Returns underpinned by income

UK Commercial Property Outlook

After a brief respite earlier this year, property yields are once again on the rise, driven by a further increase in gilt yields.

This is a sample of our latest quarterly UK Commercial Property Outlook, originally published on 21st August, 2023. Some of the forecasts contained within may have been changed since publication. Access to the complete report, including detailed forecasts and near to long-term analysis, is available as part of a subscription to our CE Advance premium platform or to our dedicated UK Commercial Property coverage.

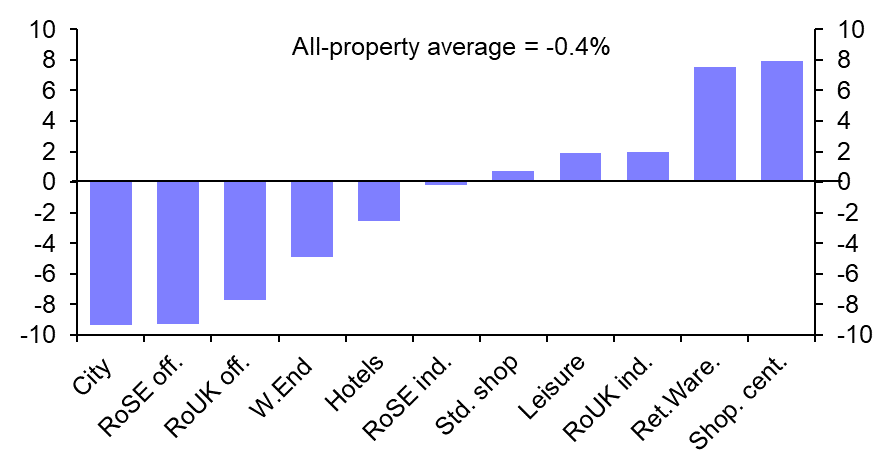

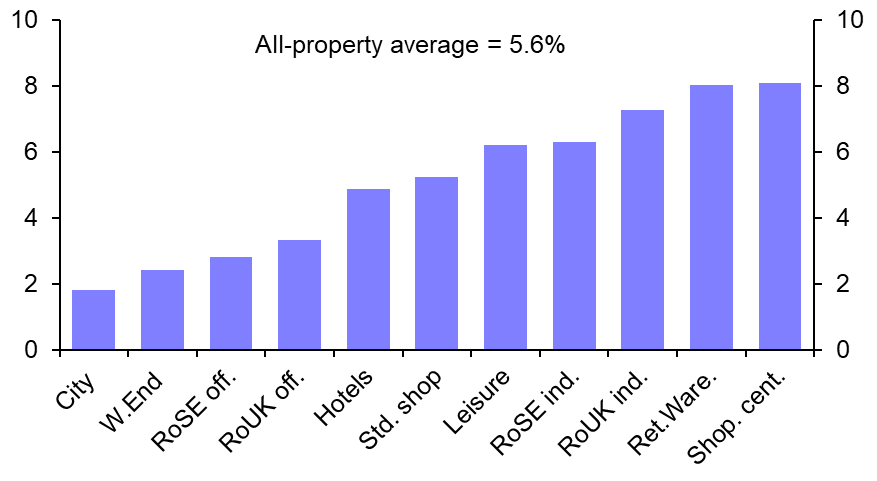

We don’t expect a repeat of the surge in yields seen last year, but we also think any compression beyond this year will be minimal as the spread between property yields and risk-free rates remains close to historical levels. Rents have held up better than expected, but an upcoming recession points to a slow down next year with outright falls for offices. Capital value growth will therefore average just 1.6% p.a. over 2023-27 at the all-property level. Compared to the past, total returns will therefore depend more on income. That implies higher income returns in sectors such as retail will mean they perform relatively well over the next few years, although industrial also does well thanks to decent rental growth.

