and what that means for the economic and policy outlook

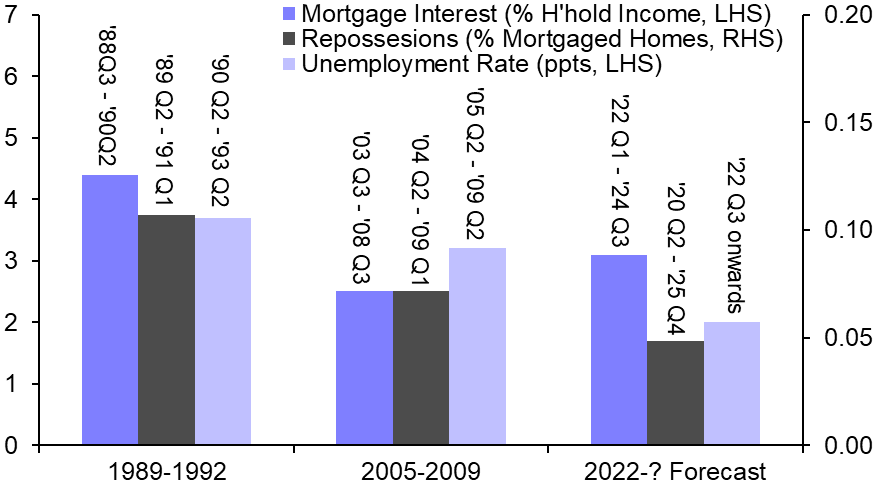

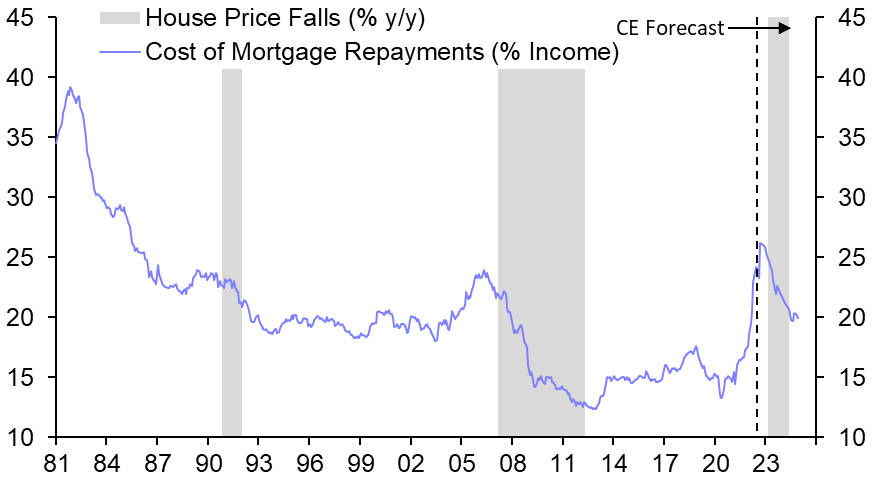

We warned early in this tightening cycle that over-heated housing markets would be a key vulnerability as global interest rates rose from historic levels. As inflation has proven more persistent, rates have been rising at a more aggressive pace and housing booms have begun to turn to busts. In this special collection from across our global coverage, we’ve highlighted key research to help you understand the global and country-level macroeconomic risks around falling house prices, showing how they will affect economic activity and how policymakers are likely to respond.

