Bank stress adds to downside risks for US economy

Q2 US Economic Outlook

While we would still describe our baseline scenario as a softish landing, the downside risk of a much harder landing is rising.

Below are excerpts from our latest quarterly US Economic Outlook. Access to the complete report, including extensive near-to-long-term forecasts and analysis is available as part of a subscription to our CE Advance premium platform or to our dedicated US Economics coverage.

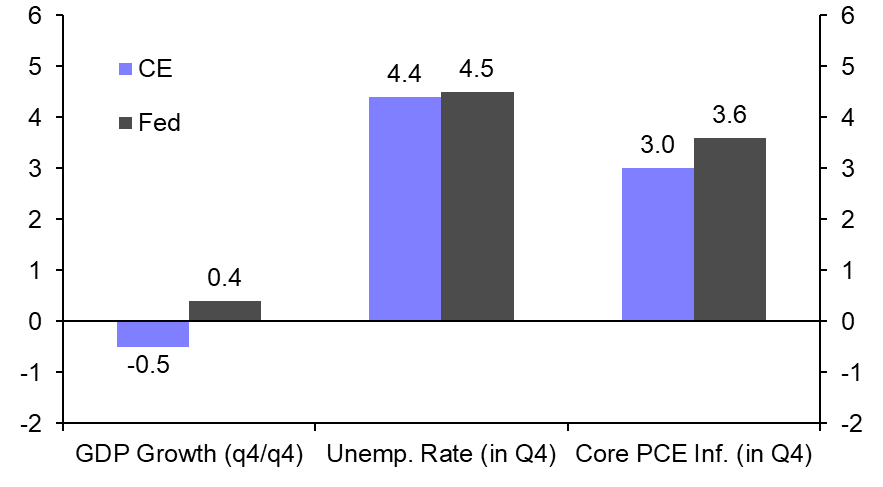

Acute bank stress will prompt a further tightening in credit conditions, which leaves us even more convinced that the economy will fall into recession this year. With core inflation remaining stickier than we had originally expected, however, the Fed probably won’t begin cutting its policy rate until September. Furthermore, while we would still describe our baseline scenario as a softish landing, since the peak-to-trough fall in GDP is less than 1% and the unemployment rate peaks at a modest 5%, the downside risk of a much harder landing is rising. We are most concerned that an adverse feedback loop will develop between small banks and commercial real estate, triggering an even bigger credit tightening.

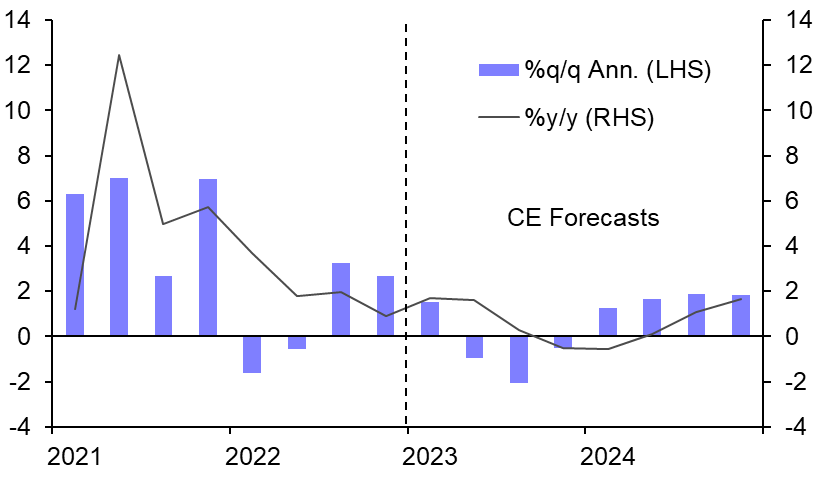

- Admittedly, activity and employment started the year on a strong footing, but we suspect the unseasonably mild winter in the Northeast provided something of a temporary boost. As those effects are reversed and the lagged impact of higher interest rates continues to feed through, which will now be compounded by smaller banks reining in lending, we expect GDP to begin contracting from the second quarter onwards. (See Chart 1.)

