- Although the extra risk premia on the UK’s sovereign bonds and currency that emerged in the wake of the UK’s “mini”-budget have partly unwound, this doesn’t necessarily mean Gilts and sterling are set to return to where they were before Liz Truss’s short-lived experiment with much looser fiscal policy.

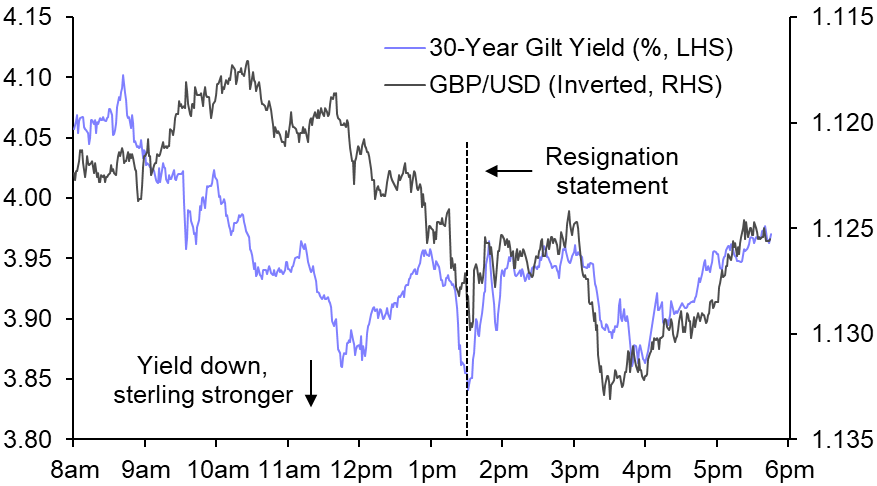

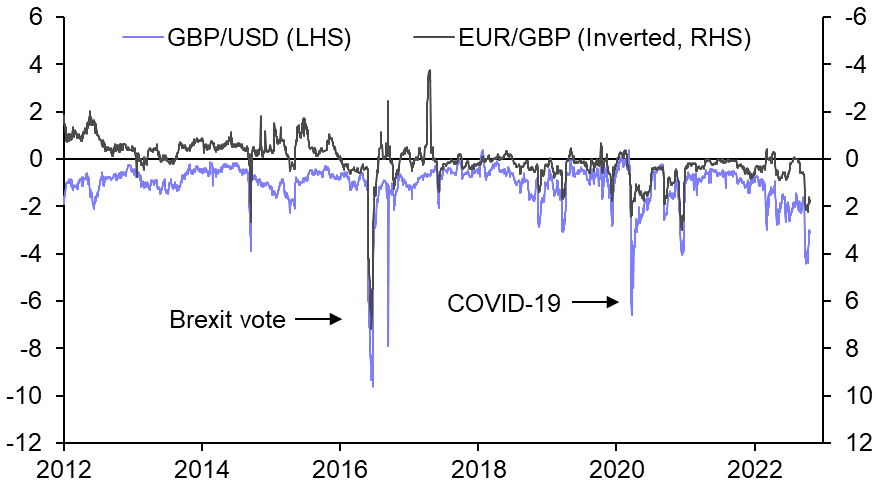

- Ironically, long-dated Gilt yields rose and sterling’s value against the dollar fell initially after the outgoing prime minister resigned at ~1.30pm BST. However, these developments only partially retraced larger moves in the opposite direction earlier on Thursday, when speculation grew that she might step down imminently. The pre-resignation trend reasserted itself not long afterwards, when it became clear that Boris Johnson and Rishi Sunak might both be in the running to replace her. But that hasn’t really lasted either. At the time of writing, the 30-year Gilt yield was a bit lower, and cable higher, than at 8.00am BST. (See Chart 1.)

