It’s that time of year when economists set out their views of what to expect over the coming twelve months. You can find our contribution on this dedicated ‘World in 2024’ page, and listen to our podcast, in which I discuss the macro outlook for next year with David Wilder.

Most of this year has been focused on recession risks, the outlook for inflation and the associated implications for monetary policy. But we haven’t been fixed on these issues exclusively. As 2023 draws to a close, here are five pieces concentrating on what we think were the other major themes of the year:

The robots are coming, but not for our jobs

The debate around AI has become both myopic and hyperbolic. In our Spotlight report we presented a framework for thinking about the full macro and market effect of the AI revolution. The conclusions were generally positive – we argued that AI had the potential to raise productivity growth by up to 1.5%-pt a year, and we pushed back against the idea that AI would create widespread unemployment. But our AI Economic Impact Index showed how the US was better placed than Europe and China to reap the potential benefits from AI. And we argued that, even in the case of the US, it will be several years before the AI revolution starts to lift economic growth. Read the full report here and download our AI Economic Impact Index on CE Advance.

A new era of higher rates

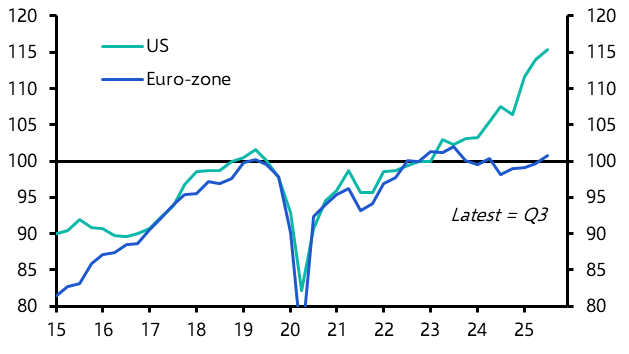

One of the key challenges facing central banks is knowing how much monetary tightening is enough. A large part of the answer depends on what has happened to the neutral real interest rate, or r* – a useful analytical concept, but something that is extremely difficult to observe in real time. In an in-depth September report, we argued that in the US r* may have risen by around 50bps to 1% since the pandemic. What’s more, we argued that it will rise further, to as much as 2% over the coming years. This won’t prevent central banks from being able to loosen policy in 2024, but it does mean that we’ve entered a period of higher interest rates following the years of ultra-loose policy in the 2010s.

Fiscal concerns will linger

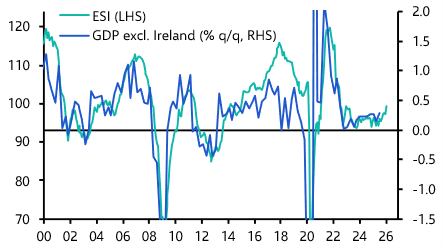

The public finances of several major advanced economies are looking increasingly shaky. Budget deficits are widening and not just because governments’ debt interest payments have increased – there has been a structural loosening of fiscal policy compared to the period immediately before the pandemic. At the same time, public debt burdens are significantly higher. In our view, all of this adds up to a toxic mess. We don’t expect an imminent fiscal crisis – not least because we think bond yields are likely to drop back next year as central banks cut interest rates. But a sustained effort is required to repair fiscal positions and there is a growing risk that governments that drag their feet will be punished by bond investors.

China’s slowdown in train

China’s economy is set to disappoint again in 2024 as a cyclical pick-up in activity that we anticipate in the first few months loses momentum and growth falls below 4% by year-end. The economy’s failure to secure a sustained recovery is because, as we explained in August, China’s trend growth is decelerating at a faster pace as its structural slowdown deepens. That analysis updated our 2018 report which made the case for Chinese growth to slow to just 2% by the 2030s. At the time of publication, our analysis was criticised for being overly (panda) bearish. Although our view has since become more widely accepted – forming the basis of a cover story by The Economist earlier this year – there’s still a pervasive belief in markets that, if only Beijing would ease credit or fiscal policy by just enough then Chinese economic growth could get back on track. The crowd of investors holding onto that idea will be further eroded by another year of economic disappointment.

US-China fracturing, visualised

The period of hyper-globalisation that turbocharged global growth between 1990 and 2020 may be over, but that doesn’t mean the world is deglobalising. Instead, we think the global economy is fracturing into two blocs – one that aligns primarily with the US and another that aligns with China. This shift is at the root of wide-ranging changes in the structure of global economic and financial relationships. We recently revisited our fracturing map, providing an interactive view of the data to show how relationships within and between the geopolitical groupings are evolving. And, for the first time, we made our decoupling database accessible to clients through an interactive dashboard.

As we shift into 2024, investors – and economists – will continue to fixate on when and by how much central banks could cut rates. But these are stories that will continue to evolve and shape macro and market outcomes long after the upcoming easing cycle has finished.

What you may have missed

Jonathan Petersen, a senior economist on our Markets team, looks at the outlook for the dollar in light of the stunning, Fed-fuelled rally in financial markets.

Senior EM Economist Liam Peach explains why the surge in Turkey’s FX reserves is less impressive than it appears.

After a series of roundtables held in London last week, our Property team addressed some of the key questions raised by clients.