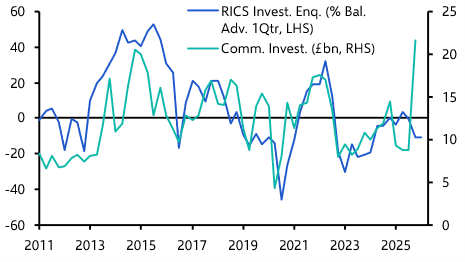

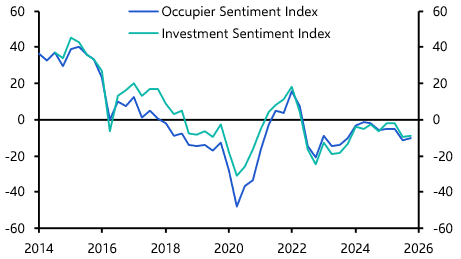

Investment Market

- A rise in gilt yields due to persistent inflation led to a worsening in property valuations in Q2. That implies property yields have further to rise and, alongside tighter credit conditions, that has weighed on investor sentiment. Investment across all sectors totalled just £7.4bn in Q2, down 57% y/y, with office investment seeing the largest decline. We expect the 10-year gilt yield will drop from 4.7% today to 3.0% by end-25 but, given current narrow spreads, we doubt property yields will see much compression over the next few years. Alongside lacklustre rental growth that means total returns at the all-property level will only just exceed 5.5% p.a. over 2023-27.

