What will a world of structurally higher interest rates look like? How will central bank behaviour change in the coming years? What will this mean for market returns?

Our senior economist team hosted a special online briefing all about their new work estimating r* and the global economy through 2030.

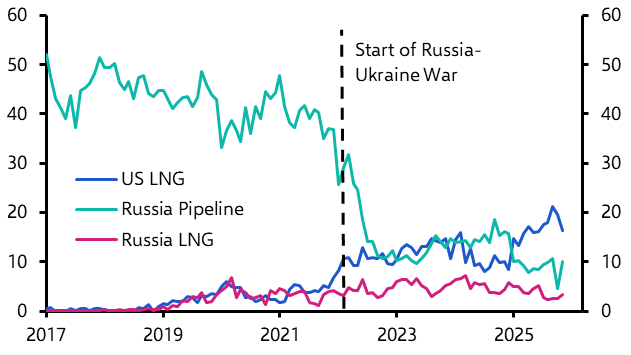

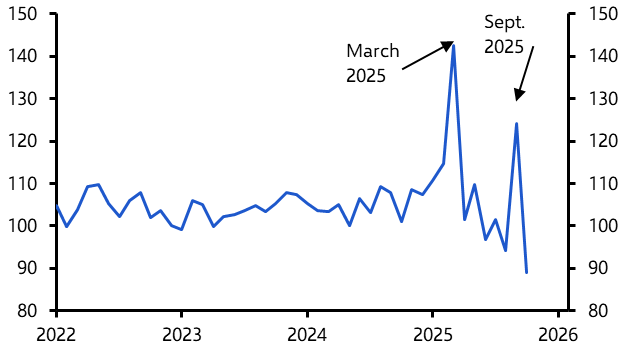

The team talked through major forces that will reshape advanced economies in the coming years – from demographic change to artificial intelligence to the green transition – to show why we are entering a period of higher equilibrium real rates, and what that means for a broad swathe of asset prices.

During this 30-minute session, our economists answered client questions as they addressed key issues, including:

- The forces that will raise equilibrium real interest rates in advanced economies from their ultra-low levels of the 2010s;

- How this changing rate environment will affect how central banks set interest rates over the longer-term;

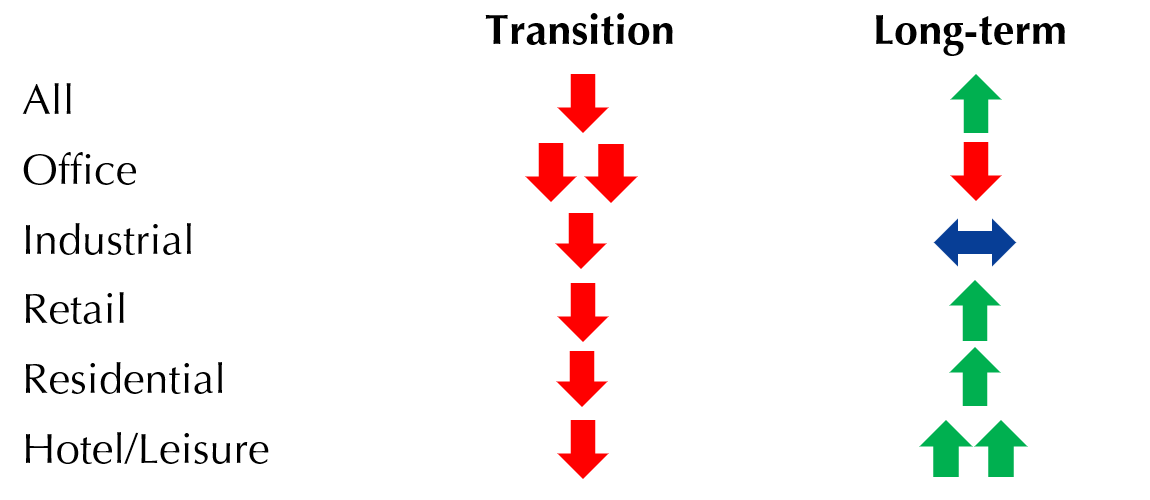

- What rising risk-free rates could mean for asset allocation.

Start date: