Capital values to fall through 2024 – retail to outperform

Q4 Commercial Property Outlook

These are some of the key takeaways from our latest quarterly US Commercial Property Outlook, originally published on 25th September, 2023. Some of the forecasts contained within may have been changed since publication. Access to the complete report, including detailed forecasts and near to long-term analysis, is available as part of a subscription to our CE Advance premium platform or to our dedicated US Commercial Property coverage.

With the economy showing signs of slowing and transaction volumes likely to stay low in H2 2023, a tough 6-12 months lies in store for commercial real estate.

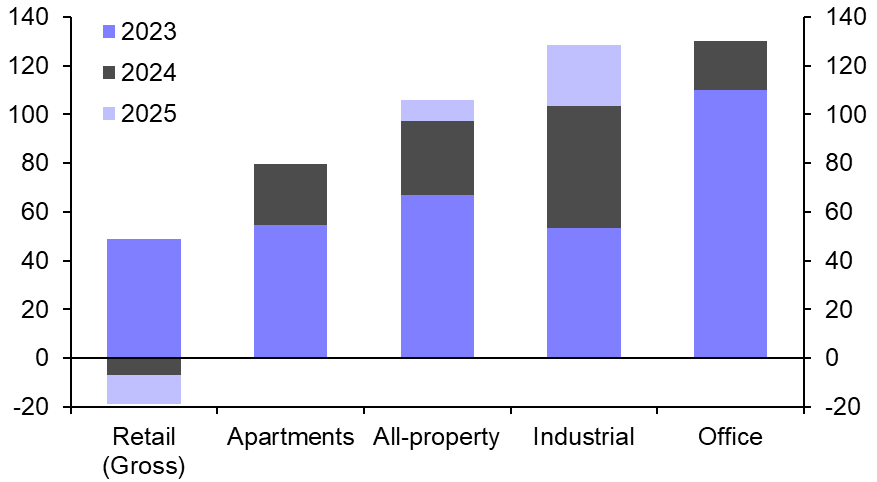

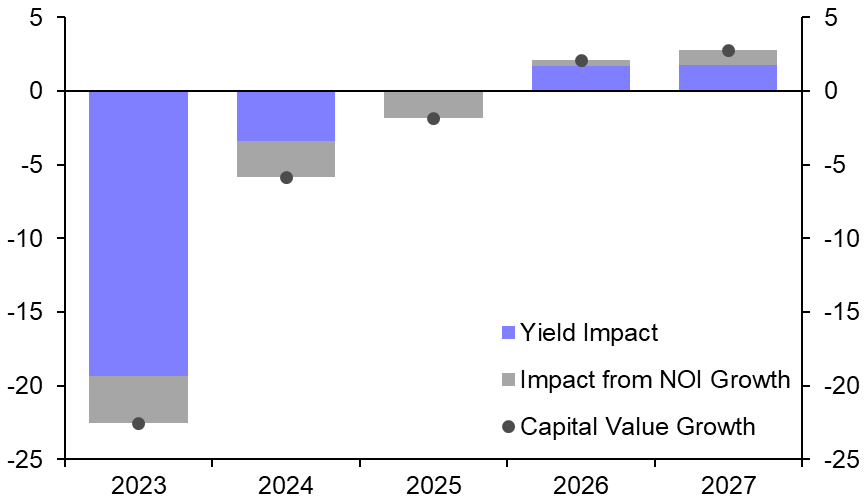

We still expect cap rates to rise on the back of higher Treasury yields, but the full extent of this is likely to take time to come through in valuations. As a result, while we think capital values will fall by more than 10% this year, we also expect a further drop of around 5% in 2024 before values stabilise in 2025. That means total returns of just 2% p.a. for 2023-27, though that climbs to around 4.5% p.a. if 2023 is excluded. There will be sector differentiation though, with offices unsurprisingly seeing the worst performance and retail outperforming, with values in the latter actually growing a little next year. The higher yield environment will drag on industrial and apartment valuations, which currently look particularly stretched, but for multi-family at least, we think values will grow again in 2025.