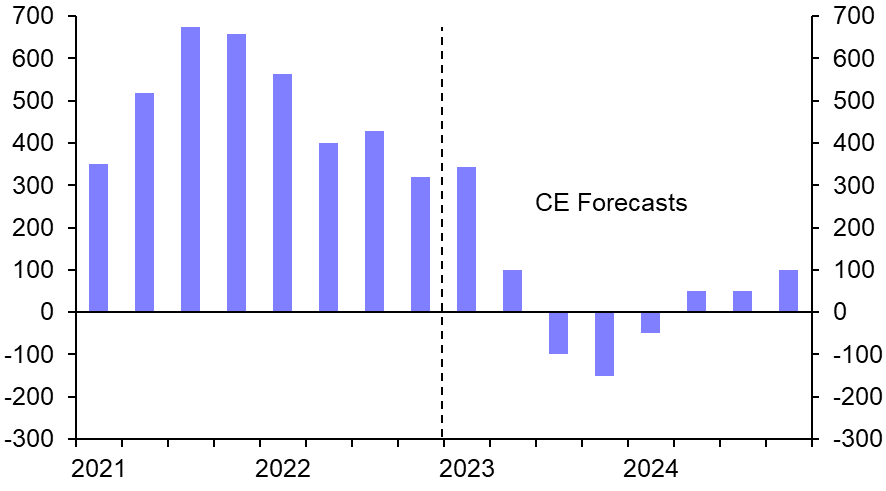

- Although labour market conditions have remained unusually robust, we also anticipate some modest declines in employment. (See Chart 2.) But the unemployment rate only rises to a peak of 5.2% in our baseline scenario, which would be unusually low when compared with recent cyclical downturns.

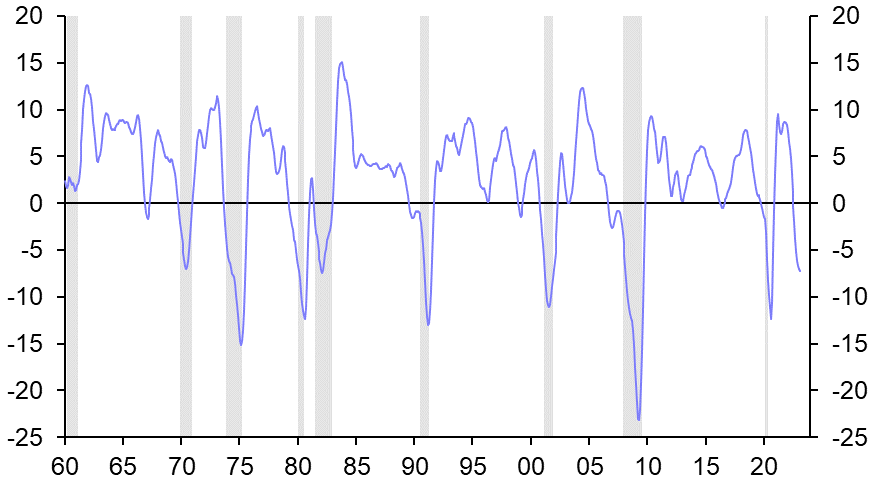

- Despite the strong start to the year evident in the coincident activity data, the growth rate of the leading economic index is deep in negative territory, which has proven to be an excellent recessionary signal, with few false positives over the past 50 years. (See Chart 3.)

