Q4 US Economic Outlook: Economy to benefit from lower interest rates

After starting its loosening cycle with a bang, we expect the Fed to take a more measured approach to cutting interest rates from now on.

This is a sample of our latest quarterly US Economic Outlook, originally published on 23rd September 2024. Some of the forecasts contained within may have changed since publication. Access to the complete report, including detailed forecasts and near to long-term analysis, is available as part of a subscription to our CE Advance premium platform or to our dedicated US Economics coverage.

With inflation normalising due to improving supply, the Fed is in the fortuitous position of being able to lower interest rates even though economic growth remains solid and the unemployment rate is still relatively low. Despite the downshift in employment growth, we expect GDP growth to remain strong over the next couple of years, as monetary policy rapidly shifts from a headwind to a tailwind. The presidential election adds to the uncertainty. We are worried that tariffs and immigration curbs imposed in a second Trump administration could be stagflationary.

- With inflation normalising due to improving supply, the Fed is in the fortuitous position of being able to lower interest rates even though economic growth remains solid and the unemployment rate is still relatively low. Despite the downshift in employment growth, we expect GDP growth to remain strong over the next couple of years, as monetary policy rapidly shifts from a headwind to a tailwind.

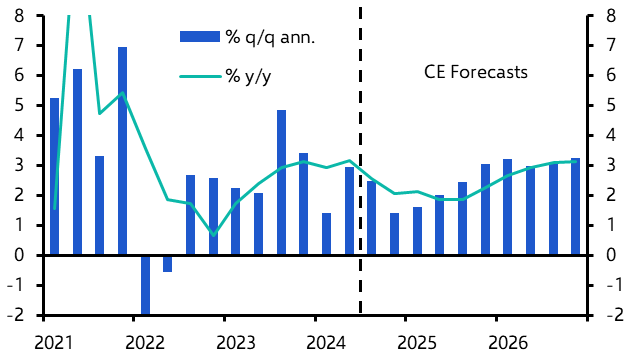

- Third-quarter GDP growth is tracking at 2.5% annualised, principally thanks to the strength of consumption growth. (See Chart 1.) Although their excess savings accumulated during the pandemic appear to be all-but exhausted, households are still benefitting from low pandemic-era fixed mortgage rates, which mean debt servicing costs remain muted. Higher-income households are also receiving a boost from wealth gains stemming from the stock market boom.

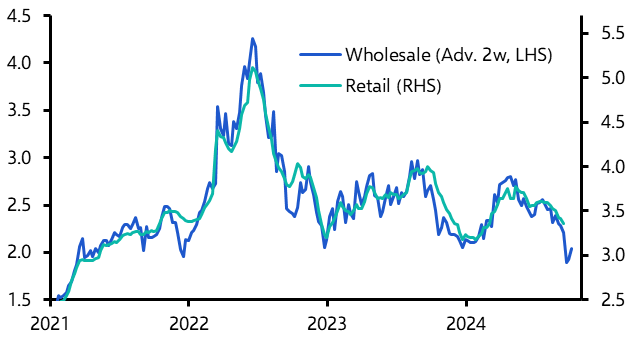

- Admittedly, the pick-up in credit card and auto loan delinquencies suggests that lower-income households are struggling a little, but the most-recent drop back in energy prices should provide some relief. (See Chart 2.)

|

Chart 1: Real GDP |

Chart 2: Gasoline Prices ($ Per Gallon) |

|

|

|

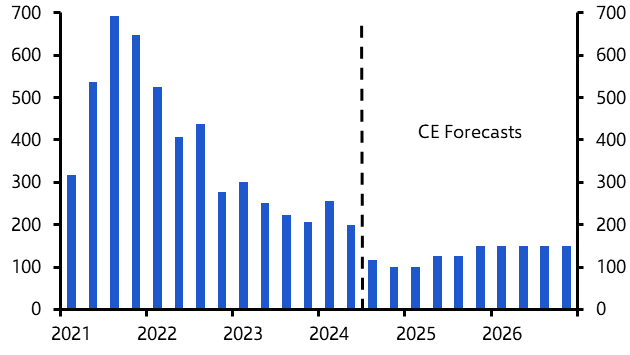

- The pace of employment growth has slowed, and the BLS has indicated that the monthly gains over the last 18 months will ultimately be revised lower. Nevertheless, rather than continuing to deteriorate, we expect those monthly gains to stabilise at around 100,000. (See Chart 3.)