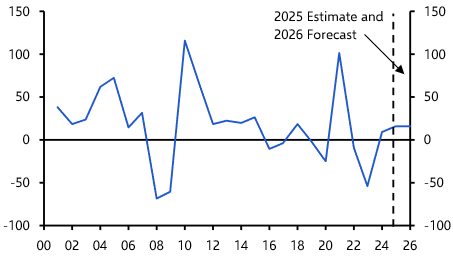

Investment Market

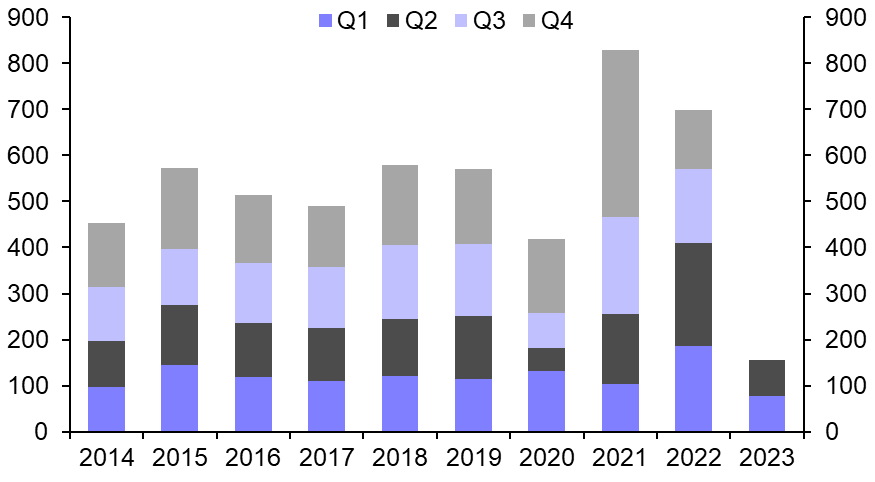

We expect investment activity to remain weak over the coming months, before picking up gradually next year. The slow uplift reflects a retrenching debt market and large refinancing requirements, which will prevent a bounce-back similar to the COVID-19 re-openings. While we think Treasury yields will drop back from their current levels, appraisal-based indices still have some way to go before pricing looks fair. As a result, we expect MSCI all-property yields to rise by another 75 bps before flattening out in 2025. That will mean capital values fall by another 11% by end-2024, taking the total peak-to-trough fall since mid-2022 to 20%.

Chart 1: Quarterly Commercial Real Estate Investment ($ bn) |

Chart 2: Yield Shift Forecasts by Sector (Bps) |

|

|

|

|

Sources: NKF, RCA, MSCI, Trepp, Capital Economics |

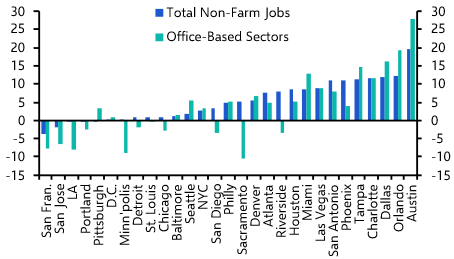

Office Market

The outlook for office demand is weak - there has been no major uptick in office attendance post- Labor Day and jobs growth is set to slow further. As a result, we think vacancy will trend higher in the coming years as firms cut back on excess space. That will weigh on net operating incomes. NOI yields will eventually rise by a total of 165 bps from the lows of 2022. This means that we think capital values have a further 20% to drop, taking the peak-to-trough fall to 35% by 2025.

Chart 3: Office Vacancy

|

Chart 4: Office Capital Values

|

|

|

|

|

Sources: MSCI, Trepp, Capital Economics |

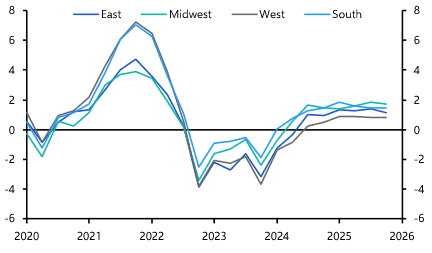

Retail Market

Retail saw a resurgence in occupier demand in Q2, supported by steady growth in retail sales. However, we think the sector will face a cyclical slowdown as the poor economic outlook weighs on demand over the next 6-12 months. Yields have further to rise too, but we expect they will peak by the end of this year, after which capital values will recover. Capital growth should reach 2.5% p.a. on average between 2024-27, with total returns of close to 8% p.a.

