Q4 2024 Global Economic Outlook

A soft patch

The global economy has hit a soft patch with the euro-zone virtually stagnant, the US labour market flagging and China rationing its policy stimulus.

These are the key takeaways from our Q4 Global Economic Outlook, originally published on 26th September, 2024. Some forecasts contained within may have been changed since publication. Access to the complete report, including extensive forecasts and near to long-term analysis, is available as part of a subscription to our CE Advance premium platform or to our dedicated Global Economics coverage.

We expect the global economy's weakness to persist around the turn of the year given the pessimistic message from various business surveys and the fact that most economies are still feeling the effects of previous interest rate hikes. Even if the stimulus that China is now implementing props up its economy in the near term, this will not resolve its underlying problems. However, the risk of a global hard landing still seems relatively low. Fiscal policy remains supportive in general and the ongoing decline in inflation will boost real incomes even as employment slows. Easing price pressures will allow most central banks to normalise interest rates in the months ahead, which should allow growth to regain some pace in 2025.

- We expect the recent soft patch in global economic activity to persist for several months yet. But the risk of a hard landing still seems relatively low as lower inflation is supporting real incomes. Monetary policy normalisation should generate a modest economic revival in most areas in 2025, although risks are skewed to the downside.

- While most of the hard data suggest that global economic activity has remained resilient, the recent downturn in surveys of manufacturing activity is somewhat worrying. (See Chart 1.) This sector tends to be more sensitive to higher interest rates as households cut back purchases of big ticket items like cars and appliances and firms delay spending on capital goods. So it is possible that previous monetary policy tightening has begun to take a heavier toll.

- The recent slowdown in employment growth and uptick in unemployment across several major economies has also sparked some concern. Meanwhile, sentiment towards China has continued to weaken.

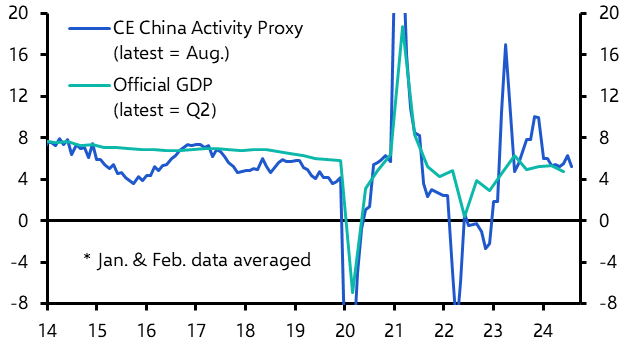

- We still do not anticipate a hard landing for the global economy. Most of the hard data have continued to hold up, with consumers in the US still spending and China’s exports booming. Indeed, for all the pessimism, China’s economy looked on course to just about meet the “about 5%” growth target even before the latest increase in stimulus. (See Chart 2.)

