Economic Themes

Monday, 15th September

This Week

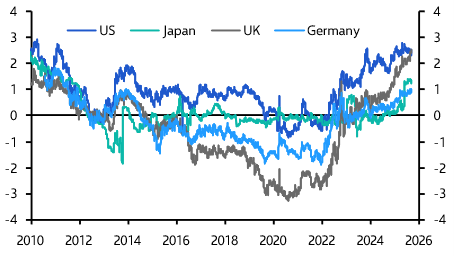

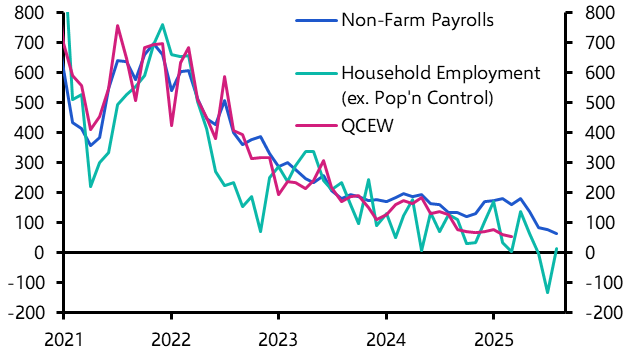

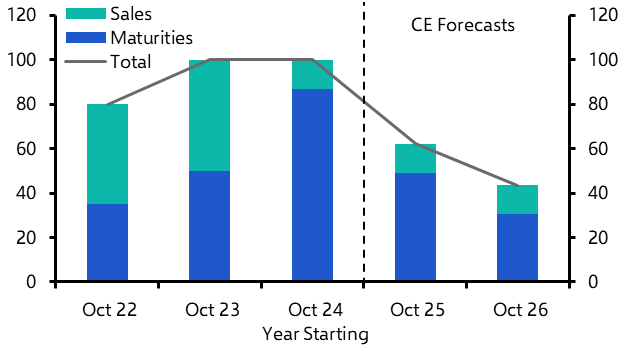

- A 25-basis-point rate cut from the Fed this week looks baked in, but we think markets are pricing in too much easing over the forecast horizon. Join the team on Thursday for our regular Drop-In covering all of the recent decisions from the major central banks.

- Our rejigged, interactive Equities dashboard combines our price and total return forecasts with detailed insights into valuations, earnings, correlations and sector compositions.

- If you're in London this Wednesday, 17th September join the team for an in-person event about our latest analysis on how Trump's second term is reshaping the process of global fracturing. Register here.

DASHBOARD OF THE WEEK

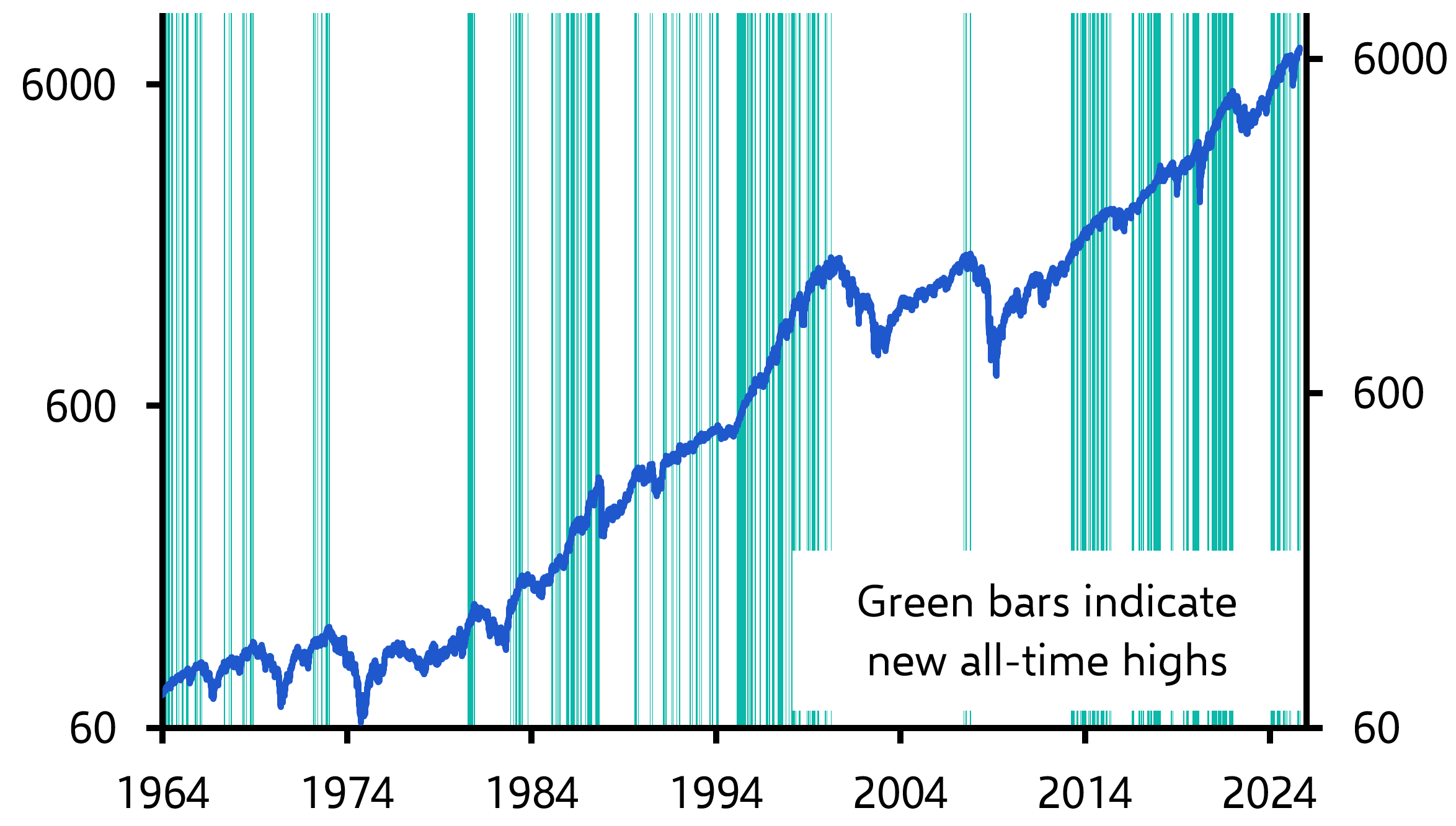

Equities Dashboard

This new dashboard presents all of our equity forecasts out to the end of 2027, including price and total return forecasts in a range of currency denominations. It also features historical performance data as well as detailed insights into valuations, earnings, correlations and sector compositions.

PODCAST

The Weekly Briefing

US economy pre-Fed health check Oil prices vs geopolitics

The Fed meets this coming week to decide how much monetary relief the US economy really needs. Group Chief Economist Neil Shearing says that, employment data aside, the evidence argues for fewer rate cuts than markets are pricing in.