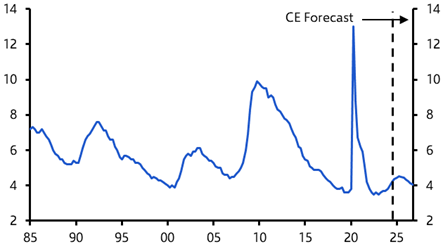

- Assuming that the recent sharp slowdown in unauthorised immigration is sustained, (or even becomes more pronounced if Donald Trump wins this November’s presidential election), then that slower pace of employment growth won’t necessarily translate into a rising unemployment rate. We expect it to peak at 4.5%. (See Chart 4.)

|

Chart 3: Change in Employment (000s, Monthly) |

Chart 4: Unemployment Rate (%) |

|

|

|

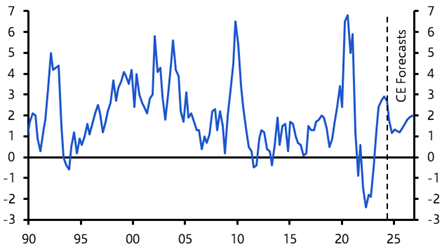

- We also expect a modest cyclical slowdown in productivity growth over the next 12 months, before a more pronounced AI-related structural pick-up takes effect from 2026 onwards. (See Chart 5.) Our optimism over productivity growth is the key reason why we expect GDP growth to accelerate without triggering any meaningful rebound in inflation. (See Chart 6.)

|

Chart 5: Productivity (%y/y) |

Chart 6: Core Inflation (%) |

|

|

|

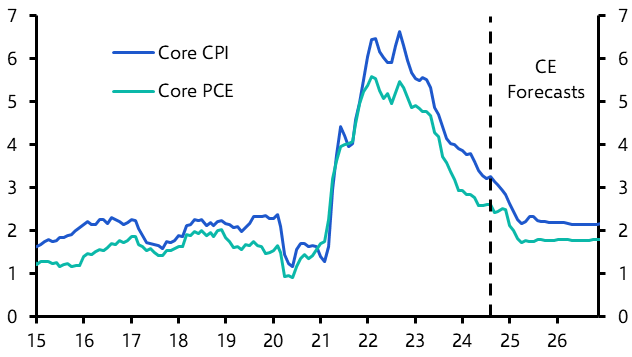

- Core PCE price gains have slowed again to a target-consistent 2% annualised pace. Prices increased at a similarly muted pace in the second half of last year, however, so the annual core PCE inflation rate will remain close to 2.5% until early next year, when it will rapidly fall to 2% or even slightly below target.

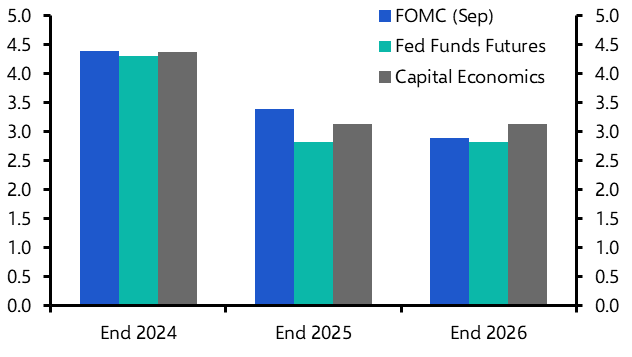

- With inflation all-but vanquished, we expect the Fed to cut interest rates to between 3.00% and 3.25% next year. (See Chart 7.)

- Our forecasts are based on an assumption of policy continuity but, particularly if Donald Trump wins the presidential election, we would expect to make changes. We explain here why we think Trump’s plans for tariffs and curbs on immigration would subtract 0.8% from real GDP and add 1.2% to the price level.

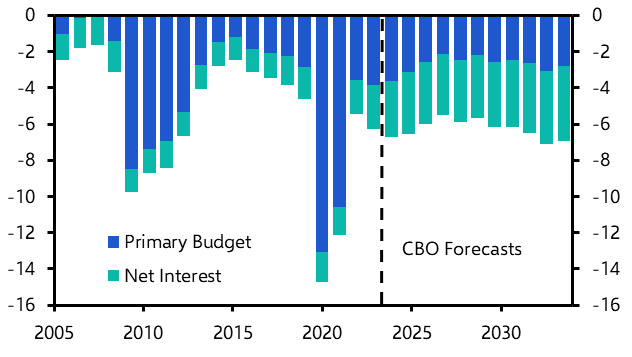

- Regardless of who wins, we don’t expect any major fiscal stimulus. With the Federal deficit already running at more than 6% of GDP, partly because debt servicing costs are rising, and the debt burden approaching 100% of GDP, we suspect any plans for additional stimulus would be met by an adverse market reaction. (See Chart 8.)

|

Chart 7: Fed Funds Rate Expectations (%) |

Chart 8: Federal Budget Balance (% of GDP) |

|

|

|

|

Sources: LSEG, Federal Reserve, CBO, CE |

Activity - GDP growth to strengthen in 2025 and beyond

- Lower interest rates should provide a boost to the most rate-sensitive expenditure components, namely durables consumption, business equipment investment and residential investment. We expect GDP growth to accelerate from 2.0% in 2025 to 3.0% in 2026.