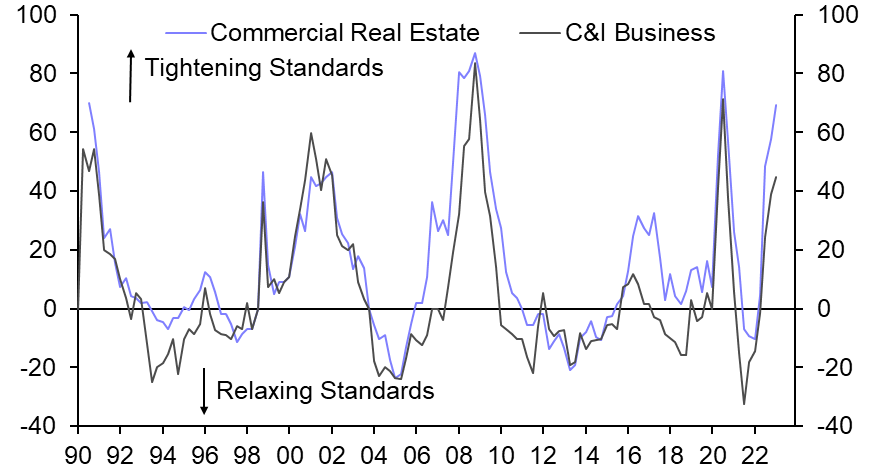

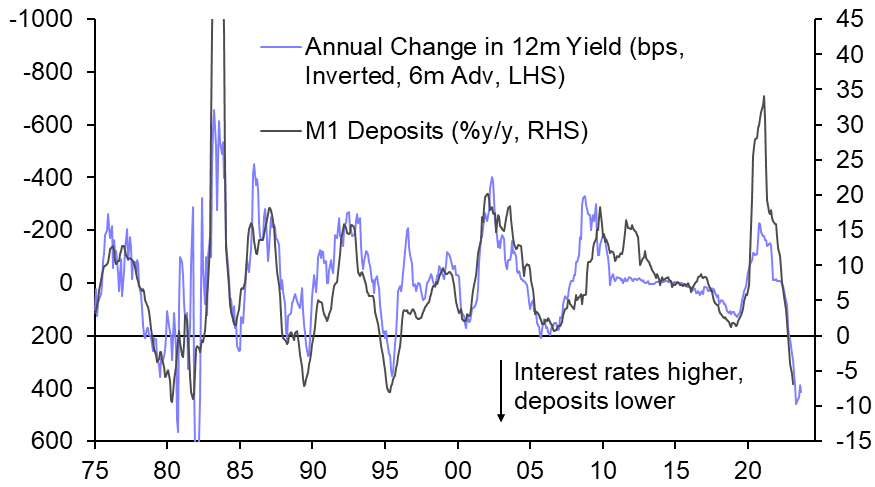

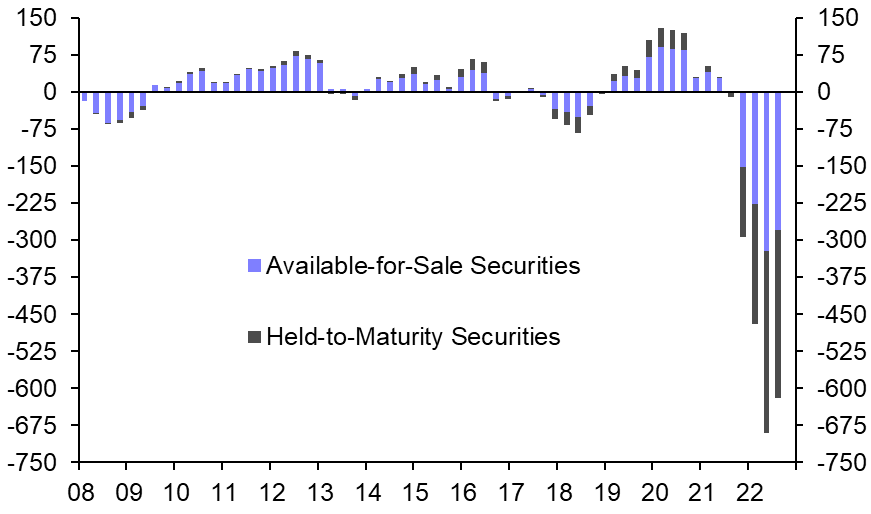

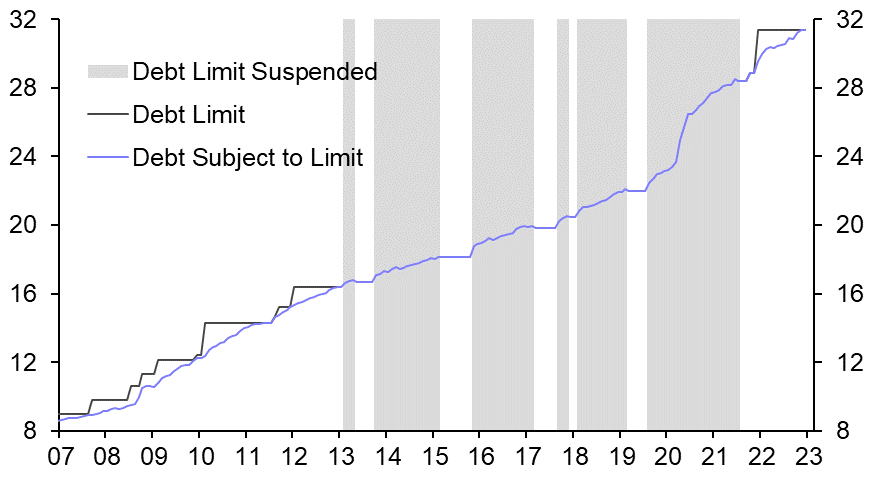

- Even before the collapse of SVB and Signature Bank, an elevated number of banks were tightening lending standards, particularly on business and commercial real estate borrowers. (See Chart 4.) Historically, tightening to that degree has only ever previously been seen in the immediate run up to, or during, recessions. While smaller banks are now seeing deposit flight because of concerns about large-deposit insurance, the broader issue is simply that, as interest rates have soared, savers have been shifting their money into money market funds that offer higher returns. (See Chart 5.)

