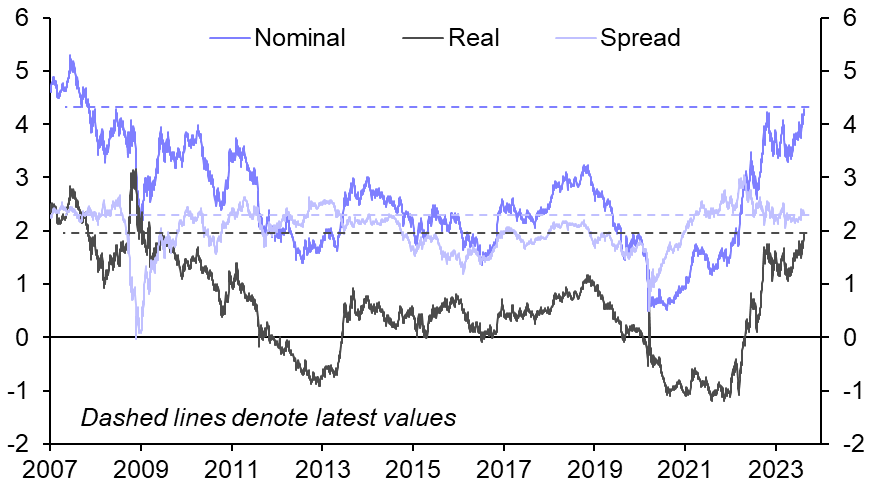

Government bond yields have been hitting multi-year highs even though data show inflation in retreat and central bankers are preparing to down tools – if they haven’t already. Why the disconnect? Group Chief Economist Neil Shearing talks to David Wilder about what’s been happening in the bond market, whether this is why some EMs have been struggling, and what Jerome Powell might say at Jackson Hole this week.

Plus, Global Economist Ariane Curtis has just completed work on the outlook for fiscal policy in developed markets. She talks to Senior Global Economist Simon MacAdam about why policy is likely to continue supporting growth and why this complicates the task of central banks to get inflation under control.

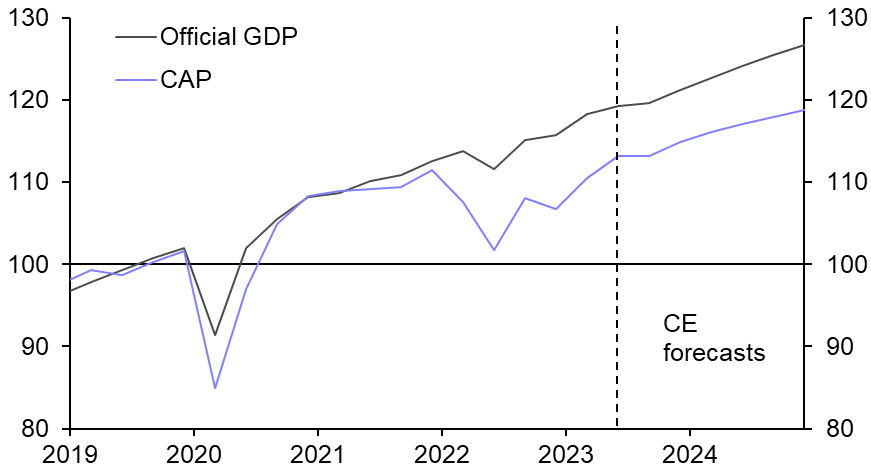

And, amid growing fears about China’s economic and financial risks, the team held an online briefing to give clients a chance to ask about everything from where the renminbi is going to local government debt to whether China is turning into Japan. Listen to an exclusive clip from that briefing with Neil, China Economics head Julian Evans-Pritchard and Senior Global Markets Economist Thomas Mathews.