A degree of calm has returned to markets over the past week, but some sense of nervousness persists. The hunt is on for the next shoe to drop.

Historically, problems in the property sector have been at the heart of major crises. This was most recently the case in the 2007-08 global financial crisis. But it was also true of the US Savings and Loans crisis in the 1980s and 1990s, the UK secondary banking crisis of 1973-1975 and – going back further – the Great Crash of 1929.

This is due to several features that distinguish property from other asset classes. The first is that mortgage loans form a large part of banks’ assets – meaning that if a collapse in property prices turns safe-looking securitised loans into bad debts, it has a significant impact on the health of banks’ balance sheets. Loans to commercial and residential property account for just under one-quarter of banking assets in the US.

A second feature is that property forms a large part of overall household wealth (about 30% of net wealth in the case of the US). Accordingly, a collapse in property prices also has an impact on household balance sheets.

These features mean that if property prices fall, there is a risk of a mutually reinforcing feedback loop from banks to households, and the financial system to the real economy.

Clients can find our extensive analysis about risks in global housing markets on a dedicated webpage here. The short version is that while we expect house prices to fall by 10-20% in most major markets, household leverage is not alarmingly high and we do not expect a drop in prices to cause widespread problems across the banking system.

Instead, if property is to be the source of deeper strains in the banking system, the place to look may be commercial real estate. This has become a focus of concern in recent days, particularly in the US, but the linkages with the banking system – which is the real source of vulnerability – have not received sufficient attention within the debate.

At the risk of stating the obvious, commercial property is a fundamentally different asset class to housing. For a start, some of the market is traded publicly (i.e. REITs) while some is traded privately. What’s more, the market is extremely diverse, covering everything from office markets in global cities to industrial units in rural counties.

Reflecting this, the performance and prospects of different parts of the commercial real estate market are very different. Some sectors, such as shopping malls, are in long-term decline, while sectors such as offices face a permanent hit from the pandemic, and some (such as industrial warehouses) are benefiting from structural shifts in economies.

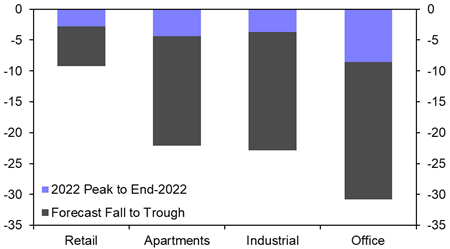

All property commercial real estate prices in the US have fallen by 4-5% from their peak in mid-2022 and we expect a further 18-20% fall from here (making a peak-to-trough fall of around 22%). But this will encompass a wide divergence in performance across sectors. (See Chart 1.) (For detailed analysis, see our dedicated US Commercial Real Estate service.)

|

|

|

|

| Sources: MSCI, Capital Economics |

However, as our Chief US Economist Paul Ashworth has argued, from the perspective of financial stability the key point to note is that lending to commercial property in the US is dominated by the country’s small and mid-tier banks. Lending to commercial property accounts for about 40% of all loans by smaller US banks (defined by the Fed as being those outside the 25 largest by asset size). These banks account for about 70% of outstanding loans to the commercial real estate sector.

Crucially, these smaller banks are also experiencing pressure on their deposit base. The immediate focus has been on the risk of deposit flight caused by concerns about the health of mid-tier banks in the wake of the collapse of SVB and worries about uninsured deposits in excess of the federally-insured limit of $250k.

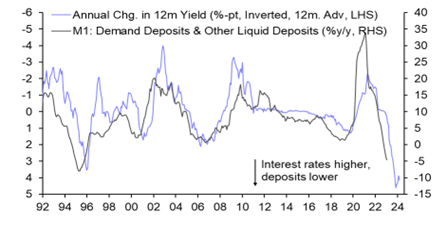

But this has obscured a broader problem, which is that higher interest rates are causing a shift out of bank deposits and into money market funds as interest rates on short-dated securities rise faster than those on commercial bank deposits. (See Chart 2.)

|

Chart 2: Bank Deposits and Interest Rate |

|

|

| Sources: Refinitiv, Capital Economics |

This leaves banks in a bind: either they raise deposit rates in line with money markets and try to maintain profits by increasing rates on loans that are due to refinance, or they shrink the asset side of their balance sheet in order to accommodate a smaller deposit base. Either way, the fact that smaller banks dominate lending to commercial real estate means that financing to the sector is likely to tighten.

At the very least, this is likely to add to the downward pressure on capital values. But in a worst case scenario it’s possible that a “doom loop” develops between smaller banks and commercial property, in which concerns about the health of these banks leads to deposit flight, which causes banks to call in commercial real estate loans, which then accelerates a downturn in a sector that forms a key part of its asset base, which intensifies concerns about the health of the banks and thus completes the vicious cycle. Likewise, it’s possible that concerns about commercial real estate expose other vulnerabilities in the financial system, such as maturity mismatches within open-ended funds. (For more about risks at shadow banks, see here.)

To be clear, the risks emanating from the property sector are very different from those 15 years ago, and the consequences are likely to be far less damaging to the real economy. But in the hunt for the next shoe to drop, commercial real estate – and its linkages to small and mid-tier banks – looms large.

You may have missed:

- All our coverage on the banking turmoil can be found on this dedicated page, including this analysis of the economic threat posed by US small bank exposure to commercial real estate.

- I discuss the role of commercial real estate in the turmoil in the latest episode of our weekly podcast.

- Away from the panic around banks, Senior EM Economist Liam Peach explored the economic implications of Xi Jinping’s meeting with Vladimir Putin.