Invitation-only Roundtable

The End of the Ultra-Low Rates Era

R* in the Post-Pandemic Economy

Wednesday 8th November

What will a world of structurally higher interest rates look like? How will central banks respond in a more volatile inflation environment? What will increasing risk-free rates mean for asset allocation?

Chief Global Economist Jennifer McKeown hosted an exclusive in-person briefing all about our new analysis of equilibrium real interest rates with economists from across our Macro and Markets teams.

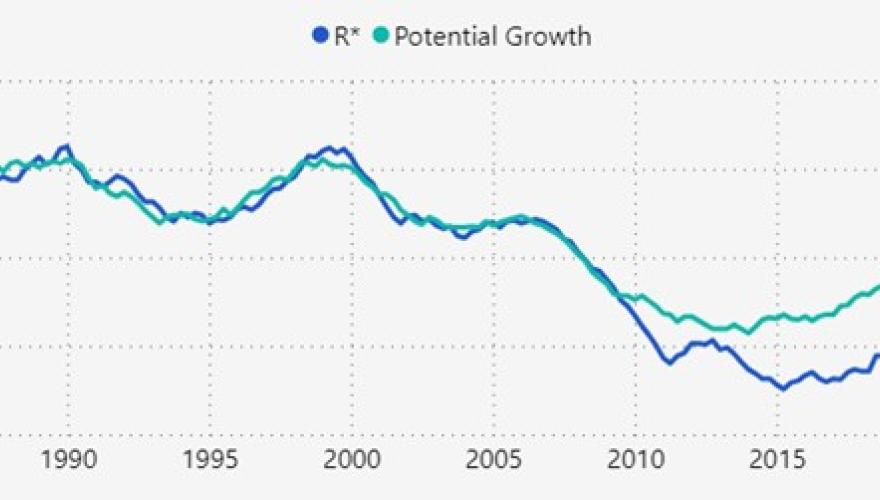

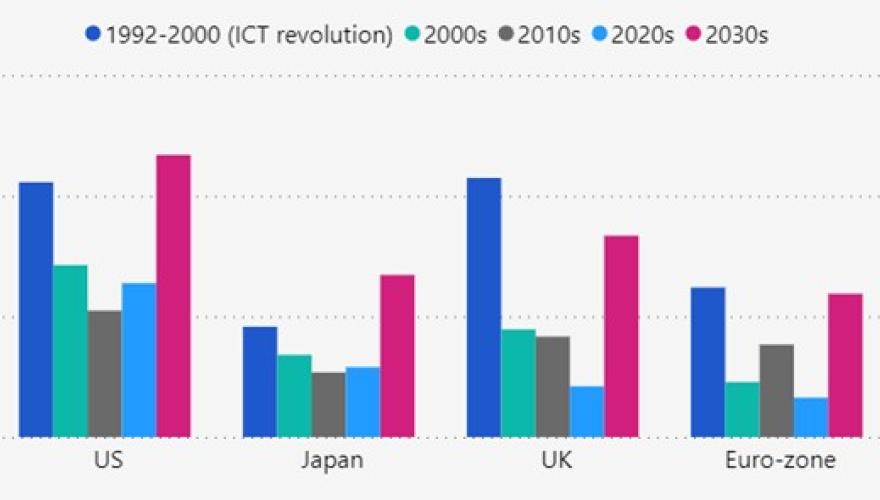

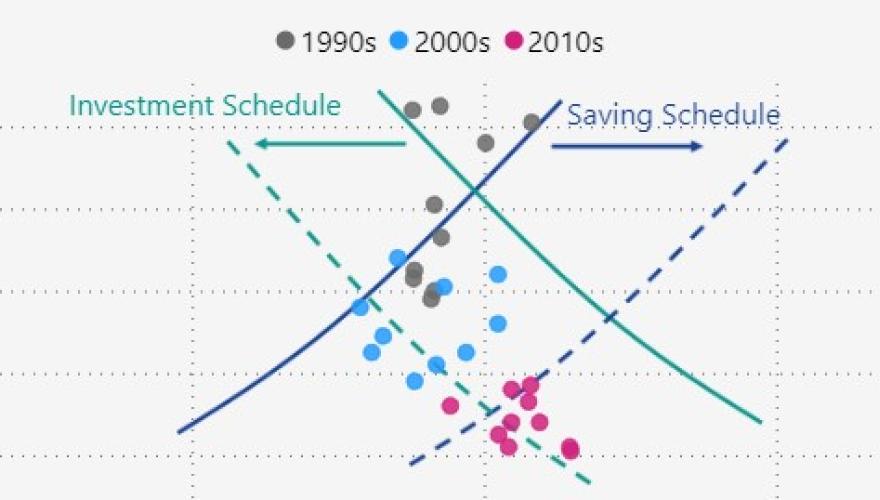

The team talked through major forces that will reshape advanced economies in the coming years – from demographic change to artificial intelligence to the green transition – showing why the ultra-low rates era is dead, what to expect from an age of higher equilibrium real rates, and what this all means for a broad swathe of asset prices.

