In a note over summer I trailed our annual Spotlight event, which this year will focus on deglobalisation and the fracturing of the global economy. The series of reports and events, which we will launch next month, together will set out a framework for thinking through how global fracturing will evolve, and its implications for the world economy and financial markets. As ever, history provides a guide.

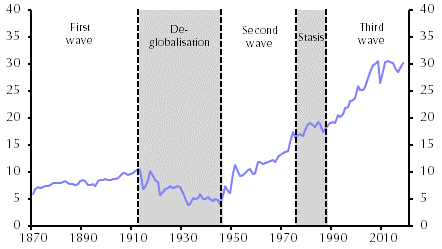

In some respects, the period of globalisation that fundamentally reshaped the world economy during the 1990s and 2000s was nothing new. In fact, the world has experienced three waves of globalisation over the past 150 years. The first ran from 1870 to 1914. During this period, a combination of tariff reduction and new technologies (in particular the growing use of steam-powered ships) led to a surge in global trade. In the four decades from 1870, global goods exports rose from 5% to 10% of world GDP. (See Chart 1.)

|

Chart 1: Global Exports (% of Global GDP) |

|

|

|

Sources: Klasing & Milionis (2014), Penn World Tables, World Bank |

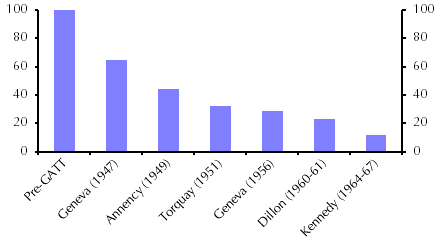

The second wave of globalisation ran from 1945 to the early 1970s. Once again, this was driven by a combination of policy liberalisation and new technologies. Successive rounds of the General Agreement on Tariffs and Trade (or GATT) led to a steady reduction in trade tariffs. (See Chart 2.) The Treaty of Rome, which was signed in 1957, created the European Economic Community and paved the way for substantial economic integration within Europe. And the growing use of air freight and the development of bigger and more efficient ships reduced transport costs and increased the speed of moving cargo. As a result of all of this, global goods exports increased from about 5% of GDP in 1950 to over 15% of GDP

| Chart 2: Weighted Average US Tariff Rates After GATT Rounds (Pre-GATT = 100) |

|

|

|

Sources: Baghwati (1989), Siebert (1997) |

The first two waves of globalisation shared several common features. In particular, the central feature of both was an increase in the trade of goods. The third wave of globalisation – which started with the fall of the Berlin Wall in 1989 and was accelerated by China’s accession to the WTO in 2001 – was also characterised by a large increase in global goods trade. Between 1990 and 2010, global goods exports increased from 20% to 30% of world GDP.

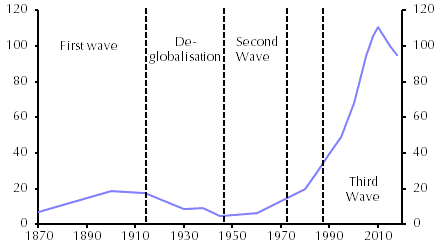

But, unlike in the first two waves, integration went beyond just the trade of goods. Services exports doubled as a share of global GDP – from around 3.5% in 1990 to over 7% in 2019. And, most importantly, the third wave of globalisation contained a significant financial component. Between 1990 and 2018, there was a five-fold increase in cross-border bond and equity flows and a seven-fold increase in foreign direct investment flows. While the external assets of the world’s leading economies rose in the first two waves of globalisation, the increase was modest. In contrast, during the third wave of globalisation the external assets of advanced economies rose from around 30% to over 100% of global GDP. (See Chart 3.) In addition to the globalisation of production, we also experienced the globalisation of finance.

|

Chart 3: Advanced Economies’ Foreign Assets Held* (as a % of World GDP) |

|

|

|

Sources: Obstfeld and Taylor (2004), Maddison, IMF, CE * Sum of UK, France, Germany, Netherlands, US, Canada and Japan. |

The third wave of globalisation is now over but history illustrates the radically different paths that could lie ahead. After the first wave there was a decisive push by policymakers to roll back integration. Admittedly, there was a brief attempt after the end of the First World War to revive the pre-war order. But this foundered during the 1920s, in part due to an ill-conceived attempt to restore the Gold Standard, and was ended decisively by the Great Depression and the policies that followed. In 1930 the US imposed the Smoot-Hawley tariffs, which raised duties on 20,000 products and led to a wave of retaliation. Britain imposed a 10% general tariff in 1932 and other countries followed suit. As a result, average tariff rates more than doubled in the 1930s. By 1935, global exports were lower as a share of world GDP than they were in 1870. (See Chart 1 again.)

In contrast, the second wave of globalisation which followed the Second World War didn’t so much go into reverse as stall. The “Nixon shock” of 1971 suspended the dollar’s convertibility into gold and effectively ended the Bretton Woods system of global economic governance that had underpinned post-war integration. This was followed in the 1980s by trade restraint policies from the Reagan administration aimed at capping imports from Europe and Japan. But the push-back against globalisation was small and short-lived compared to the 1930s. Europe continued to integrate and other countries (notably in Asia) opened up. Rather than falling as a share of world GDP, global exports plateaued.

The crucial lesson for today is that the extent to which the third wave of globalisation is followed by a period of significant retrenchment will depend to a large extent on the actions of governments. Much is made of the potential for new technologies, such as 3D printing, to usher in a new wave of reshoring but this is a red herring. The actions of policymakers are more important.

A second lesson is that the central features of prior integration will frame any subsequent decoupling. The first two waves of globalisation focussed heavily on trade integration, particularly in goods. The latest wave has been much broader. Trade in services has increased substantially, but there has also been significant financial and technological integration between countries.

The extent of fracturing will be determined by the actions of policymakers. But compared to the first two waves of globalisation, it is likely to be far broader, affecting everything from cross-border financial flows and transfers of technology, to labour and product standards and supply-chain security. That in turn will have potentially major implications for the global economy and markets – we’ll be exploring these issues and discussing their implications in our upcoming research series and events.

Our 2022 Spotlight series of research and online events about the fracturing of the world economy will launch in mid-October.

In case you missed it:

- The closure of the Nord Stream pipeline raises economic risks for Germany, argues Senior Euro-zone Economist Jack Allen-Reynolds. He’ll be participating in our ECB post-September meeting online debrief this Thursday – register here to join.

- Ahead of Monday’s confirmation that Liz Truss won the race for Conservative party leadership, Chief UK Economist Paul Dales discussed what the new PM’s policy priorities should be.

- Mike Pearce from our US team explored the potential economic implications of November’s mid-term elections.