Chart 1: CE Forecasts for Total Returns in 2023

|

Chart 2: CE Forecasts for Total Returns in 2023-2027

|

|

|

|

|

Sources: MSCI, Capital Economics |

Office Market

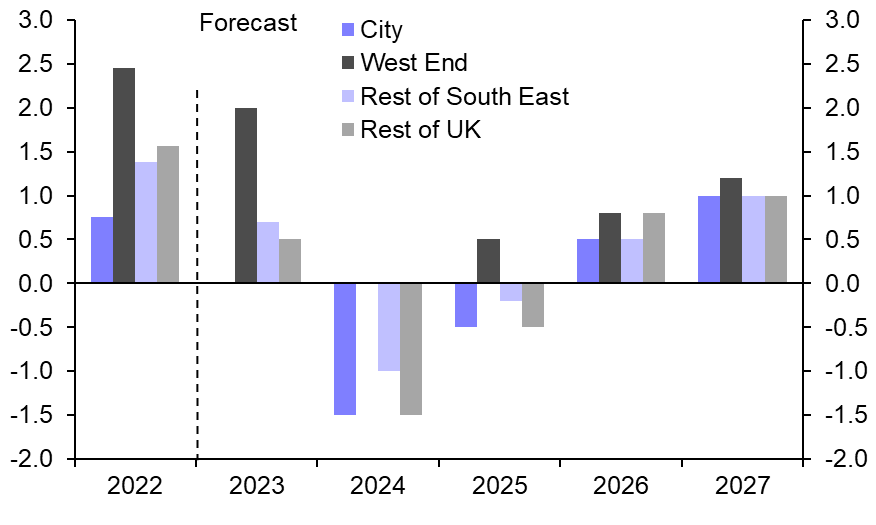

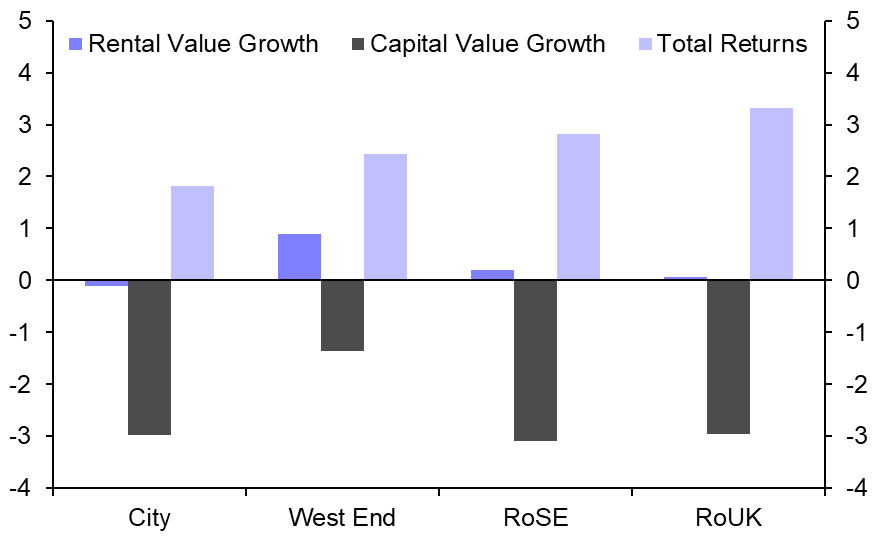

- Despite office-based employment holding up surprisingly well, office demand has seen a substantial drop. That disconnect is likely to reflect the impact of the shift to remote work. Looking ahead the upcoming recession means job growth will fall back, while firms will be adjusting to hybrid working patterns for some time yet. That will weigh on demand at the same time as a lot of new space comes on the market. Vacancy rates – already at 14-year highs in London – are therefore set to rise further. Rental growth will turn negative in 2024, and only return to modest growth in 2026. And with yields unlikely to see any compression, total returns will be just 2.7% p.a. over 2023-27, comfortably the worst of all sectors.