|

Chart 1: Global Manufacturing & Services Sector PMIs |

Chart 2: Official GDP & CE China Activity Proxy (% y/y) |

|

|

|

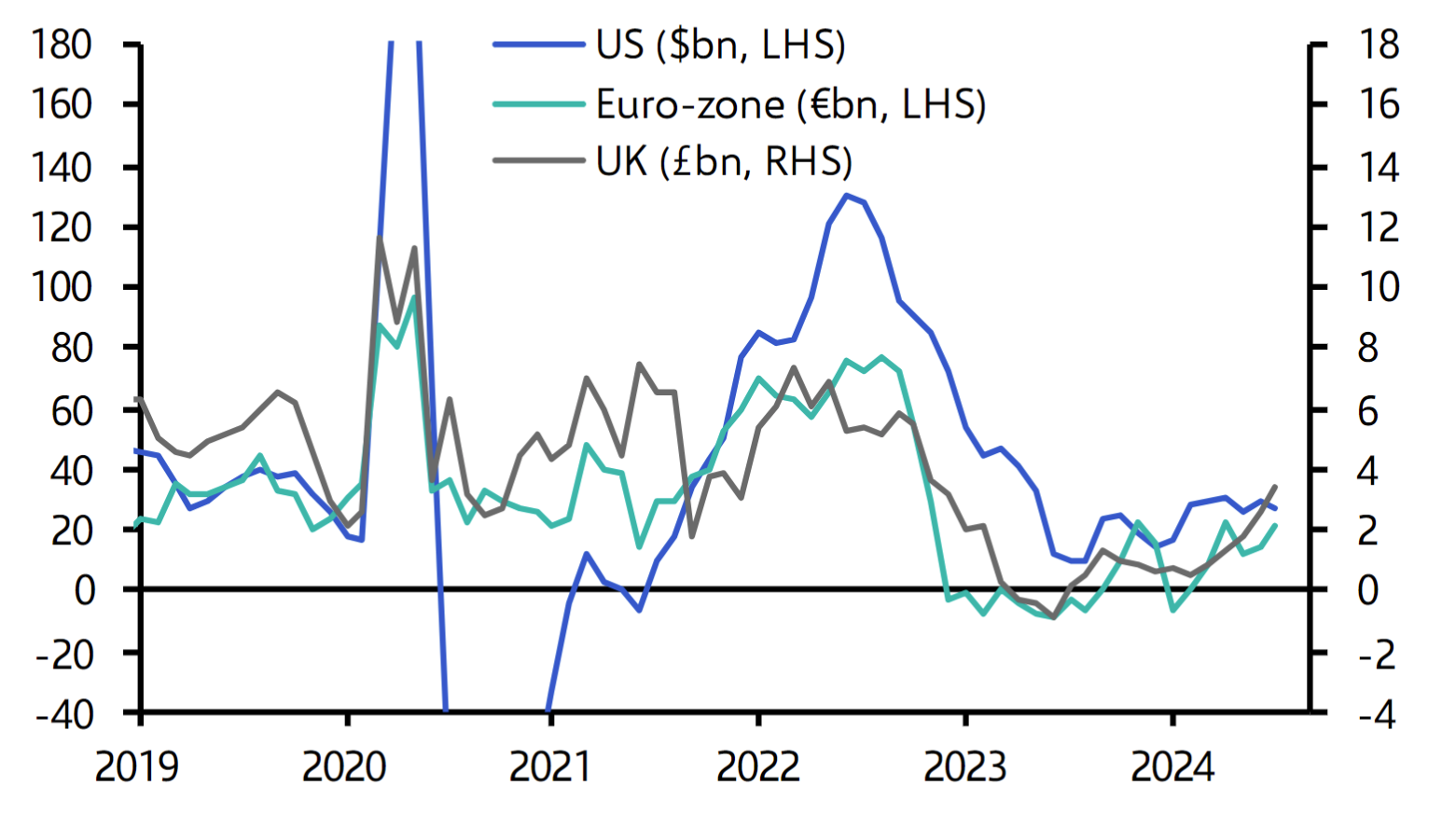

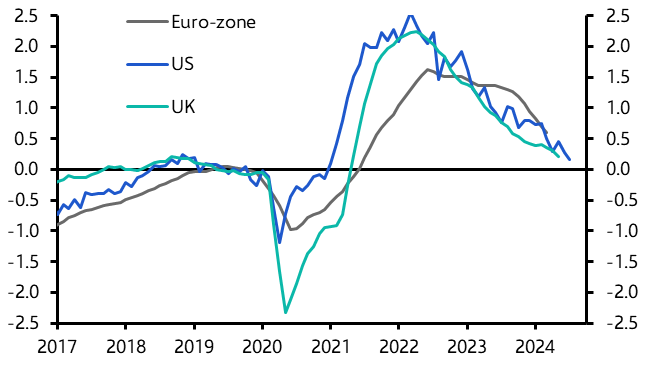

- Previous sharp falls in inflation related mainly to food and energy costs are supporting real incomes growth. Early interest rate cuts and expectations of more to come have already reduced borrowing costs and bolstered bank lending. (See Chart 3.) While employment growth has softened, we are not seeing major job cuts. Indeed, wider measures of labour market conditions such as vacancy rates suggest that conditions are simply normalising after a period of tightness. (See Chart 4.) And while policy stimulus will not solve China’s structural problems, it should offer some further support to growth in the near term.