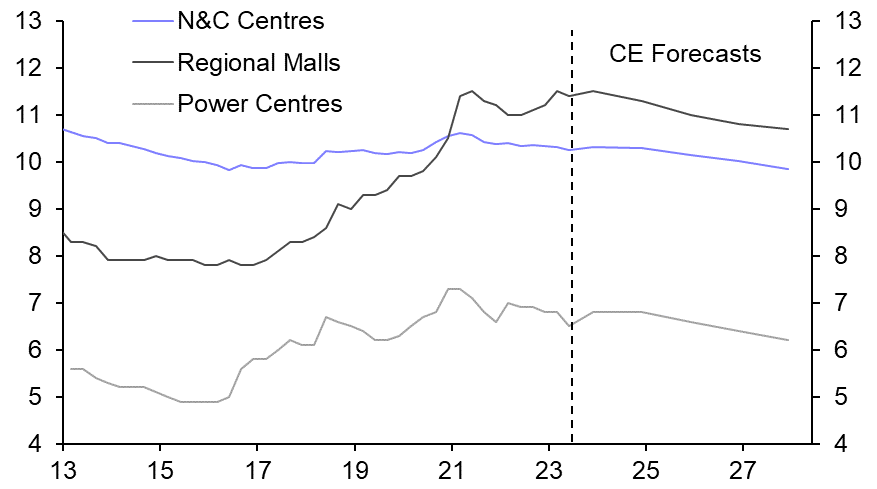

Chart 5: Retail Vacancy Rate by Sub-Sector (%) |

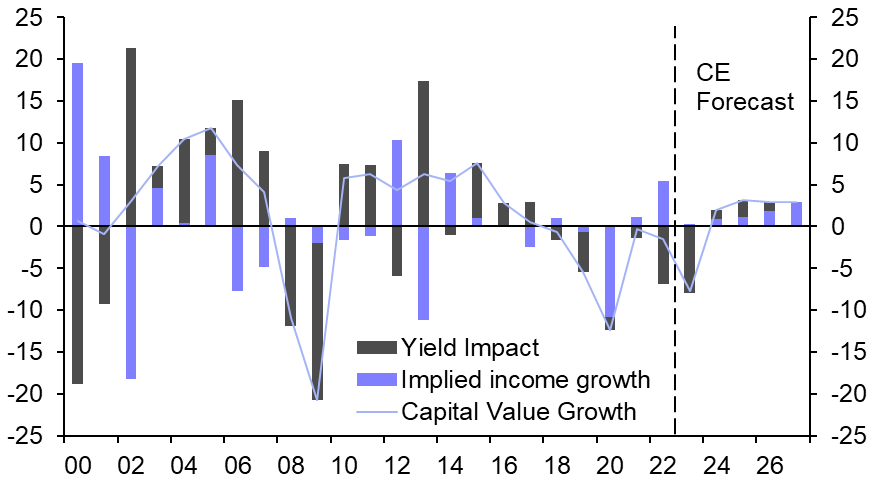

Chart 6: Retail Capital Value Contributions

|

|

|

|

|

Sources: MSCI, Capital Economics |

Industrial Market

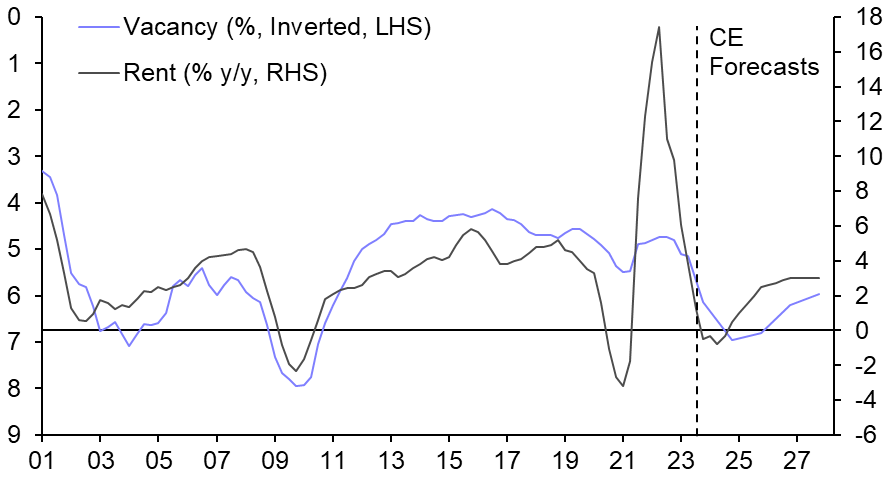

Industrial demand has normalised after spiking during the pandemic, but low vacancy will sustain solid rent growth for the next five years. That said, the sector remains the most overvalued. We therefore expect yields to climb and capital values to fall, dropping by nearly 15% over the next three years before yields peak in 2026. As a result, total returns will average minus 2.5%-3.0% p.a. in 2023-24, but should turn positive again in 2025.