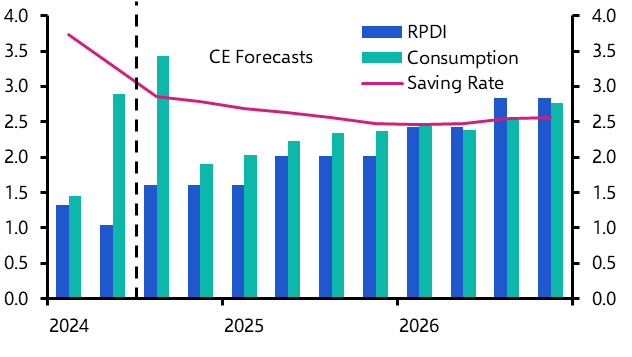

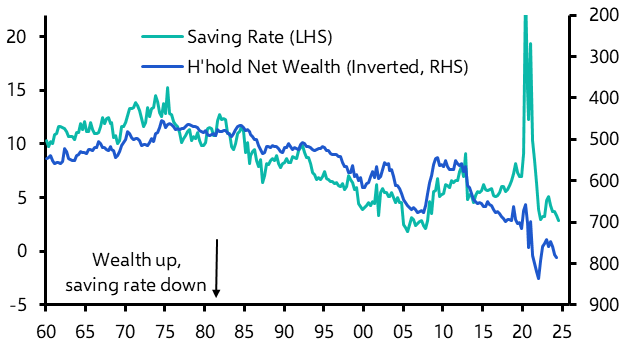

- Although we expect employment growth to remain muted, there is still scope for strong productivity growth to drive an acceleration in real personal disposable income growth, particularly in a low inflation environment. (See Chart 9.) Admittedly, there is not much scope for the saving rate to fall any further. But it is low, in part, because higher-income households have been funding spending via their wealth gains. (See Chart 10.) Our upbeat equities forecast point to additional wealth gains next year too.

|

Chart 9: Real Consumption, Income & Saving |

Chart 10: H’hold Saving & Net Wealth (% of Income) |

|

|

|

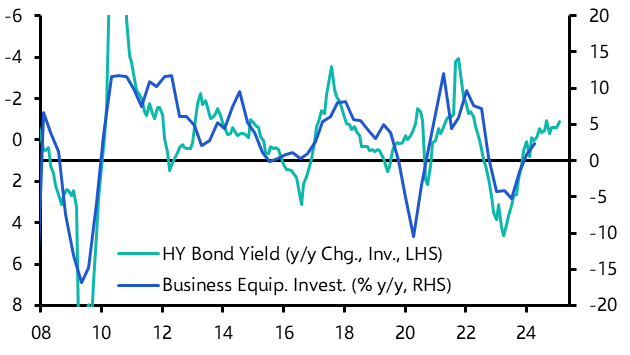

- The decline in corporate bond yields seen in anticipation of the Fed’s loosening cycle, already appears to be driving a resurgence in business equipment investment. (See Chart 11.)

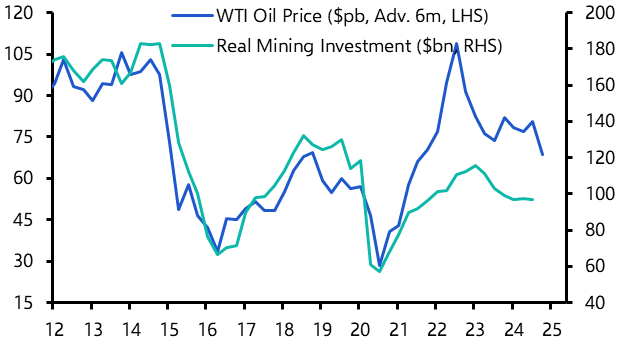

- We would normally expect the drop back in the oil price to hit mining investment, but the previously close relationship between the two has broken down in recent years. (See Chart 12.) That’s principally because of technological advances in horizontal drilling techniques, which have enabled firms to increase production without needing to drill more holes. The upshot is that we don’t expect lower energy prices now to weaken mining investment.

|

Chart 11: Equipment Invest. & Non-IG Bond Yield |

Chart 12: Oil Price & Mining Investment |

|

|

|

- The drop back in mortgage rates should trigger a 15% rebound in existing home sales to around 4.5 million annualised by the end of this year. (See Chart 13.)

