Another year of double-digit value falls

Q1 2024 US Commercial Property Outlook

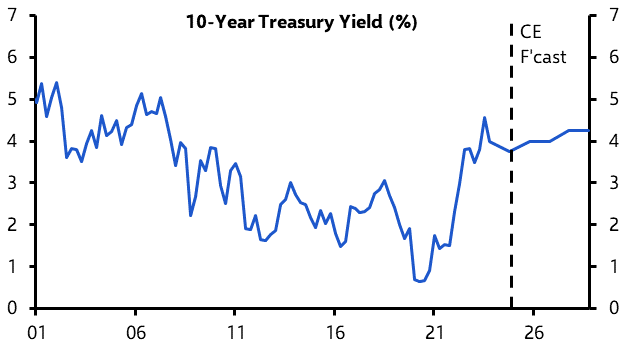

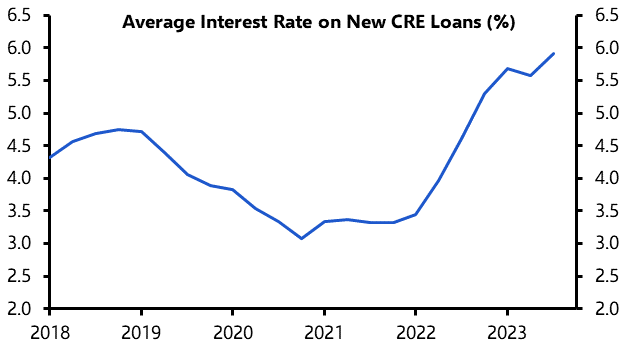

Persistent weak growth and elevated (albeit soon-to-be falling) interest rates continue to spell trouble for real estate values.

These are just some of the key takeaways from our latest quarterly US Commercial Property Outlook, originally published on 15th December, 2023. Some of the forecasts contained within may have been changed since publication. Access to the complete report, including detailed forecasts and near to long-term analysis, is available as part of a subscription to our CE Advance premium platform or to our dedicated US Commercial Property coverage.

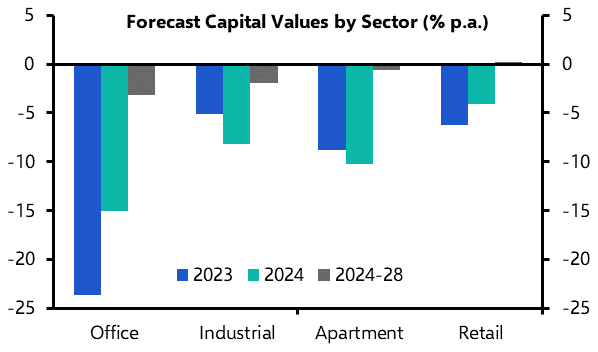

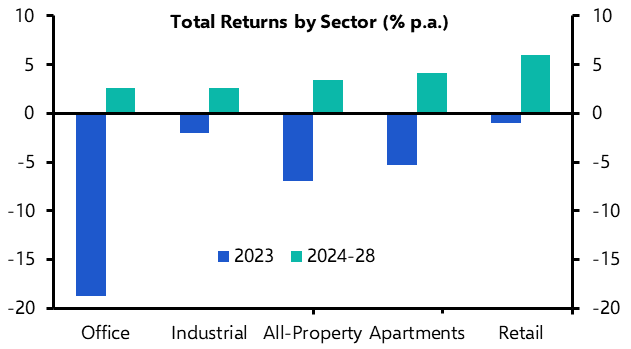

We see NOI growth softening further over the next year as the industrial rent boom gives way to more “normal” growth rates and apartment rents flatline. At the same time, the adjustment in cap rates will continue to come through in appraisals, meaning that all-property capital values fall by 10% in 2024, after dropping 11% in 2023. Further ahead, the outlook for occupier markets is still strong in industrial and apartments, but both will remain overvalued in 2024 and will see further cap rises beyond, which will weigh on total returns. Instead, retail will be the bright spot, seeing average annual returns of 6% p.a. over 2024-28. Meanwhile, offices still face a substantial value adjustment, with another 20% fall to come in our view. What’s more, we still think it is likely to take two decades or more before office values regain their peak of Q1 2020.

