Aggressive tightening moves from the Federal Reserve, Bank of England and European Central Bank are shaking up the outlook for commercial property returns. In a 19th May online briefing, Chief Property Economist Andrew Burrell and colleagues Amy Wood and Kiran Raichura discussed our latest forecasts for yields and returns. The following are extracts from that conversation, edited for clarity:

Andrew Burrell: Perhaps you can draw out what the recent changes in sentiment towards interest rates mean in US markets?

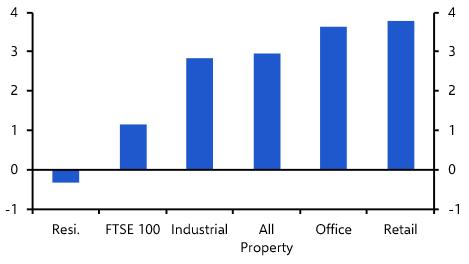

Kiran Raichura: If we start with the answer and work backwards, the key takeaway is that we have downgraded our forecasts. But it's not panic stations. Interest rates have risen and our expectations of those rate rises have been brought forward to the next year or two and so we've already seen property valuations squeezed by higher bond yields – both Treasury yields and corporate bond yields have obviously risen sharply in the last three months or so. And we also assess property valuations against equity earnings yields, and again, property valuations look pretty stretched against those. And obviously, along with interest rates rising, we've seen the cost of debt rising, which obviously squeezes the potential upside for investors making use of debt. So we've brought forward our expectations of property yield rises by around six months or so, so that they actually start in the second half of this year. Then we see continued rises next year and that brings it forward from what was more of a 2023-2024 outlook. And what that does for returns over the next two years is reduces them by about four percentage points at the all-property level per annum.

Andrew Burrell: Obviously, Europe is slightly different as policy rates there haven't actually risen yet but we think that's only a matter of time before they do. Amy, you could you could give the European story and how this relates to the other to the other markets we've heard about.

Amy Wood: The euro-zone story is actually quite similar to the US in that we’ve brought forward the rise in property yields that we had expected to come in 2024-2025 to next year. The ECB is a bit behind the Fed and the Bank of England in their tightening cycle but it's coming soon. And we've already seen some pretty sharp rises in bond yields as investors have priced in more interest rate tightening and we think there's still further room for bond yields to rise. We also expect to see an even sharper squeeze on property valuations next year. With property-to-bond spreads likely to fall well below their post-GFC averages. There's some uncertainty about timing but we now think all-property yields at the euro-zone level will reach their trough this year and will increase by around 10 basis points over the next two years and this implies small falls in capital values in 2023 and 2024 and means euro-zone prime all-property total returns are reduced by about a half by the end of 2024. Andrew, take us through our view on the outlook for the UK?

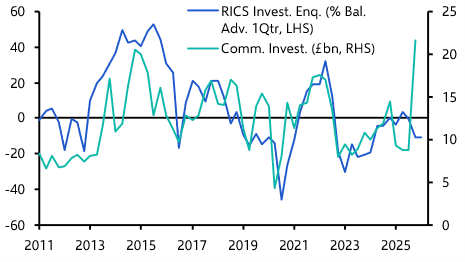

Andrew Burrell: Going back to the similarities in what you and Kieran have said, policy rates started going up earlier in the UK but it's actually what's been happening with bond rates which is an across-the-board trend – UK bond rates have gone up significantly. That's putting pressure on the spread with property yields. There was no evidence in Q1 of any disruption: yields continued to fall quite sharply at the all-property level and in quite a few of the sectors. But given the real change in sentiment that we've seen since then that the chances of a further downward movement are very limited even in the leading sectors. And we actually expect that things will tread water for the rest of the year and that yields will be broadly flat at the all-property level this year, and then start to move upwards from next year. And though that’s probably bringing forward what we already had in our forecast by a year, perhaps 18 months.

Watch the entire briefing ‘Commercial property in a world of rising interest rates' to learn more about how monetary tightening will affect returns, including sectoral winners and losers.

Capital View