Recession and rate cuts

Q1 2024 Euro-zone Economic Outlook

We expect the euro-zone to continue to broadly stagnate in the first half of this year. With inflation approaching the 2% target, the ECB will probably cut rates sharply.

These are just some of the key takeaways from our latest quarterly Euro-zone Economic Outlook, originally published on 12th December, 2023. Some of the forecasts contained within may have been changed since publication. Access to the complete report, including extensive forecasts and near to long-term analysis, is available as part of a subscription to our CE Advance premium platform or to our dedicated Euro-zone Economics coverage.

We expect the euro-zone to continue to broadly stagnate in the first half of this year. With inflation approaching the 2% target, the ECB will probably cut rates sharply.

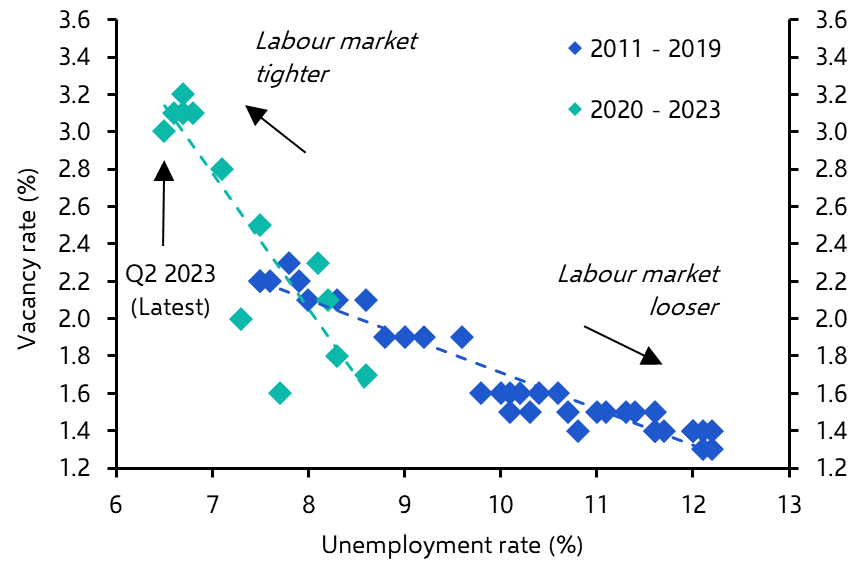

The euro-zone will remain in or close to recession in the first half of 2024 as the effects of higher interest rates continue to weigh on household consumption and investment, and fiscal policy is tightened. Headline inflation has already dropped sharply and will be close to the ECB’s 2% target for most of 2024. Although the labour market is still tight, it is easing and the level of vacancies is coming down from its recent highs. This should help to keep core inflation on a downward path. We suspect that the ECB will begin a policy easing cycle around April and forecast that it will cut its deposit rate from 4% currently to around 2.25% by the end of 2025.

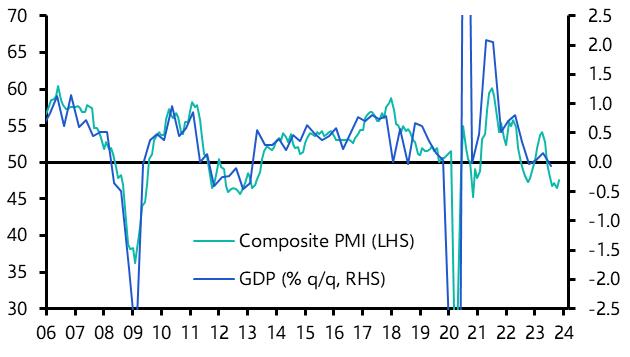

- The euro-zone economy has flat-lined for four successive quarters starting at the end of 2022 and business surveys suggest that things have deteriorated since the middle of the year. A technical recession is very likely. (See Chart 1.)

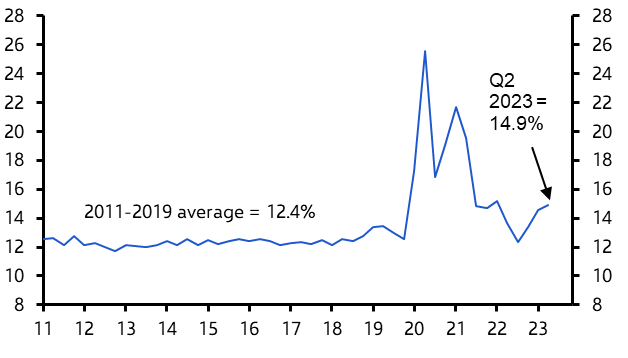

- Household consumption looks set to remain sluggish for some time. Admittedly, real household incomes should increase in light of the pick-up in wage growth and fall in inflation. But rather than spending their Covid windfalls, households have stepped up their saving rates in recent months. (See Chart 2.)

|

Chart 1: Euro-zone GDP & Composite PMI |

Chart 2: Household Savings (% of Disposable Income) |

|

|

|

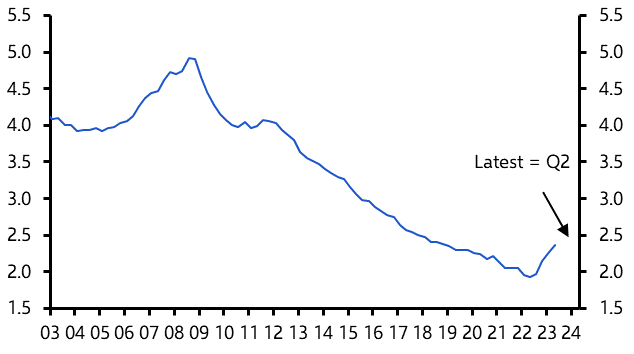

- Moreover, although the pass-through of tighter monetary policy has been slower than expected, the cost of servicing household debt will rise steadily. (See Chart 3.)