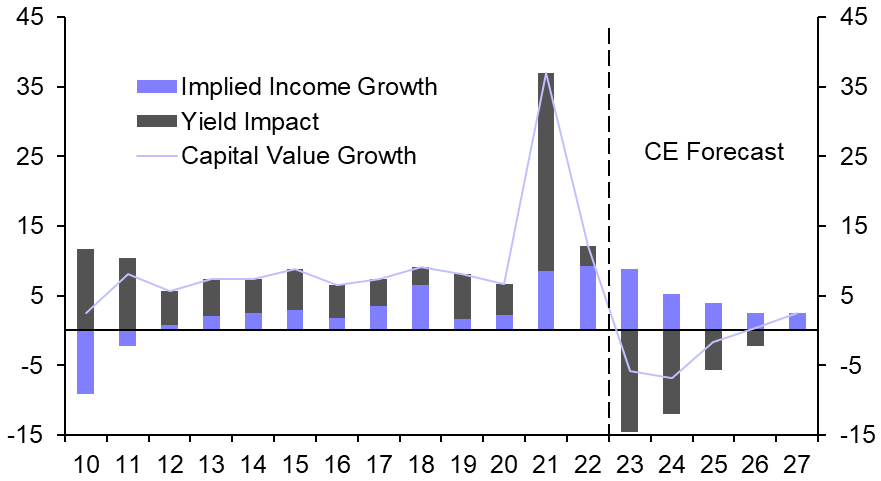

Chart 7: Industrial Capital Value Contributions

|

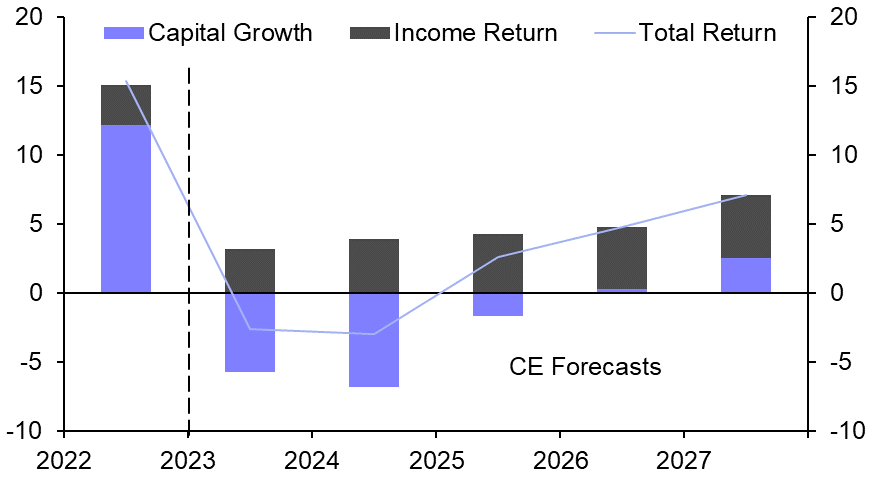

Chart 8: Industrial Capital Growth, Income Return and Total Return (% p.a.) |

|

|

|

|

Sources: MSCI, REIS, Capital Economics |

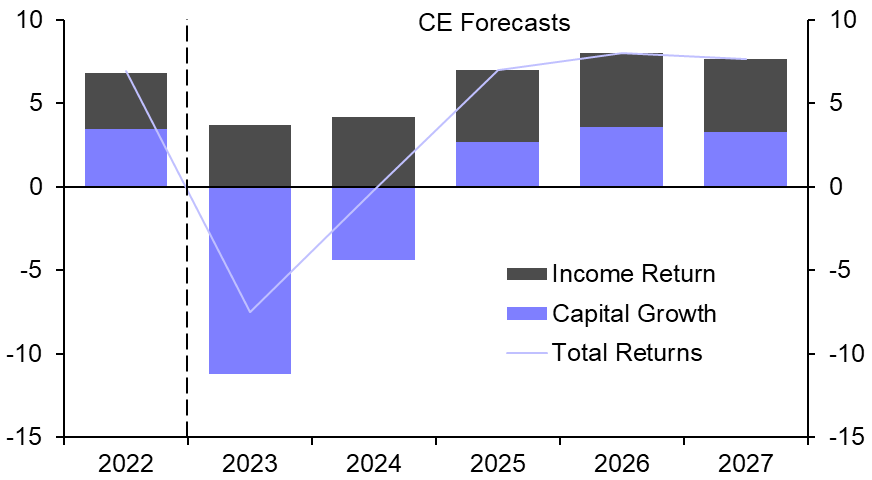

Apartment Market

A tough economic backdrop and stretched affordability will weigh on demand, just as a swathe of new supply completes. Along with rising costs, this will weigh on NOIs over the next 18 months. We expect apartment yields to continue to rise over the remainder of 2023 and 2024. As a result, capital values will fall by a cumulative 20% from their 2022 peaks. Total