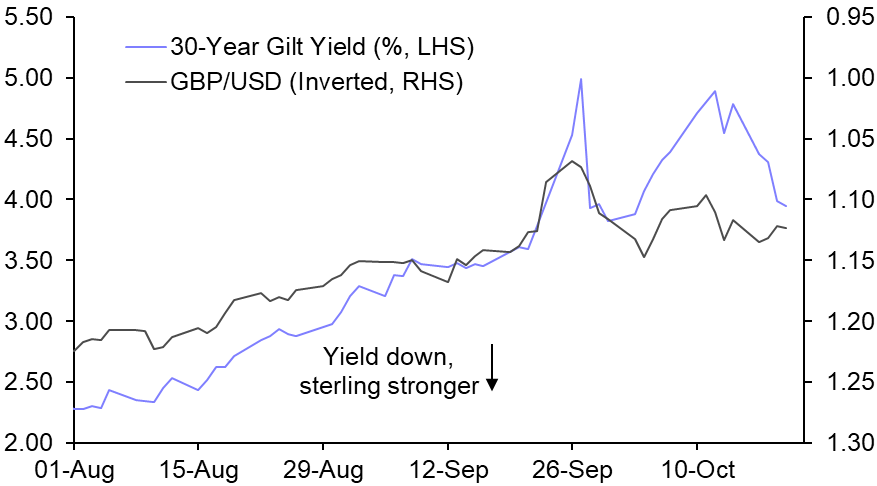

- The bigger picture is that today’s moves in long-dated Gilts and sterling have been quite small in the context of their recent gyrations. This reflects the fact that the substantial changes in their value in the wake of last month’s mini-budget had already unwound before today’s events unfolded. (See Chart 2.) That is tied, of course, to the government’s recent volte-face on fiscal policy and the Bank of England’s intervention to support the Gilt market in the wake of troubles in the pension industry.

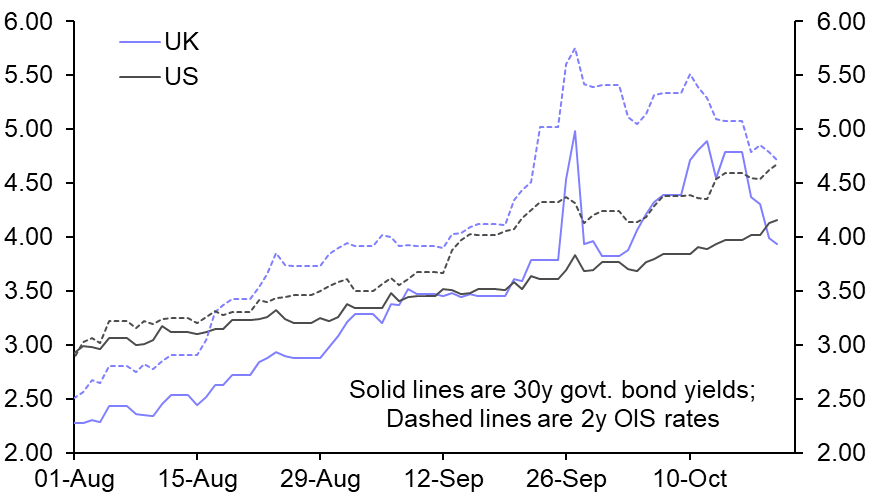

- That doesn’t imply that the putative “risk premium” on UK assets associated with the government’s previous plans for unfunded fiscal expansion has necessarily evaporated, since the international context matters. Nonetheless, there is some evidence to support such a claim in the bond market at least. The surge in the gap between 2-year overnight indexed swap rates in the UK and US after the mini-budget has unravelled, leaving it near its previous negligible level. And it is a similar story when it comes to the gap between long bond yields. Indeed, the 30-year Gilt yield has now fallen below the 30-year Treasury yield. (See Chart 3.)

