Stronger start, weaker end to 2024

China Economic Outlook Q1 2024

While China’s growth has disappointed this year, there isn’t much evidence of substantial slack in the economy that forceful stimulus could address. Instead, it seems that China’s sustainable growth rate has slowed.

These are just some of the key takeaways from our 13-page Q1 China Economic Outlook. Access to the complete report, including extensive forecasts and near to long-term analysis, is available as part of a subscription to our CE Advance premium product or to our dedicated China Economics coverage.

China’s economy has regained some strength recently. We expect this to continue into 2024, on the back of support from fiscal policy and a further pick-up in household spending. But with property construction likely to continue to decline and exports set to do the same, the recovery will lack momentum. Growth will have dropped below 4% by the end of the year.

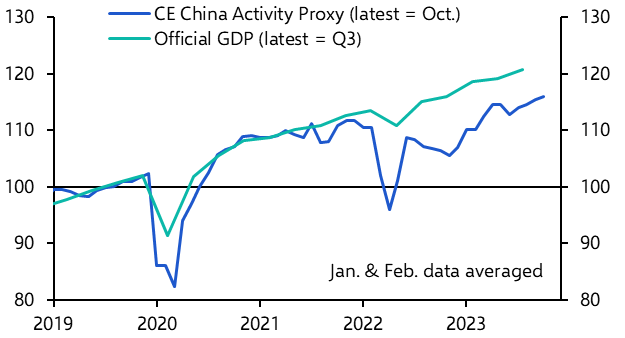

- China’s economy faltered during the summer, contracting outright on our China Activity Proxy measure. (See Chart 1.) It has regained that ground recently, though we continue to believe that growth over the past couple of years has been far weaker than the pre-COVID trend or than the official GDP figures show.

- The recent improvement can be attributed in part to household spending. Retail sales have accelerated as consumer confidence has rebounded. (See Chart 2.)

|

Chart 1: CE China Activity Proxy & Official GDP (2019 = 100, seasonally-adjusted) |

Chart 2: Consumer Confidence & Retail Sales |

|

|

|

- There aren’t any sizeable excess savings for households to spend in China – they didn’t receive fiscal transfers during the pandemic – and many will be feeling poorer with house prices falling and equity markets in a rut. But the savings rate is still a little higher than it was in 2019. (See Chart 3.) If sentiment continues to improve, households should feel comfortable spending more of their income, giving consumption a further boost. And the labour market is relatively tight: the unemployment rate is now lower than its average in the five years before the pandemic.

- The government in October took the rare step of announcing an adjustment to the current year’s budget to ensure that fiscal support didn’t dry up. That was rapidly followed by a surge in bond issuance. (See Chart 4.) A sizeable chunk of the proceeds have not yet been spent. We expect these funds to be channelled into infrastructure and other public investment projects over the next few months.

|

Chart 3: Household Savings Rate (%, seasonally-adjusted) |

Chart 4: Govt. Investment vs Revenue from Borrowing & Land Sales (3m % y/y) |

|

|

|

- Manufacturers have benefitted over recent months from an under-appreciated export boom. By cutting prices, China’s exporters have been able to push shipment volumes to record highs. (See Chart 5.) But price cuts aren’t a sustainable means of shoring up demand in a weakening global economy. We expect export volumes to fall next year.

- Efforts to boost property sales have not succeeded so far but they continue to be expanded (see Chart 6) and we think that they will gain traction over coming months. That should lift some of the gloom around China’s economic prospects. But a sales rebound probably wouldn’t translate into stronger construction activity. More likely, sales revenues will help speed up project completions so that overall activity still falls.

|

Chart 5: Goods Exports ($, 2019 = 100, seasonally-adjusted) |

Chart 6: Minimum Downpayment Required* (%, 35 city average) |

|

|

|

- Monetary easing has played a much smaller role than fiscal policy in recent economic support efforts. One reason is that the PBOC has been pre-occupied with preventing the renminbi from weakening much beyond 7.3/$. The recent reversal of the dollar has given the PBOC some respite, and we expect policy rates to be lowered soon. But policymakers are still wary of stoking another credit boom, and we expect only 20bp of cuts by mid-2024.

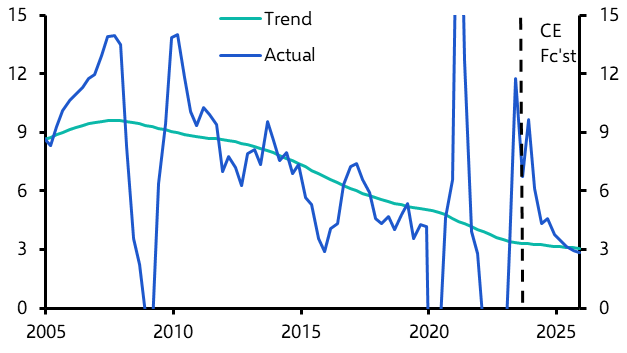

- There is good reason for this caution. While China’s growth has disappointed this year, there isn’t much evidence of substantial slack in the economy that forceful stimulus could address. Instead, it seems that China’s sustainable growth rate has slowed. (See Chart 7.) That’s a final reason to believe that faster growth over the next few months won’t be sustained. We forecast that China’s economy will start 2024 growing around 6% y/y on our CAP measure but that growth will have decelerated to below 4% by the end of the year. (See Chart 8.)

|

Chart 7: CE China Activity Proxy (% y/y) |

Chart 8: Capital Economics China Activity Proxy & Official GDP (% y/y) |

|

|

|

Chart sources: CEIC, Capital Economics

This content is based on a report prepared for Capital Economics clients by Mark Williams, Julian Evans-Pritchard, Sheana Yue and Zichun Huang published on 6th December, 2023.

Get the full report

Trial our services to see this complete 13-page analysis, our complete China macro insight and forecasts and much more