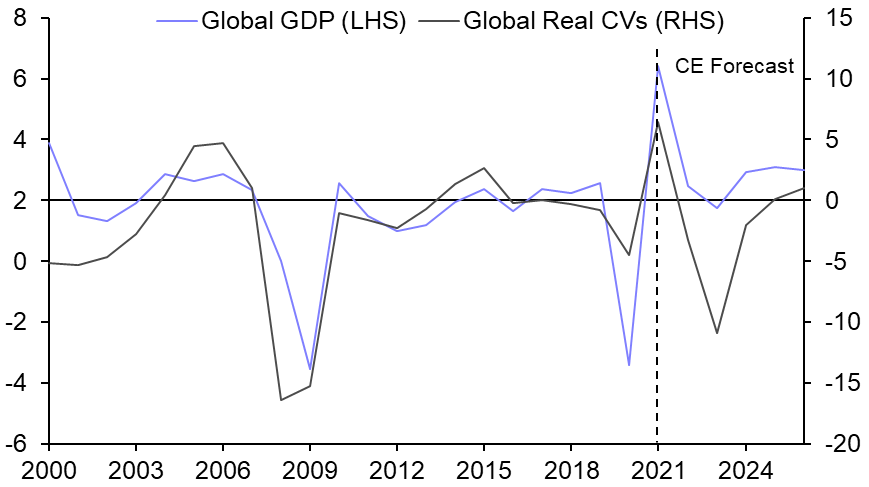

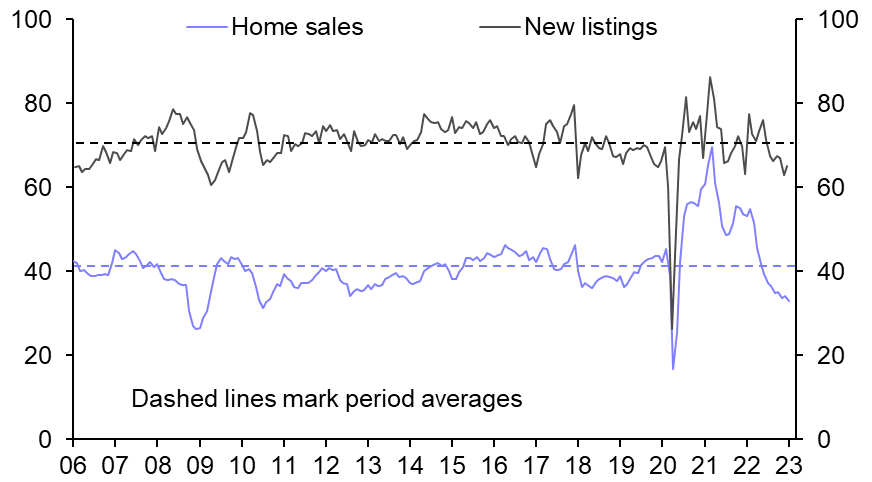

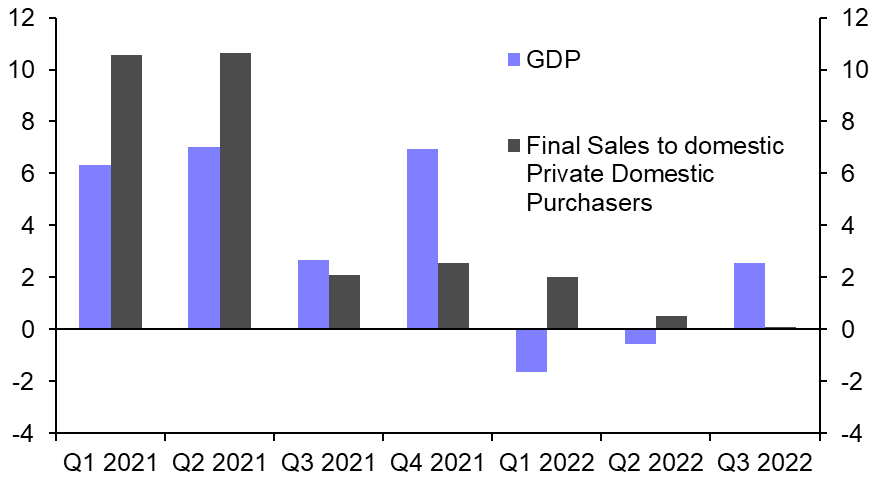

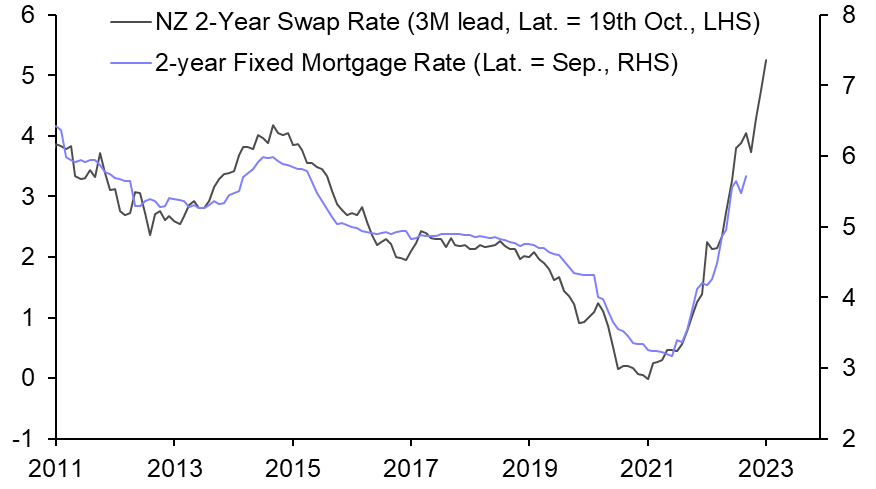

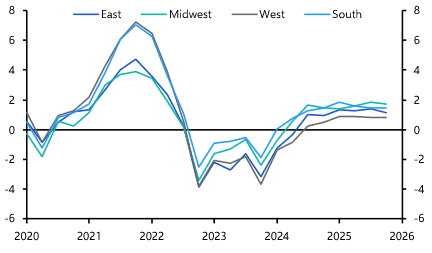

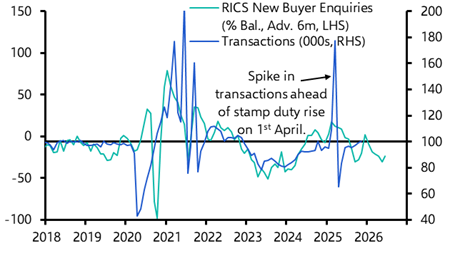

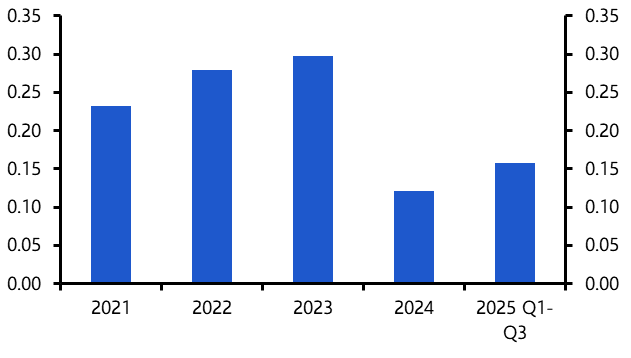

Housing downturns starting to take toll on economies

Prices and activity have further to fall, with market weakness set to contribute to recessions in advanced economies