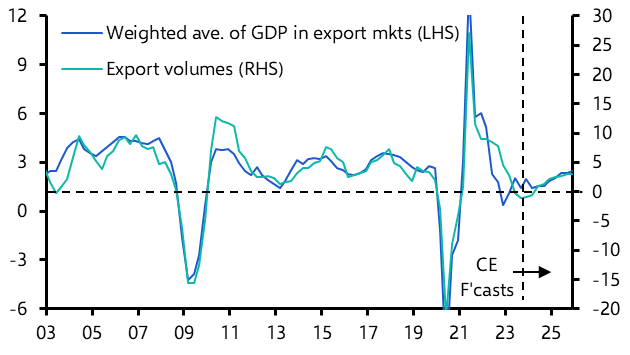

- Meanwhile, we expect only modest export growth given the lacklustre outlook for the euro-zone’s main trading partners. (See Chart 4.) And fiscal policy will be tightened in most countries this year as energy support is phased out and the EU’s fiscal rules are reinstated. Investment in property and machinery and equipment will be hit by a combination of weak demand and the rising cost of credit.

|

Chart 3: Euro-zone Household Interest Expenditure |

Chart 4: EZ Exports & GDP in Export Mkts (% y/y) |

|

|

|

- All told, we forecast GDP to contract in Q4 and flatline in the first half. We have then pencilled in a weak recovery as interest rates fall and real incomes rise.

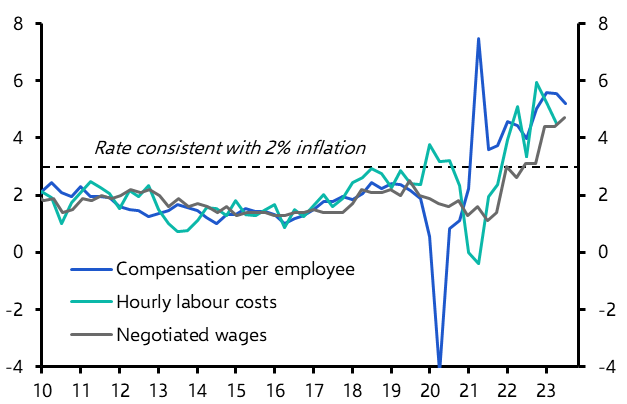

- The labour market has been resilient so far and measures of wage inflation and vacancy rates remain high by past standards. (See Charts 5 and 6.) However, surveys show declining employment intentions.

|

Chart 5: Labour Compensation (% y/y) |

Chart 6: Euro-zone Beveridge Curve |

|

|

|

- The big fall in headline inflation is now behind us as 2022’s energy price hikes have dropped out of the year-on-year comparison. Headline inflation is likely to trend down and core inflation should decline steadily this year too. (See Chart 7.)

- Policymakers will soon turn their attention to interest rate cuts. Whereas they had previously been reluctant to move before seeing more evidence that wage inflation has slowed, we think they will now be confident enough to start the easing cycle as soon as April. We forecast the deposit rate to fall to 2.75% by end-2024 and 2.25% by end-2025. (See Chart 8.)

|

Chart 7: Euro-zone Consumer Prices (% y/y) |

Chart 8: ECB Deposit Rate (%) |

|

|

|

|

Chart sources: Refinitiv, Capital Economics |

More insight and extensive two-year forecasts are available in our full Europe Economic Outlook, including

- How Germany will remain in or close to recession until well into 2024 because of its energy-intensive industrial sector, dependence on external demand and fiscal austerity.

- The factors supporting the case for a mild recession in France, even though it has weathered the energy price shock better than some.

- Why Italy is set for a period of stagnation as household incomes remain squeezed and the previously vigorous construction sector falters. Public finances are a vulnerability and we expect the debt ratio to rise.

- How economic growth will slow in Spain over the coming quarters, but also why it will still outperform the euro-zone as a whole. The rebound in household consumption will continue due to a very tight labour market, while the transmission of higher policy rates to household debt interest spending is largely complete.

- What happens as the Netherlands economy comes down from a post-Covid high and why we expect it to remain in recession in the first half of 2024.

- Why Prime Minister Costa’s resignation won’t change the near-term fiscal outlook in Portugal. But slower growth and higher interest rates will weigh on tourism and the housing sector.

- How Greece should continue to outperform the wider euro-zone economy for the next couple of years and public debt will fall.

- Why Ireland's economy is cooling as a result of rising interest rates and slowing investment in residential property.

Plus broader European economic coverage, including:

- How weakness in the mainland economy and krone appreciation will help to bring Norway's inflation down more quickly than Norges Bank is forecasting. As a result, we expect the Bank to begin cutting rates from a peak of 4.50% around the middle of 2024 – sooner than its own forecasts imply.

- Why, after a strong post-Covid rebound, Sweden is in a deep recession, and why we think the Riksbank will start rate cuts before long.

- How, in Switzerland, inflation has undershot the SNB’s forecasts and is likely to fall to around 1% next year and stay there. And why we think the SNB will cut interest rates by 25bp in March, followed by a further 50bp of cuts later in the year to take the policy rate to 1.0%.

These are just some of the key takeaways from a 27-page report published for Capital Economics clients on 12th December 2023 and written by Andrew Kenningham, Adrian Prettejohn, Bradley Saunders and Pollyanna Hall.

Get the full report

Trial our services to see this complete 27-page analysis, our complete Europe macro insight and forecasts and much more