The grim reality of Europe’s cost of living crisis is beginning to stir governments into action. In Germany, the government has announced a support package that freezes energy prices for households and businesses. The new UK government has done something similar.

These massive fiscal interventions are intended to tackle the crises threatening the German and UK economies head on, and they will provide some immediate relief. But the complexities of the cost of living crisis will require a more involved – and more painful – policy response than a price freeze.

In reality, the “cost of living crisis” label conflates many issues. Real wages and living standards in Europe are being squeezed by a deterioration in the region’s terms of trade caused by soaring global energy prices. But inflation rates also reflect a more general rise in prices as the post-pandemic rebound in aggregate demand hits supply constraints, and workers (understandably) respond to the resulting increase in prices by trying to push up their pay to protect their living standards.

These cost and price pressures have different causes and different consequences. Accordingly, they require different policy responses.

Worse than the ‘70s

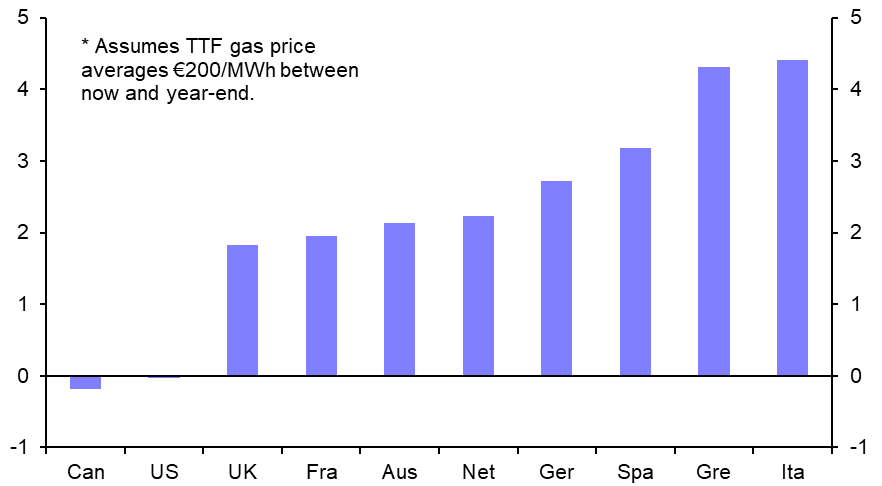

If the prices of a country’s imports increase relative to its exports then it is worse off. Small shifts in the terms of trade don’t tend to have a major impact on living standards but large shifts do. And the surge in European gas prices is a very large shift, translating to a massive terms of trade shock. If the current level of gas prices is maintained, the deterioration in the terms of trade would be equivalent to over 4% of GDP in Italy, nearly 3% in Germany and almost 2% in the UK. (See Chart 1.) These losses would be larger than either of the two oil shocks of the 1970s.

|

Chart 1: Increase in Cost of Net Gas Consumption (2022 versus 2021, % of GDP)* |

|

|

|

Sources: Refinitiv, BP , Capital Economics |

The ultimate hit to GDP will depend not only on the size and duration of the terms of trade shock, but also on who bears the costs: consumers, companies, the government, or a combination of all three. If the shock is temporary, then the government can cushion the impact on demand and therefore output through fiscal support. This is the rationale for the freezing of retail gas and electricity prices that has been announced by the UK and Germany over the past week.

These measures are unlikely to prevent either country from falling into recession over the coming quarters, but they will limit the depth of the downturn. As a result of the package of support that has been announced, we think the UK will experience a peak-to-trough fall in output of something like 0.5% rather than the 1.0% we originally forecast.

The fiscal costs of an intervention on this scale are huge – perhaps as much as £75bn a year (~3.75% of GDP) in the case of the UK. However, from the perspective of the “cost of living crisis”, freezing utility prices may only be a sticking plaster. If wholesale energy prices remain elevated and the shock to Europe’s terms of trade is longer-lasting, then there is no way to avoid a large and sustained reduction in incomes and output.

Not just an energy story

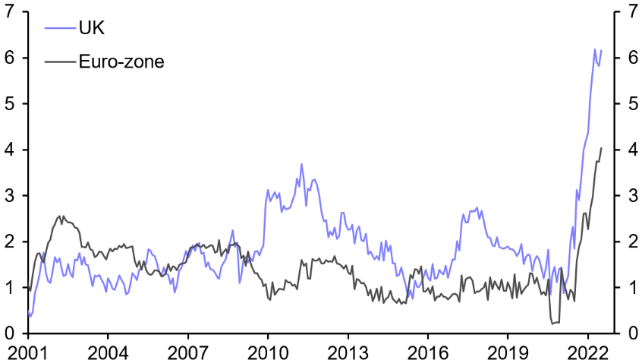

This brings me to the second element of the current crisis – namely a generalised rise in inflation. Headline inflation has surged to 8.8% in Germany, 9.0% in Italy and 10.1% in the UK. But this is not simply an energy story. Core inflation has also jumped. (See Chart 2.) In the UK, it is currently running at 6.2%. In the euro-zone it is 4.3%. This reflects the underlying strength of aggregate demand relative to potential supply, both of which have been affected by pandemic-related distortions.

| Chart 2: Core Inflation (% y/y) |

|

|

|

Sources: Refinitiv, Capital Economics |

Tight labour markets mean that this generalised rise in inflation is having so-called “second round” effects on wages as workers try to push up pay in order to protect their real incomes. In the UK, wage growth is currently running at close to 5% y/y. This is incompatible with a 2% inflation target when underlying trend productivity growth is probably around 1.5%. (In such circumstances, wage growth should be closer to 3.5% in order to be compatible with 2% inflation.)

In order to get on top of this generalised inflation, policymakers will need to slow the pace of wage growth. But the extent to which they will need to engineer this through tighter policy (and thus weaker demand) will depend to a large extent on what happens on the supply side of economies. New analysis from the Office for National Statistics suggests that the UK may have lost between 270,000 and 400,000 workers since the pandemic. The Bank of England will need to form a judgment as to whether this is a permanent or temporary loss when setting policy.

Still higher rates to come

All of this will be fiendishly difficult to get right. But while fiscal support can provide an effective (if expensive) sticking plaster to a temporary terms of trade shock, it’s likely that monetary policy will need to tighten much further to tackle the UK and Europe’s generalised inflation problem effectively. We got a flavour of that at last week’s European Central Bank meeting, where interest rates were increased by 75bps – a move that would have been unthinkable at the start of this year. We expect further aggressive monetary tightening by the ECB over the coming months, taking the policy rate to 2% by the end of this year.

In the UK, our long-standing forecast that rates would reach 3% was bold a few months ago but is now looking more mainstream. In fact, one of the paradoxes of large fiscal support is that the Bank may now need to tighten monetary policy by more than would otherwise be the case. An increase to 4% is now possible.

Government support will ease, rather than eradicate, Europe’s cost of living crisis. But underlying price pressures will force central banks in the region to tighten policy further as winter draws in.

In case you missed it:

- Brazil’s upcoming presidential election will be one of the big political EM stories in Q3, drawing an increasing amount of attention in the market ahead of first-round voting on 2nd Oct. To help clients keep track of our insight into its economic and market implications, we’ve created this dedicated page.

- We have also collated all of our research on Europe’s energy crisis in one place on our website – view it here.

- Finally, our Senior Global Economist, Simon MacAdam revisits the latest evidence on the shape of Phillips Curve and explores whether inflation can be brought to heel without the need for large job losses.