Residential outperforms within a modest recovery

UK Commercial Property Outlook

Capital values for most property sectors are now close to bottoming out, but with yields set for a period of stability the recovery will be modest by past standards.

These are just some of the key takeaways from our latest quarterly UK Commercial Property Outlook, originally published on 30th May, 2024. Some of the forecasts contained within may have been changed since publication. Access to the complete report, including detailed forecasts and near to long-term analysis, is available as part of a subscription to our CE Advance premium service or to our dedicated UK Commercial Property coverage.

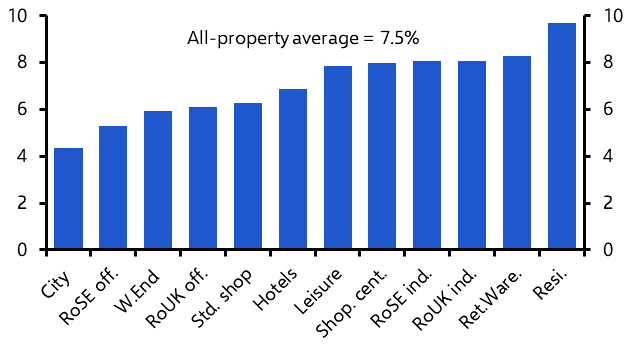

We expect all-property total returns to average 7.5% p.a. over 2024-28. That’s an upgrade on our previous view but that primarily reflects the addition of the residential sector into our forecasts. In that sector, a strong rental outlook will offset a low income return and boost total returns to nearly 10% p.a. over 2024-28. That’s the best performer of all sectors, with industrial expected to see returns of around 8.0% p.a. and the struggling office sector around 5.5% p.a..

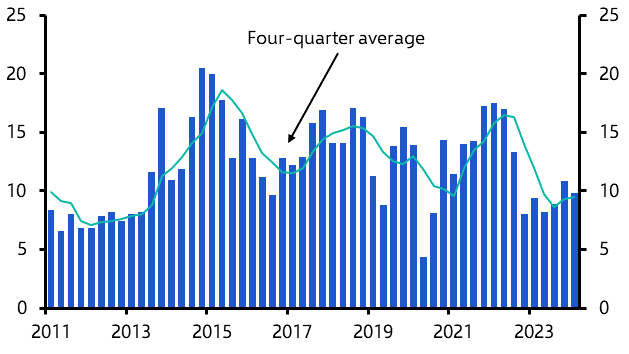

- After picking up toward the end of last year, commercial real estate transactions lost some momentum in 2024. Lambert Smith Hampton reported investment edged back to £9.9bn in Q1, from £10.8bn in Q4. (See Chart 1.) But this represented a 5% increase from Q1 2023, suggesting transactions have troughed.

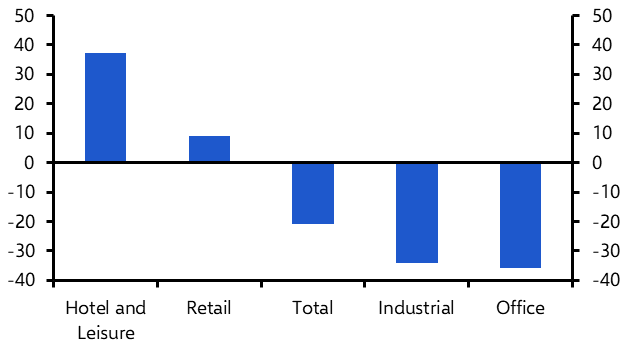

- Overall transaction volumes are being held back by a weak office market, which saw investment of just £1.7bn in Q1 and where transactions are down 36% y/y. (See Chart 2.) Industrial investment is also taking a breather following a very strong period of deals during the pandemic. By contrast, retail investment is now recovering, particularly shop transactions. But we doubt that dip in Q1 marks the start of another sustained fall in investment. Inflation is now close to target and while the cuts to UK policy rate may have been delayed somewhat, we still think they will start from late summer. That will help bring swap rates down and drive a gradual recovery in investment of around 20% y/y in both 2024 and 2025.

