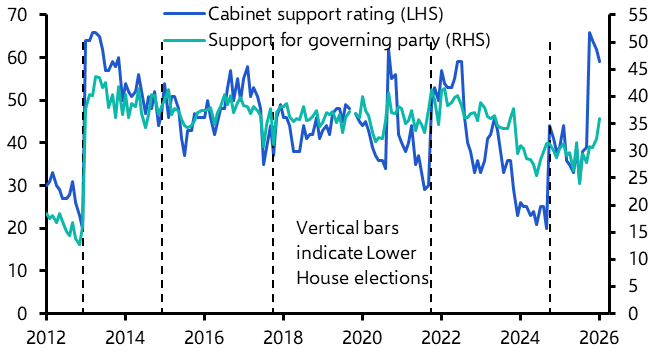

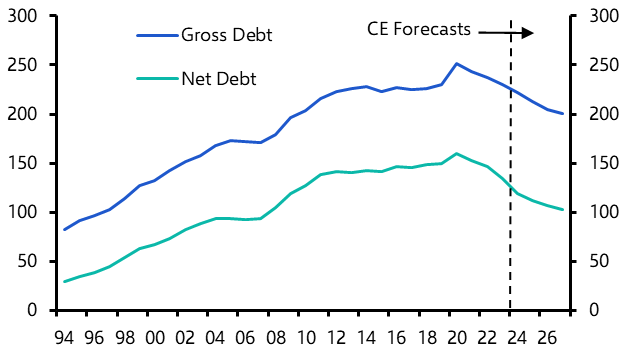

Japan’s 8th February snap election is Sanae Takaichi’s high-stakes bid to cement her mandate. But could a strengthened mandate encourage the prime minister further down a policy path that could ultimately lead to a fiscal crisis?

We’ll be online the day after the election at 08:00 GMT/16:00 SGT to analyse the results, explore what they mean for Japan’s fiscal and monetary balance, and discuss the implications for Japanese financial markets. During this 20-minute session, the team will be answering your Japan macro, policy and market questions as they address key issues, including:

- How the election outcome could influence Japan’s fiscal policy stance;

- 'Sanaenomics', the Japanese inflation outlook and BOJ strategy;

- Whether the yen could see further weakness, and JGB yields and Japan stocks more upside.

Start date:

You must be logged in to access this Drop-In. If you do not have a subscription, please get in touch with events@capitaleconomics.com