|

Chart 3: M/M Change in Net Bank Lending to the Private Sector (3-month MA) |

Chart 4: Job Vacancy Rates in Major Advanced Economies (Z-Scores) |

|

|

|

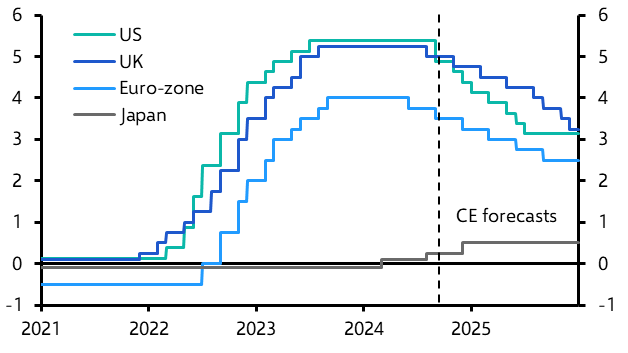

- The disinflation process has lost pace amid sticky price pressures in the services sector. We still expect policy rates to be cut to more neutral levels next year as falling wage growth causes price pressures to ease. (See Charts 5 and 6.) This should boost economic activity, albeit to a limited extent since market interest rates have already fallen to reflect anticipated rate cuts. Indeed, we suspect that the pace of policy loosening will disappoint in Europe, Emerging Europe and Latin America next year due to the persistence of wage pressures there.

|

Chart 5: Core Inflation in Major DMs (%) |

Chart 6: Major DM Central Bank Interest Rates (%) |

|

|

|

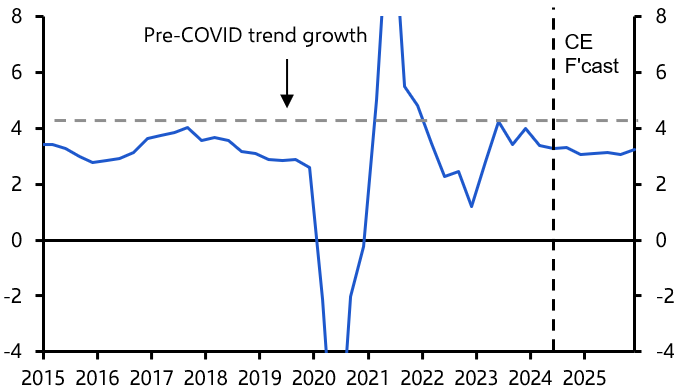

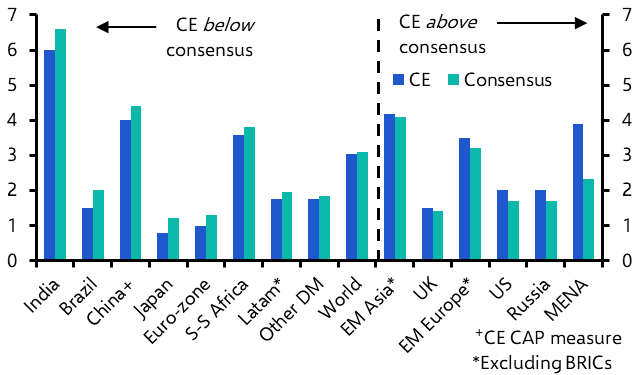

- In all, we see global GDP growth falling below its long-run average pace in the near term. (See Chart 7.) Activity should recover next year, but with significant variation by economy. The US will benefit from relatively aggressive interest rate cuts given its benign inflation picture. But growth in the euro-zone will be weighed down by fiscal tightening and structural issues in industry. And while India and China will benefit from fiscal policy support, several other emerging markets will suffer from tight policy and stubborn price pressures. (See Chart 8.)