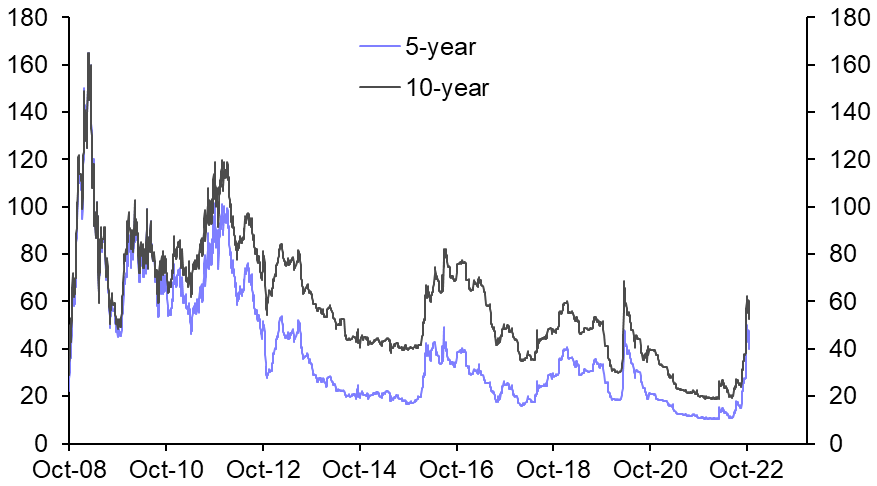

- Even so, there are still some signs of a risk premium on UK sovereign debt. For example, bid/ask spreads on long-dated Gilts generally remain wider than usual, while 5-year and 10-year credit default swap premia are much higher than they were before the mini-budget. (See Chart 4.) We don’t find that very surprising. After all, even if the expected path of UK fiscal policy returned to the status quo ex ante (i.e. the position before the outgoing prime minister outlined her plans for more expansionary fiscal policy in her leadership campaign), there ought now to be far more uncertainty about that path, especially in light of recent U-turns.

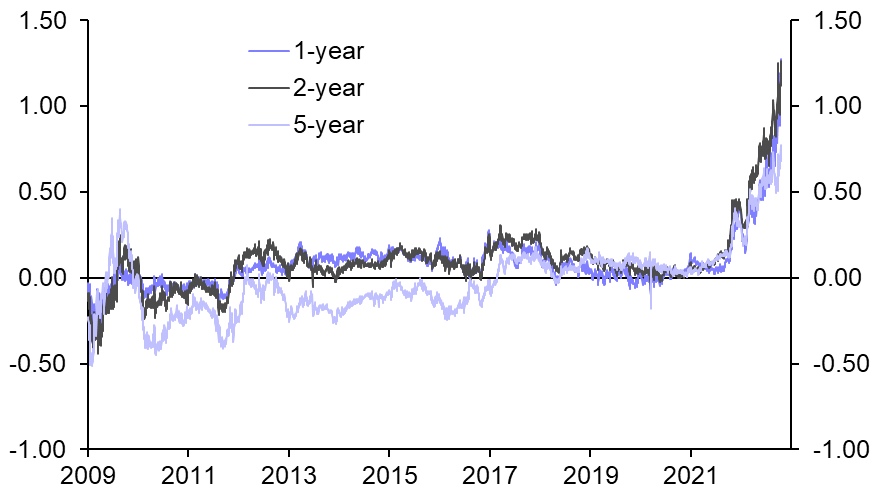

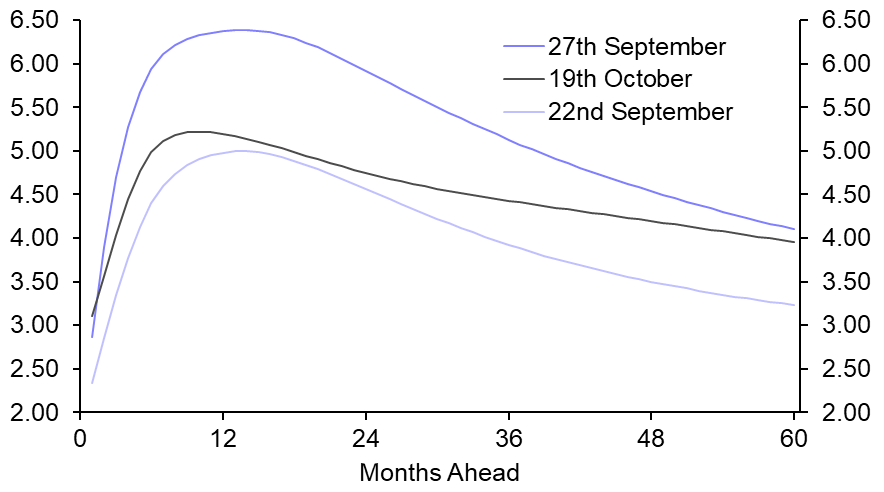

- All else equal, greater uncertainty about fiscal policy also implies greater uncertainty about monetary policy. Accordingly, even if the expected path of UK fiscal policy returned to the status quo ex ante, overnight indexed swap rates and Gilt yields could still be higher than they were before the mini-budget. Caution should be exercised when comparing overnight indexed swap rates and Gilt yields, given recent increases in the spreads between them. (See Chart 5 and here.) Yet for what it’s worth, based on overnight indexed swap rates, Bank Rate is expected to expected to remain higher for longer than it was before the mini-budget, especially beyond the 1-2 year horizon. (See Chart 6.)