Chart 3: Office Rental Value Growth (% y/y) |

Chart 4: Office Property Forecasts (% p.a., 2023-27) |

|

|

|

|

Sources: Refinitiv, ONS, CBRE, MSCI, Knight Frank, CE |

Retail Market

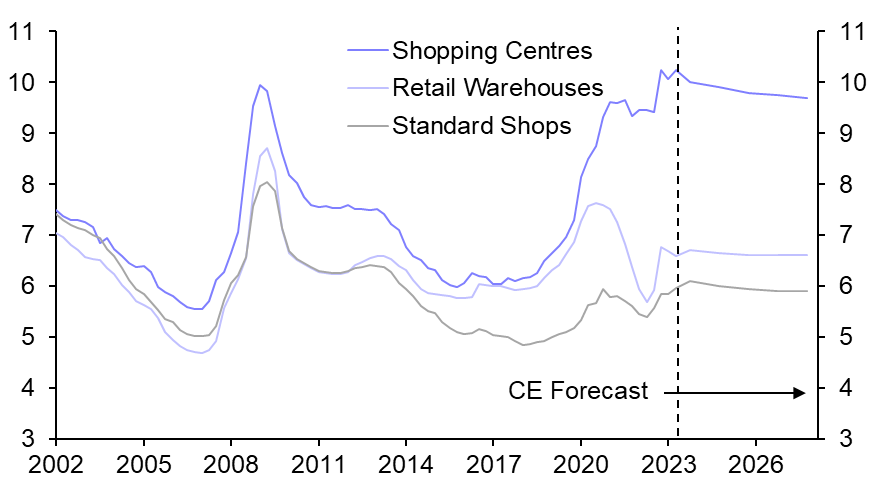

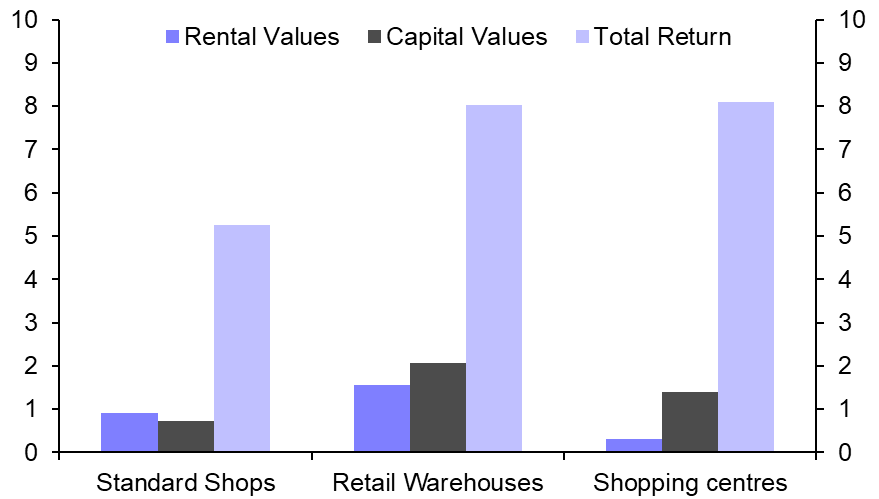

- After reviving in early summer, retail sales dropped back in July and demand is set to remain soft over the second half of the year. And despite an encouraging start to the year, further improvement in rental growth is unlikely. But further out as the economy recovers we expect rental growth to inch towards 1% y/y, settling at 1.5% y/y longer term. As interest rates drop back there is scope for modest yield reductions, though levels will stay higher than in the pre-pandemic period. Solid income returns supports total returns of 7% p.a. on average over the next five years, the best of the major sectors.