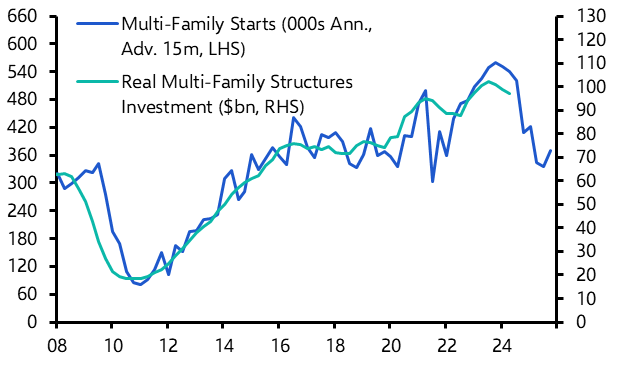

- But the glut of new multifamily apartment supply will weigh on residential investment. Because of the lengthy lags involved in the construction of these bigger projects, the slump in multifamily housing starts over the past 18 months points to a sharp drop in multifamily structures investment. (See Chart 14.) As a result, residential investment won’t begin to rebound in earnest until next year.

|

Chart 13: Existing Home Sales & Mortgage Rate |

Chart 14: Multi-family Starts & Investment |

|

|

|

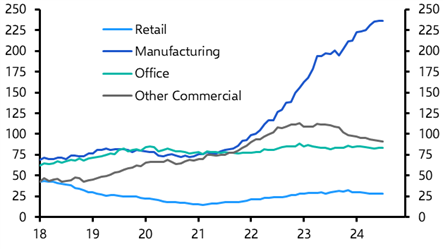

- The massive boom in manufacturing-related construction spending – as firms race to build new hi-tech battery and semiconductor plants – appears to be losing steam, so will provide a smaller boost to non-residential structures investment over the next year. (See Chart 15.) Given the collapse in capital values, the resilience of office construction looks a little strange – but that category also includes the boom in data centre construction, which we expect to continue as the AI revolution builds.

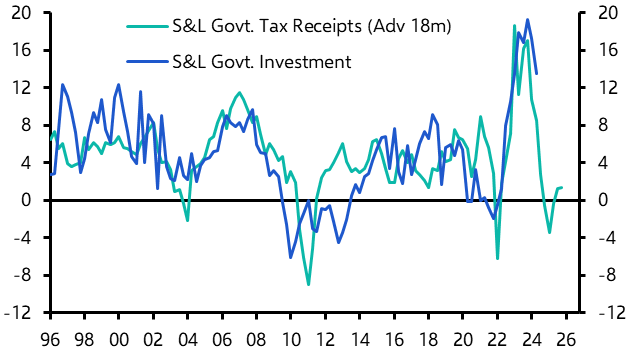

- Finally, we also expect a slowdown in government investment growth this year. The earlier strength reflected the surge in state and local government tax revenues in 2022 which, because of balanced budget rules, took some time to feed through. (See Chart 16.) Revenues fell back in 2023, however, which will weigh on government expenditure this year and next.

|

Chart 15: Construction Spending ($bn) |

Chart 16: S&L Gov’t Investment & Receipts (%y/y) |

|

|

|

|

Chart sources: LSEG Data & Analytics, Capital Economics |

Capital Economics clients get the full analysis, including:

- Why we expect a modest slowdown in non-farm payroll growth and think falls in employment are unlikely, while softer labour force growth means the unemployment rate will peak at 4.5%.

- How we are confident inflation will fall to 2% by early 2025, and then drop even slightly below target. Also why we expect core PCE inflation to end this year at 2.5%, before it falls rapidly to 1.8% in spring next year.

- Why, after starting its loosening cycle with a bang, we expect the Fed to take a more measured approach to cutting interest rates from now on, with a 25bp cut coming at each meeting until rates have fallen to between 3.00% and 3.25% next year. By that time, we expect accelerating GDP growth to dissuade the Fed from cutting rates below that neutral level.

- What this November’s elections could mean for our forecasts, particularly if Donald Trump is elected and follows through on his pledges to impose draconian restrictions on immigration and introduce a universal tariff and prohibitive tariffs on goods from China.

This is a sample of the 13-page US Economic Outlook prepared for Capital Economics clients, published on 23rd September 2024 and written by Paul Ashworth, Stephen Brown, Olivia Cross, Thomas Ryan, Bradley Saunders and Ruben Abargues.

Get the full report

Trial our services to see this complete 13-page analysis, our complete US macro insight and forecasts and much more