- Admittedly, we suspect that fiscal policy will end up tighter in the future than was widely assumed before the mini-budget in order to fill a bigger-than-envisaged hole in the public finances due to weaker economic growth. (See here.) This should become clear once the government publishes its medium-term fiscal strategy – currently scheduled for 31st October. Such an outcome would be a boon for Gilts in and of itself, especially as it might also require a less aggressive monetary policy response to bear down on inflation.

- But while this increases the downside risks to our forecast for Bank Rate to peak at 5%, which we revised up from 4% in the wake of the mini-budget, we aren’t planning to do our own U-turn on that one for the time being, given signs that inflation is proving very sticky. For context, the market-implied peak in Bank Rate is still a little higher than 5%, after peaking recently above 6%.

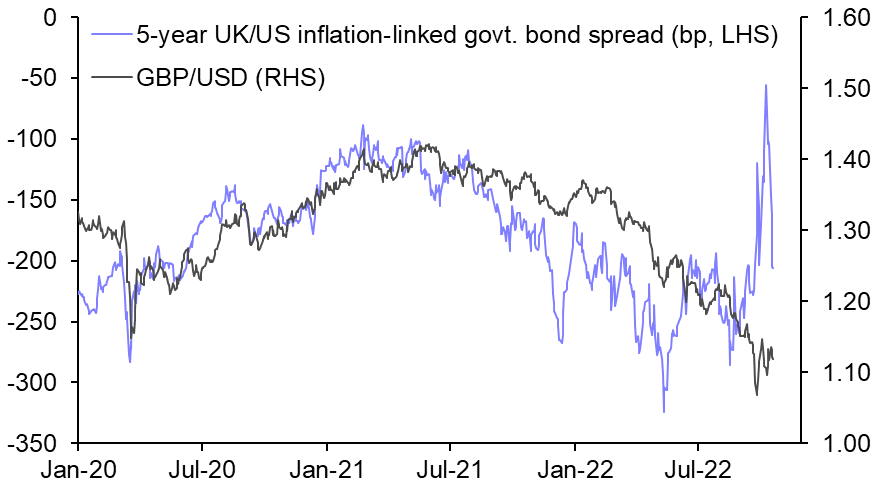

- Finally, it’s worth noting that there seems to be a bigger residual risk premium in sterling than in Gilts. Even allowing for recent liquidity-related distortions in inflation-linked government bonds (see here), which may have partly unwound, the spread between the yields of those with residual maturities of five years in the UK and the US still seems consistent with a significantly stronger level of cable than currently observed. (See Chart 7.) And risk-reversals in the currency market are consistent with investors continuing to seek protection from a slump in the pound. (See Chart 8 and here.)

|

Chart 1: 30-Year Gilt Yield & GBP/USD On Day Of Resignation (20th October) Of UK PM Truss (BST) |

Chart 2: 30-Year Gilt Yield & GBP/USD Since Start Of August 2022 |

|

|

|

|

Chart 3: UK & US 30-Year Government Bond Yields |

Chart 4: UK Sovereign 5-Year & 10-Year Credit Default Swap Premia (bp) |

|

|

|

|

Chart 5: Spreads Between UK Overnight Indexed Swap Rates & UK Government Bond Yields (pp) |

Chart 6: Instantaneous Forward Rates Implied By UK Overnight Indexed Swap Rates In 2022 (%) |

|

|

|

|

Chart 7: 5-Year UK/US Inflation-Linked Government Bond Spread & GBP/USD |

Chart 8: 1m, 25 Delta, Risk Reversals On |

|

|

|

|

|

Sources: Refinitiv, Bloomberg, Bank of England, Capital Economics |

John Higgins, Chief Markets Economist, john.higgins@capitaleconomics.com