|

|

|

|

|

|

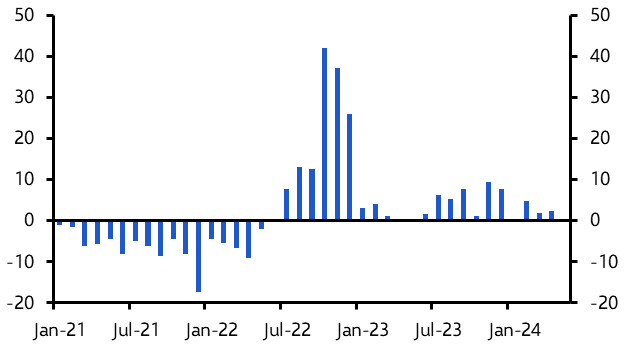

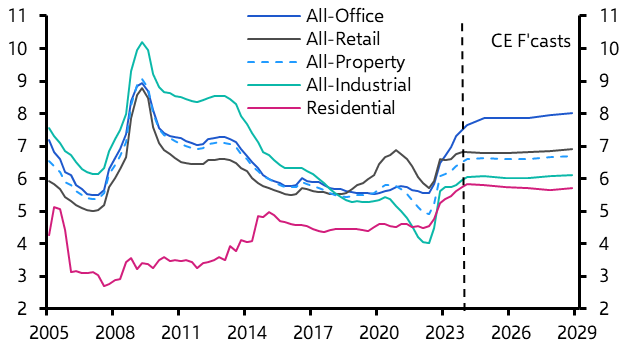

- Investment will also be supported by a stabilisation in property yields. The relatively swift correction of yields in the UK compared to the US and Europe means most of the pain is now over. Indeed, all-property equivalent yields increased by just 9bps over the first four months of 2024, compared to the 26bps rise in the final four months of 2023. (See Chart 3.) Admittedly, risk-free rates have edged up since the end of last year so there remains a small upside risk to property yields. But we still think the 10-year gilt yield will fall back to 3.50% by the end of this year and 3.25% by end-25 as inflationary pressures abate. Therefore, we expect yields at the all-property level will stabilise in the second half of 2024 at around 5.20%. (See Chart 4.)

|

Chart 3: All-Property Yields (Bps, m/m) |

Chart 4: Property Equivalent Yields by Sector (%) |

|

|

|

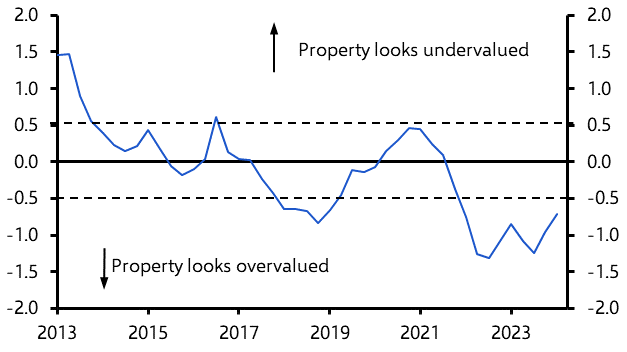

- But we also doubt yields will see much in the way of compression even as interest rates decline. After all, despite some improvement in recent quarters, property still looks overvalued on our valuation measure. (See here and Chart 5.) A period of flat yields as alternative asset yields rise is therefore required to bring property back into fairly valued territory. At 5.25% by end-28 all-property yields will be little changed from their end-24 level.

- That picture is similar across the major property sectors. Indeed, the only sector where we expect any fall in yields over the next five years is residential, where superior rental performance helps justify a small decline from 2025. (See Chart 4 again.)

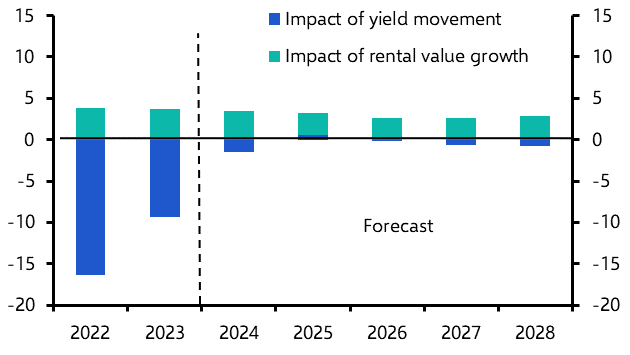

- At the all property level yields therefore make no positive contribution to capital value increases over the forecast, which will rely entirely on rental growth and average 2.4% p.a. over 2024-28. (See Chart 6.) That represents a slight improvement on our previous forecast, driven by the inclusion of the residential sector in all-property.