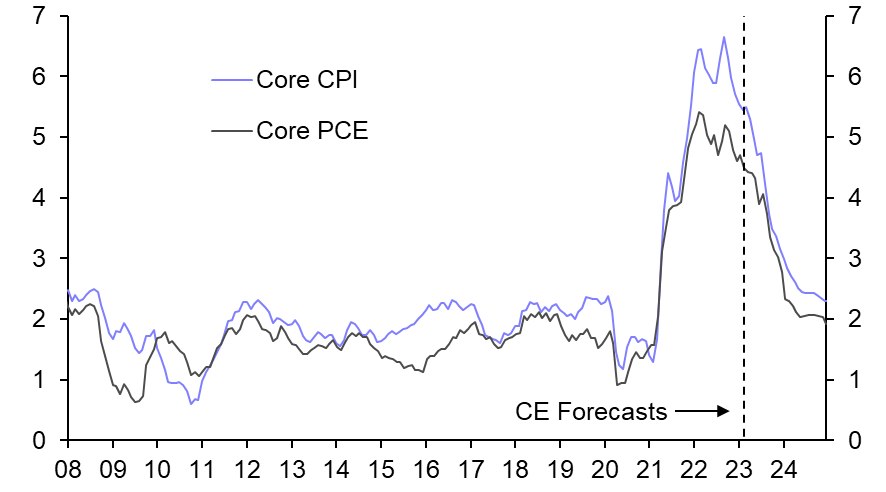

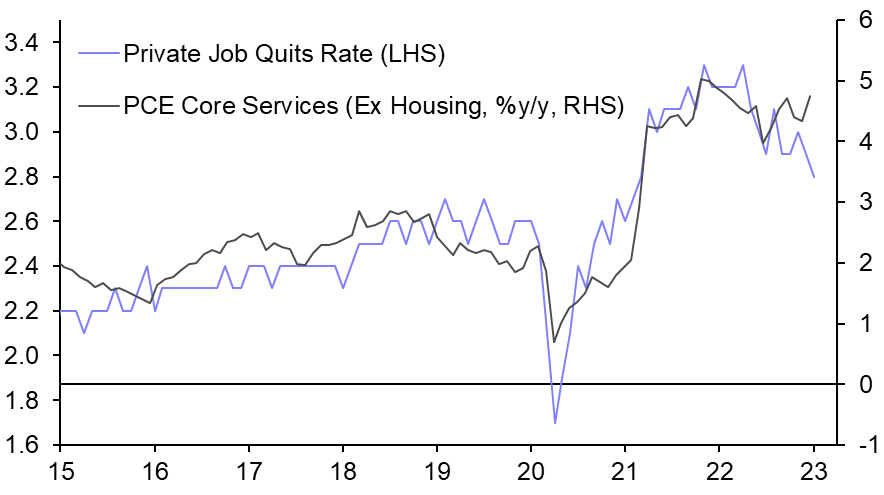

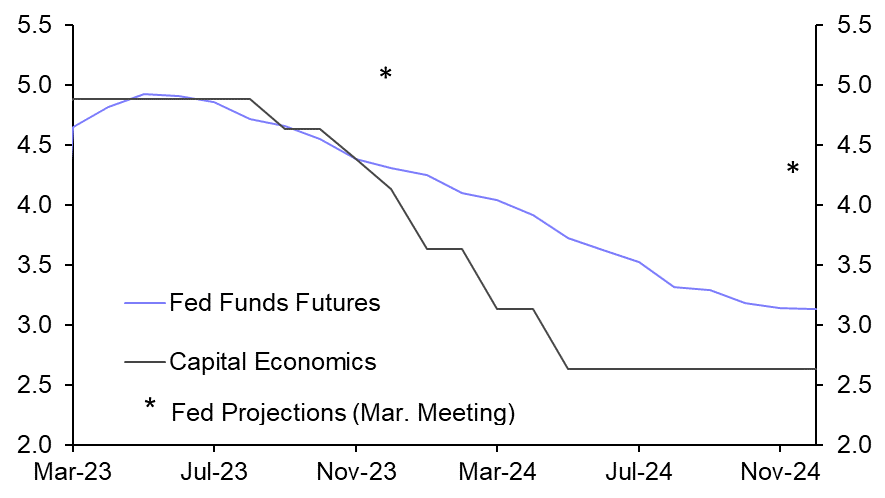

- Although we expect GDP to start contracting in the second quarter, we don’t expect the Fed to begin cutting interest rates until the end of the third quarter because of lingering concerns about still-elevated core inflation. (See Chart 6.) Core services inflation is taking longer to respond to the easing in labour market conditions evident in the drop in voluntary job quits. (See Chart 7.) Once the Fed does begin to lower rates, however, we expect a more rapid loosening of policy than futures markets are currently priced for. (See Chart 8.)

- While we still believe a softish landing is the single most likely outcome, we are reminded of Alan Greenspan’s warning that “sentiment about the economic outlook usually does not shift smoothly from optimism to neutrality to gloom; it’s like the bursting of a dam.” If stresses continue to build in the banking system and spill over into financial markets and the broader economy, then a much harder landing is possible.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sources: Refinitiv, CE, Federal Reserve |

This content is based on a report for Capital Economics clients written by Paul Ashworth, Andrew Hunter, and Olivia Cross and published on 29th March, 2023.

Make faster informed decisions

CE Advance, our new premium product, equips organisations with actionable macroeconomic data and insight to stay ahead of the curve.