- The risks to our forecasts are skewed to the downside and relate particularly to politics. We expect slow fiscal consolidation, but there is a risk that debt-funded stimulus prompts an adverse reaction in financial markets. A win for Trump in the US election would mean trade tariffs and a pushback against immigration with stagflationary consequences. It would also accentuate the threat to China from a global pushback against its export-driven model.

|

Chart 7: World GDP (% y/y) |

Chart 8: CE vs. Consensus 2025 GDP Forecasts (% y/y) |

|

|

|

|

Sources: LSEG D&A, S&P Global, FocusEconomics, Capital Economics |

These are takeaways from a 34-page report written for Capital Economics clients by Jennifer McKeown and the senior economist team, originally published on 26th September, 2024. The full report provides extensive near- to long-term economic forecasts as well as country, regional and markets analysis, including:

US – With inflation normalising due to improving supply, the Fed is in the fortuitous position of being able to lower interest rates even though economic growth remains solid and the unemployment rate is still relatively low. Despite the downshift in employment growth, we expect GDP growth to remain strong over the next couple of years, as monetary policy rapidly shifts from a headwind to a tailwind.

Euro-zone –The economy looks set to continue growing only slowly. Headline inflation should fall below 2% next year but with the core rate declining more gradually, we expect the ECB to cut interest rates at a steady pace, taking the deposit rate from 3.5% currently to 2.5% by late next year.

Japan – The economy is on the mend and underlying inflation seems to be levelling off around the Bank of Japan’s 2% target. Accordingly, we expect a final rate hike in December. But as inflation falls below target next year and the spring wage negotiations result in a smaller pay hike, we don’t foresee more tightening in 2025.

UK – We are not expecting the rises in taxes and public spending in the Budget on 30th October to trigger a major slowdown in GDP growth.

Canada – With the inflation battle all but won, weak GDP growth will force the Bank of Canada into more aggressive action, taking the policy rate to 3.25% in 2024 and 2.25% in 2025. Looser policy will support a recovery in GDP growth to 2.0% in 2025 and 3.0% in 2026, although elections at home and abroad, and uncertainty about immigration, are risks to the outlook.

Australia & New Zealand – A tight labour market and elevated public demand will keep the RBA from cutting rates before early-2025. By contrast, the more pressing need to stem the economic haemorrhaging in New Zealand explains why we expect the RBNZ will cut rates more aggressively than most expect.

China – A pivot towards fiscal and monetary stimulus should support China’s growth in the near term. But the economy continues to be propped up by investment, ongoing high levels of construction, and the willingness of trading partners to allow China’s producers to expand their market share. None of this is sustainable.

India – India’s economy is cooling but remains primed to grow by 6.0-6.5% per year between 2024 and 2026. CPI inflation is likely to remain close to the RBI’s 4% target, setting the stage for the RBI to begin loosening monetary policy from December. We think that the repo rate will fall to 5.50% (from 6.50% currently) in the upcoming easing cycle. Our forecast is a bit more dovish than the consensus expectation that rates will drop to 6.00%.

Other Asia – With price pressures set to stay subdued and economic growth likely to struggle, we expect more central banks to join the region’s rate cutting cycle over the coming months.

Emerging Europe – We have generally revised down our GDP growth forecasts slightly across Emerging Europe, but strong wage growth is keeping inflation risks alive and our interest rate forecasts lie towards the hawkish end of consensus expectations in most countries. Meanwhile, fiscal risks are building in some parts of the region ahead of elections.

Latin America – Tight policy and deteriorating terms of trade will keep growth across Latin America subdued and we think that the region will underperform other parts of the emerging world over the next couple of years. Public finance risks will continue to build as fiscal consolidation efforts fail to prevent debt ratios from rising.

Middle East & North Africa – Growth will pick-up across the region in the coming years, helped by a rise in oil output in the Gulf economies and falling inflation and improved balance sheets elsewhere. But fiscal tightening is likely across many major economies, which will act as a drag on domestic demand.

Sub-Saharan Africa – A combination of falling inflation and looser monetary policy will help GDP growth to accelerate across Sub-Saharan Africa from early next year. But tight fiscal policy will constrain the recovery and our growth forecasts generally sit below the consensus.

Commodities – We forecast most energy and metals prices to fall in 2025 as structural headwinds to demand build and supply constraints ease. Geopolitical developments in the Middle East remain a key upside risk for energy prices.

Get the full report

Trial our services to see this complete 34-page analysis, our complete Global Economics insight and forecasts and much more