|

Chart 5: All-Property Valuation Score (%) |

Chart 6: Contributions to Capital Growth (%-pts) |

|

|

|

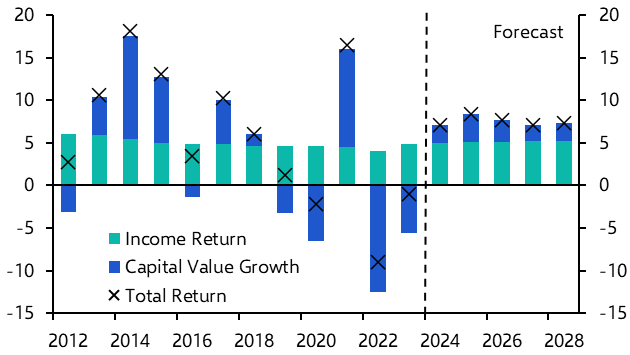

- Following two years of negative returns, all-property total returns will turn positive in 2024 at around 7%. (See Chart 7.) But with no yield compression the recovery will be dependent on income and weak by past standards, with all-property returns of 7.5% p.a. over 2024-28.

- Again, that represents an upgrade on our previous forecast of returns of 7.1% p.a., primarily due to the inclusion of residential which is set to be the best performing sector with total returns of 9.7% p.a. over 2024-28. (See Chart 8.)

|

Chart 7: All-Property Total Returns, Income Return and Capital Values (% y/y) |

Chart 8: Sector Returns (% p.a., 2024-28) |

|

|

|

|

Chart Sources: LSH, Refinitiv, MSCI, Capital Economics |

- Office Market – The impact of remote work has widened the gap between prime and non-prime offices. With firms cutting space, some are putting those savings toward better quality offices to attract and retain staff and for ESG purposes. The West End, which has a large concentration of small, prime offices and a small pipeline, will therefore see stronger rental and capital growth than other subsectors. But the office sector as a whole will continue to struggle as it adjusts to structurally lower demand, with total returns of just over 5.5% p.a. over 2024-28.

- Retail Market – Retail sales have been weak recently, not helped by the wet weather. But as real incomes recover consumer spending is set to rebound, supporting retail rental growth. Admittedly, the online share of retail sales will continue to rise gradually, which will weigh on shopping centre rents. But retail warehouses are better able to compete and are benefitting from ‘click and collect’ demand. A high income return will help all-retail total returns average 7.7% p.a. over 2024-28, just above the all-property average.

- Industrial Market – Logistics take-up fell back in Q1 2024, but developers have been quick to respond to waning demand and vacancy rates now appear to be stabilising as the pipeline has shrunk. That will provide some support to rental growth, as will the recovery in consumer spending. We think industrial rent growth will slow but remain relatively high compared to other sectors, supporting total returns of 8% p.a. over 2024-28, second only to residential.

- Residential Market – Residential rents tend to follow earnings growth and as a result have seen strong gains recently. We think that will continue over the next year as the MSCI index catches up to more timely rent measures and rental growth will beat all other sectors at more than 5% p.a. over 2024-28. That will support capital value growth even as yields see minimal compression and at close to 10% p.a. total returns will be the highest of all the sectors.

- Leisure and Hotels – The leisure sector is struggling as consumers have cut back on discretionary spending, which will hit rental growth over the next year or so. Hotels are insulated to some extent by the return of foreign tourists and as the cost-of-living crisis abates that will support hotel rents. But a low income return means hotel total returns over 2024-28 will average less than 7% p.a., lagging leisure at close to 8% p.a.

This is a sample of a 17-page report published for Capital Economics clients on 30th May, 2024. For the full report, including in-depth sectoral analysis and comprehensive five-year forecasts, request trial access to our coverage by clicking the button below.

Get the full UK commercial property picture

The full 17-page Outlook includes in-depth sectoral insight and comprehensive five-year forecasts.

Get complete access today.