Chart 5: Retail Yields by Subsector (%) |

Chart 6: Retail Property Forecasts (% p.a., 2023-27) |

|

|

|

|

Sources: MSCI, Refinitiv, Capital Economics |

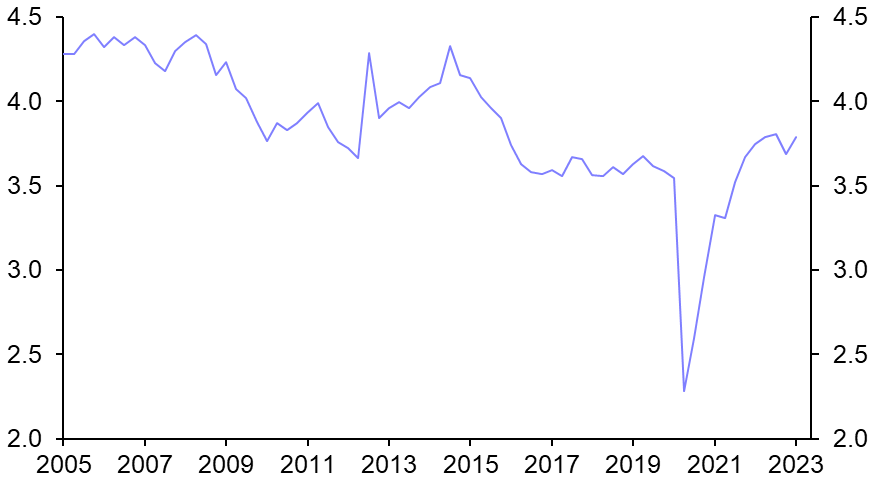

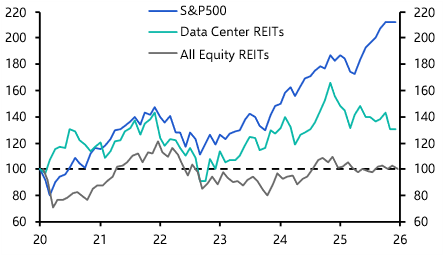

Industrial Market

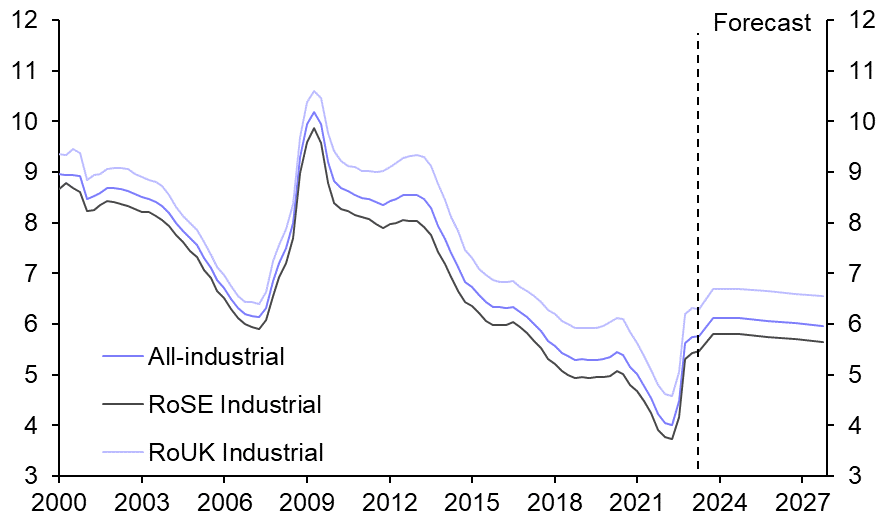

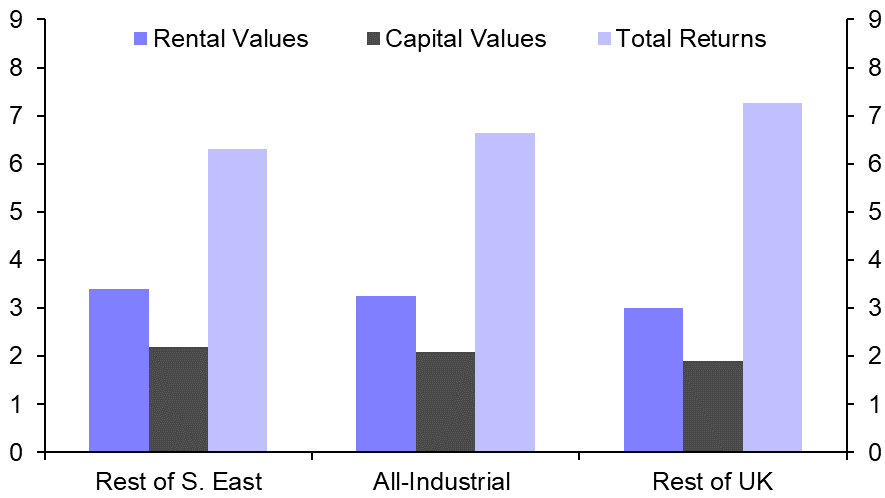

- Industrial demand has not been immune to the economic slowdown, but we think it is well-placed to weather the upcoming recession. The online share of spending will soon resume its upward trend and there is evidence that supply is now easing. Admittedly, at first glance industrial still looks to be the most overvalued of all sectors. But a structural shift in demand means we think yields will not rise much further, although they are unlikely to drop much once bond rates ease either. That said, a low income return means total returns will underperform retail at 6.6% p.a. over 2023-27.

Chart 7: Industrial Equivalent Yields (%) |

Chart 8: Forecasts (% p.a., 2023-27) |

|

|

|

|

Sources: CBRE, MSCI, ONS, Refinitiv, Capital Economics |

Leisure and Hotels

- Leisure spending has held up, but while real earnings growth will soon turn positive the full hit from higher rates is yet to be felt. That will cut leisure demand and keep rents falling this year and next. Hotels are better placed, profiting from staycations and the return of international travel, and will avoid a fall in rents. But a lower income return will keep total returns at a modest 4.9% p.a. in 2023-27.

Chart 9: Leisure Spending as Share of Total (Real, %) |

Chart 10: Hotel Property Forecasts (% y/y) |

|

|

|

|

Sources: MSCI, REIS, Capital Economics |

This is a sample of a 15-page report published for Capital Economics clients on 21st August, 2023. The report was written by Matthew Pointon and Andrew Burrell.

Make informed investment decisions quickly

CE Advance, our new premium product, equips organisations with actionable macroeconomic data and insight to stay ahead of the curve.