returns will be negative in 2023-24, before a decent recovery in 2025-27, with returns averaging 7.5% p.a. in those three years.

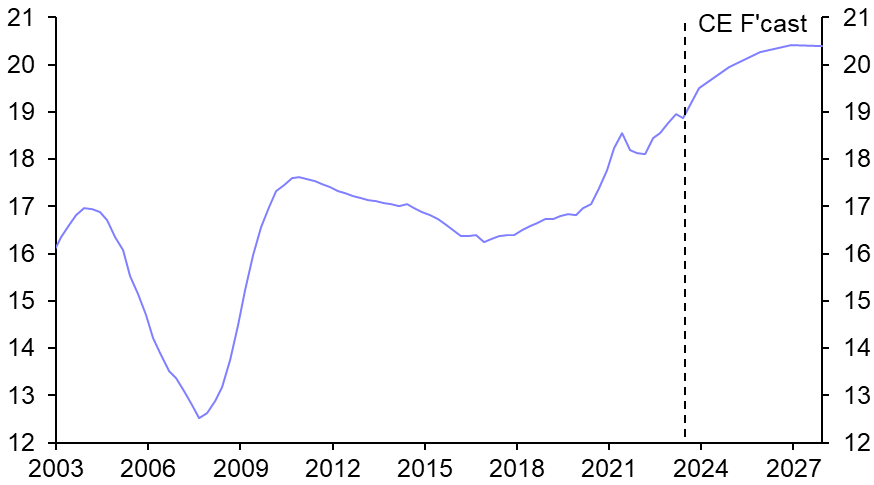

Chart 9: Apartment NOI Yields (%) |

Chart 10: Apartment Capital Growth, Income Returns & Total Returns (% p.a.) |

|

|

|

|

Sources: MSCI, REIS, Capital Economics |

These are key takeaways from a 13-page report published for Capital Economics clients on 25th September, 2023. The report was written by Kiran Raichura and Charlie Cornes.

Make informed investment decisions quickly

CE Advance, our new premium product, equips organisations with actionable macroeconomic data and insight to stay ahead of the curve.