Q3 India Economic Outlook

Economy in good shape as Modi 3.0 begins

Prime Minister Modi begins his third term with a weakened mandate, but an economy that is primed to become the world’s third largest economy within the next couple of years.

These are just some of the key takeaways from our latest quarterly India Economic Outlook, originally published on 20th June, 2024. Some of the forecasts contained within may have been changed since publication. Access to the complete report, including detailed forecasts and near to long-term analysis, is available as part of a subscription to our CE Advance premium platform or to our dedicated India Economy coverage.

- Prime Minister Modi begins his third term with a weakened mandate, but an economy that is primed to grow by 6.5-7% per year between 2024 and 2026. That would put India on course to become the world’s third largest economy within the next couple of years. Meanwhile, with inflation grinding back down to the RBI’s 4% target, we think there is scope for more rate cuts this year than the consensus is expecting.

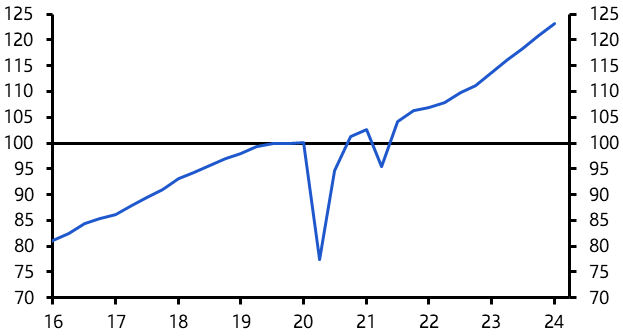

- The economy has performed exceptionally well over the past several quarters and is now almost 25% larger than it was on the eve of the pandemic. (See Chart 1.) While the Q1 GDP data may have overstated growth somewhat (there was an unusually large residual) that doesn’t change the fact that the recent pace of growth has been the fastest of any major economy.

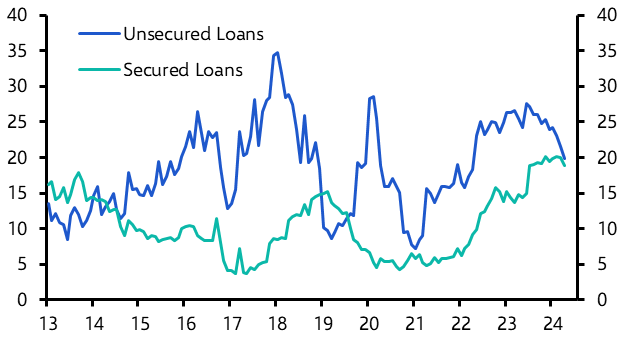

- But growth will slow over the coming quarters. The tightening of restrictions on unsecured lending is beginning to have its desired effect. (See Chart 2.) That is positive for the health of the banking sector but may restrain household consumption.

|

Chart 1: GDP (Q4 2019 = 100, SA) |

Chart 2: Loan Growth (% y/y) |

|

|

|

- However, any deceleration in growth is likely to be gentle. The pass-through from tighter monetary policy to higher lending rates appears to have already materialised, so we don’t anticipate a sharp slowdown in broad credit growth.

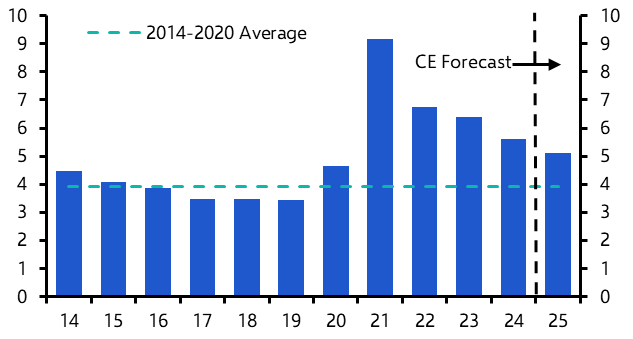

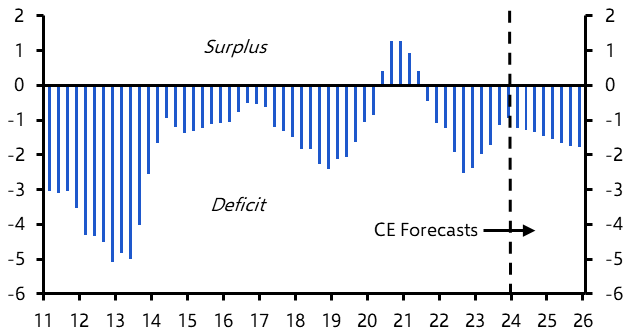

- Meanwhile, the Finance Ministry is projecting a smaller fiscal deficit in this fiscal year, but it will still be larger than the pre-pandemic norm. (See Chart 3). And the risk is tilted towards a bigger, more growth-supportive deficit as the BJP may need to make some concessions to other parties in the new coalition government.

