As inflation surges and growth slows, there’s little wonder that comparisons are being drawn with the macroeconomic experience of the seventies. Parallels are certainly building, but are we likely to see the scale of stagflation witnessed back then? And if policymakers are more determined now to prevent high inflation becoming persistent, will that come with the cost of a sharp slowdown in economic growth?

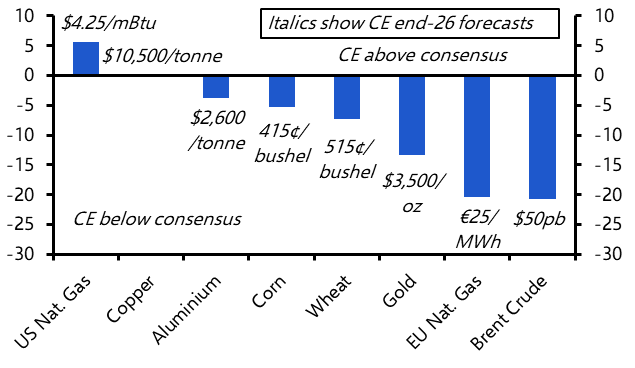

At first sight, the current situation looks worryingly similar to the early 1970s oil price shock. In 1973, the Arab oil exporting countries stopped exports to many Western countries as punishment for providing aid to Israel during the Yom Kippur war. As a result, the prices of oil and other commodities rocketed. The scale of the rise in commodity prices seen then is close to that seen today.

Moreover, inflation was already accelerating in the months before the 1973 oil price shock, just as it has been accelerating over the past year or two, albeit for different reasons. Then, the rise in inflation principally had its roots in expansionary policy stoking excess demand. Recently the cause has been a pandemic-related shift in the composition of consumer spending which has pushed up goods prices.

A new Capital Economics report discusses how current elevated inflation looks worryingly similar to the trends seen during the early 1970s oil price shock. The report explores key topics, including

- Whether rising commodity prices will drive a downturn in the real economy;

- The costs to the real economy of high inflation;

- How central banks will respond and economies cope with rising interest rates.