During the session, the team took questions from the audience as they addressed key issues, including:

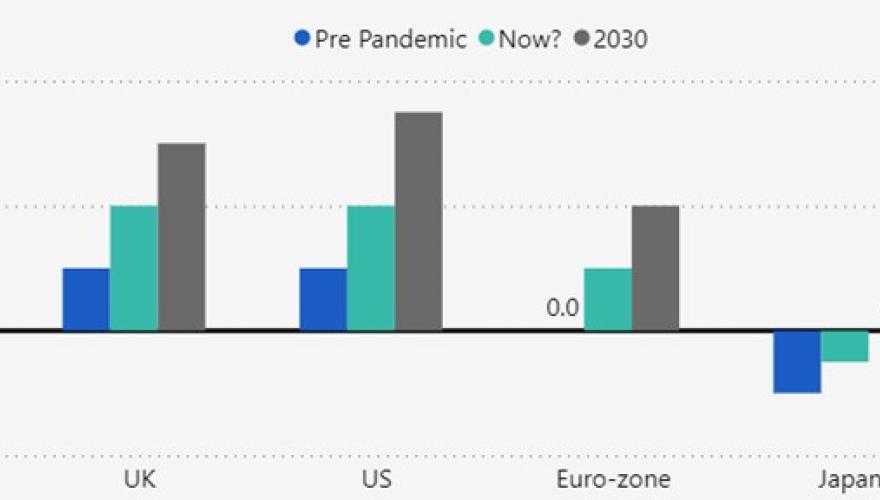

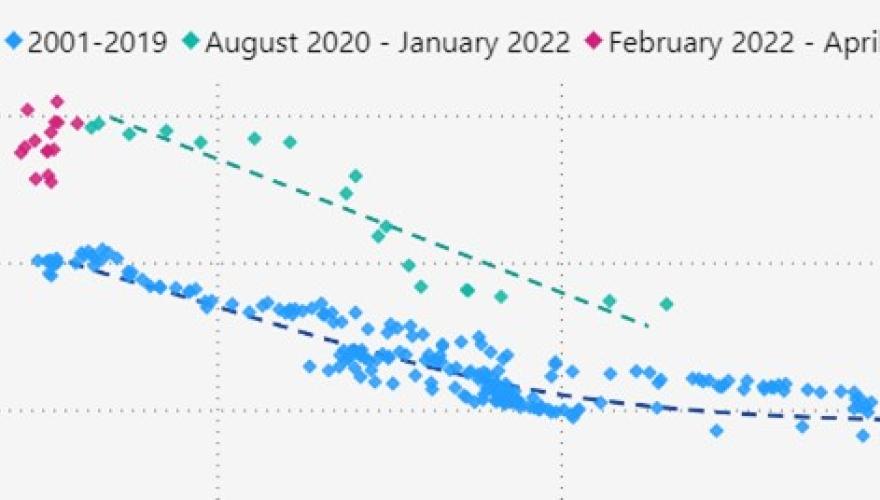

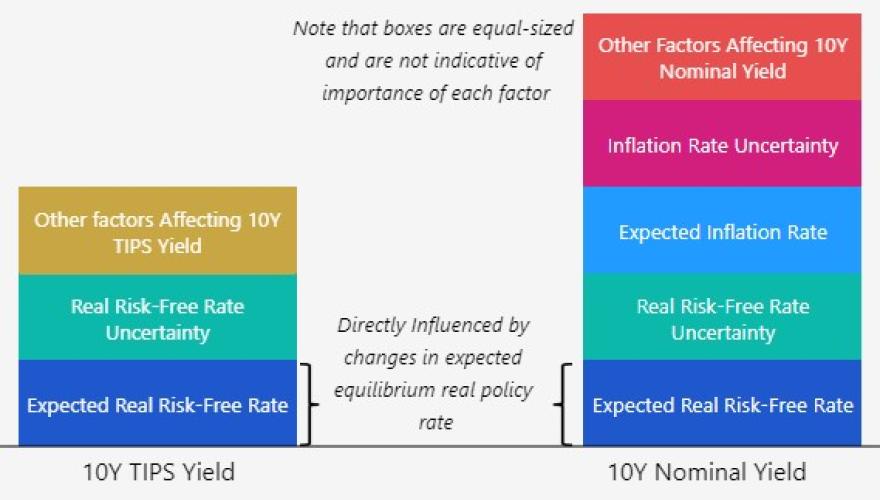

- The forces that will see equilibrium real interest rates across advanced economies rise from their ultra-low levels of the 2010s;

- How this changing rate environment will affect how central banks set interest rates over the longer-term;

- What rising risk-free rates could mean for allocating risky assets in this new rate era.

Meet our speakers:

-

Neil Shearing

Group Chief Economist

Neil Shearing is our Group Chief Economist. He has overall responsibility for managing our team of economists and leading our research, as well as developing the firm’s products and its relationship with clients. He is also a director of the company. Neil is the first point of contact for many clients and presents regularly on the global economic and financial market outlook. He is a well-known voice within the investment community and has written articles in the Financial Times and a number of other newspapers, as well as appearing regularly on TV and radio. Prior to becoming Group Chief Economist, Neil was our Chief Emerging Markets Economist, managing a team that won several awards for forecast accuracy. He also managed our New York office. Neil joined Capital Economics from HM Treasury where he worked as an Economic Adviser in various areas, including fiscal policy and global economics. He holds degrees in Economics from the University of York and the University of London and is a Fellow of the Royal Society of Arts.

-

Jennifer McKeown

Chief Global Economist

Jennifer McKeown is Chief Global Economist at Capital Economics. She leads a team of economists producing research on global themes and works closely with economists across Capital Economics’ regional services to shape the global view and to draw out the key implications of our forecasts. She is an important point of contact for many clients and presents frequently on the global economic outlook in person and at online events, as well as appearing regularly on TV and radio. Prior to becoming Chief Global Economist, Jennifer was Chief Europe Economist at Capital Economics. She joined the company from the Bank of England, where she also specialised in the economics of the euro-zone. She holds an MSc in economics from University College London and a BA in economics from the University of East Anglia.

-

Andrew Hunter

-

James Reilly

Senior Markets Economist

James is a Senior Economist on our Markets desk, contributing primarily to the Asset Allocation and Capital Daily services. He joined Capital Economics in 2021, having previously worked within the multi-asset division of Schroders. James holds a BSc in Economics from the University of Bath and an MSc in Financial Economics from Birkbeck, University of London.