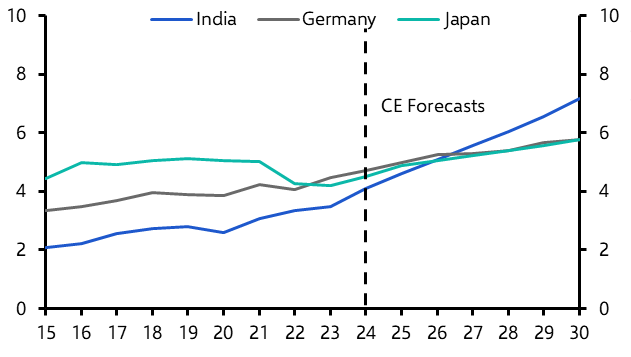

- In all, we expect average annual GDP growth of 6.5-7% between 2024 and 2026. This will set the foundation for India to overtake Japan and Germany to become the world’s third largest economy at market exchange rates over that timeframe. (See Chart 4.)

|

Chart 3: Central Government Fiscal Deficit |

Chart 4: Nominal GDP (US$trn, Based on Market Exchange Rates) |

|

|

|

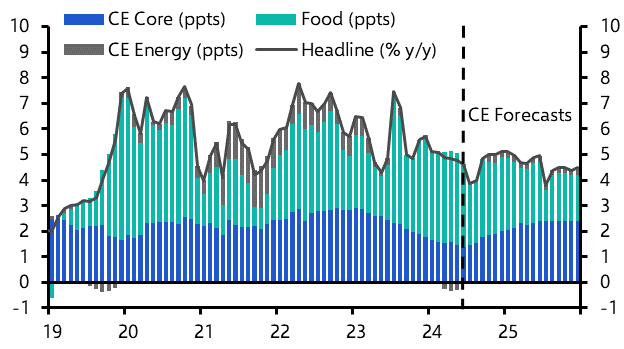

- Consumer price inflation is comfortably within the upper limit of the RBI’s 2-6% target range, and the continued easing in core inflation is an encouraging sign that broad price pressures remain low. (See Chart 5.) Looking ahead, food prices as always are uncertain, but with a healthy monsoon season in the forecasts, we are hopeful that food price inflation will ease.

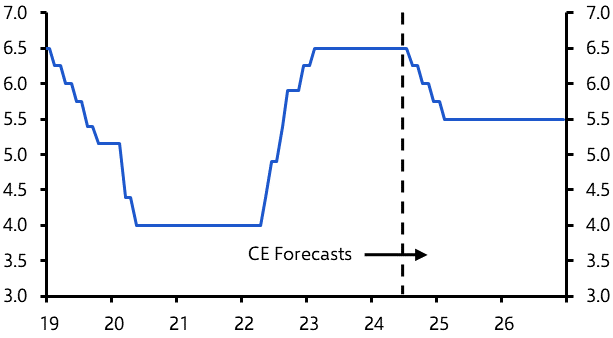

- As such, we think that the RBI will begin its easing cycle in August (see Chart 6). In all, we expect 75bps of cuts this year, which is a bit more than the consensus expects.

|

Chart 5: Consumer Prices (% y/y) |

Chart 6: RBI Repo Rate (%) |

|

|

|

- On the external front, we think the current account deficit over the next couple of years will remain within the RBI’s 2% of GDP threshold that it considers sustainable (see Chart 7) as commodity prices remain comfortably below their 2022 peaks.

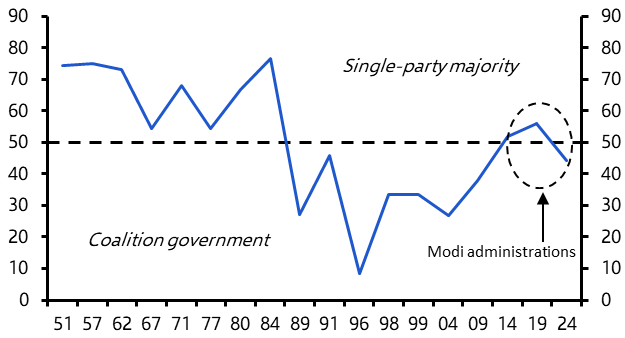

- Prospects for India’s economy over the medium term are promising. Admittedly, PM Modi’s weakened mandate (see Chart 8) will make the passage of contentious economic reforms more difficult. But he will still be able to work at the head of a stable coalition, and there appears to be a broader embrace across the political spectrum of the value of economic reform.

- And in a fracturing global economy, India is a prime candidate to benefit from the friendshoring of manufacturing supply chains given its large labour supply and low costs. In all, we think India can sustain growth of 6-7% over the medium term.

|

Chart 7: Current Account Balance |

Chart 8: Lok Sabha Election Result |

|

|

|

|

Sources: CEIC, Refinitiv, UN, Capital Economics |

These are just some of the key takeaways from a 13-page report published for Capital Economics clients on 20th June, 2024. The report was written by Shilan Shah and Ankita Amajuri.

Get the full report

Trial our services to see this complete 13-page analysis, alongside all of our India insight and forecasts.