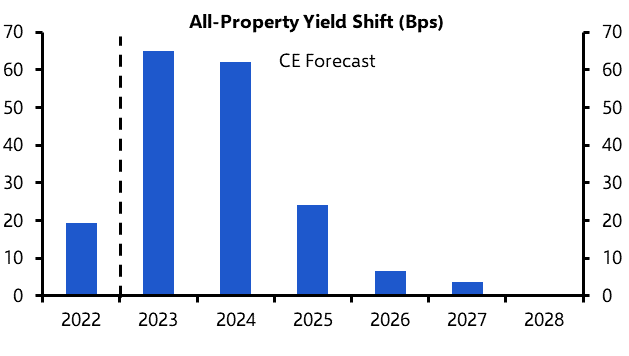

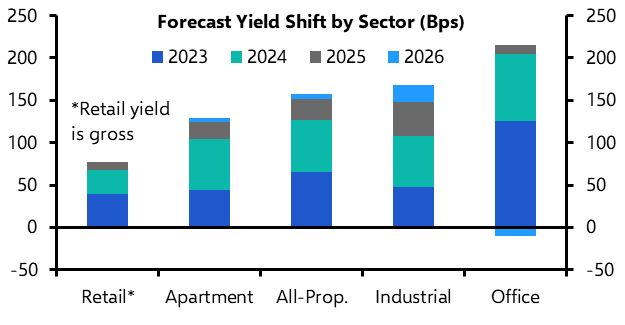

- Investment Market – Investment activity is set to remain soft into H1 2024, before gradually recovering as growing distress leads to sellers increasingly accepting more realistic prices. On that front, due to the higher longer-term level of interest rates we now expect, we think that even if appraisal-based cap rates reach 4.5% in Q4 2023, they will still have another 100 bps to go over the next few years. As a result, we think all-property capital values still face another 10% fall in 2024 and up to a further 5% in 2025.

- Office Market – Though new supply is slowing, contracting demand continues to be the main driver of rising vacancy, which we think will continue for another couple of years. Along with declining sublease rents, this means NOIs are set to keep falling. And with total cap rate rises to exceed 200 bps, we expect office values to contract by 43% overall, implying around 20% of value falls are still to come. As a result, total returns across 2024-28 will limp to just 2.5% p.a..

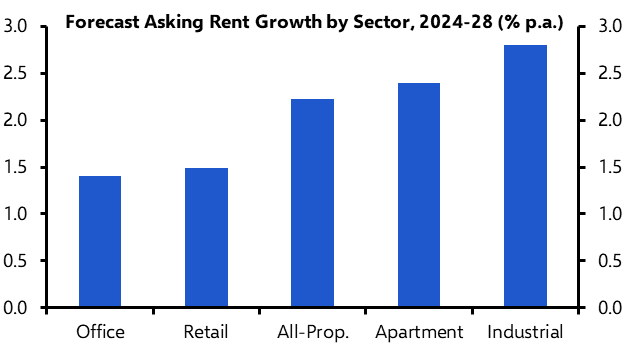

- Retail Market – Cyclical weakness will weigh on retail demand over the next year, but thereafter, we expect a steady recovery. Meanwhile, muted new supply means that vacancy rates are either set to be stable or falling, which sets the sector up for NOIs to grind higher. With cap rates close to fair value already, we expect a period of solid performance for retail over the next five years, with average annual total returns hitting 6% p.a. in 2024-28, making the sector our best performer over the full period.

- Industrial Market – We expect both demand and supply to normalise after the pandemic-era boom. While this should see rent growth slow, we expect it to remain solid over the forecast horizon. However, the big issue facing the sector is that as time passes and rent growth slows, investors will not be able to build significant gains into their cash flows. And, with the risk-free rate forecast to be above 4% later in the forecast, we think industrial cap rates need to see a substantial adjustment. This will hit values and means that we see total returns being as poor as those for offices on a five-year basis, at just over 2.5% p.a..

- Apartment Market – The short-term apartment outlook is poor, but this should give way to solid performance later in the forecast period. In the next year or so, demand will remain soft and supply strong, prompting further rises in vacancy and little increase in rents. At the same time, we think cap rates need to rise much further to adjust to the higher rate environment. But from H2 2025, as cap rates peak and rent growth returns to around 2.5-3% p.a., total returns should pick up to 7.5% p.a. for 2026-28.

2024 in Charts

|

|

|

|

|

|

|

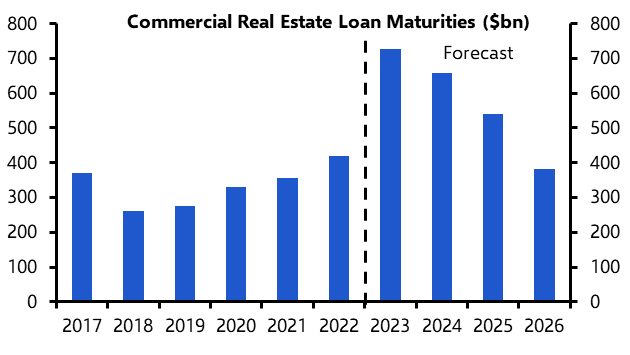

Chart 3: The record levels of loan maturities in 2023-25 therefore come at an inopportune time. |

Chart 4: But this should bring more forced sellers to market, helping the cap rate rise play out sooner. |

|

|

|

|

Chart 5: Offices will see the largest cap rate rise in 2024, but we think industrial has the furthest to go in 2024-26. |

Chart 6: That is despite industrial rent growth exceeding 2.5% p.a.. |

|

|

|

|

Chart 7: This suggests office values will continue to plummet. Only retail values see growth over 2024-28. |

Chart 8: Retail returns therefore stand out over the forecast horizon. Office and industrial trail. |

|

|

|

|

|

Chart sources: CBRE, Newmark Research, Refinitiv, CE |

These are just some of the key takeaways from a 13-page report published for Capital Economics clients on 15th December, 2023. The report was written by Kiran Raichura, Charlie Cornes and Thomas Ryan.

Get the full report

Trial our services to see this complete 13-page analysis, our complete US commercial property insight and forecasts and much more