A version of this note was published in The Times on 7th November, 2023

World leaders gathered at Bletchley Park, the home of Britain’s wartime code breakers, last week to hammer out a joint response to an altogether more modern puzzle: how to regulate artificial intelligence.

This is perhaps the existential challenge that governments will face over the next decade. AI has the potential to radically alter how we live our lives and how firms, households and governments interact. Yet there is a natural tendency to frame its consequences in apocalyptic terms: at best, AI is coming for our jobs, at worst it will take over the world. In that vein, much of the communique that accompanied the Sunak government’s Bletchley summit was devoted to the technology’s potential threats and the associated need for guardrails.

This is not to say that the AI revolution will be entirely benign. You don’t have to be a technologist to see how AI could be used for ill, from election interference to terrorism. It is therefore important that governments agree on a common framework for regulating AI.

But there’s also a danger that they are overly-focused on the technology’s threats at the expense of helping to deliver its potential economic benefits.

Think steam and electricity

The extent to which AI will transform the economic outlook will depend to a large extent on whether it can be considered to be what is known in the jargon as a “general purpose technology”, or GPT. GPTs are technologies that have a wide range of applications across many sectors of the economy. The three classic examples are steam power, electricity and the internet. All three generated substantial improvements in productivity and growth.

In our recently published Spotlight project, we concluded that, on balance, generative AI met most of the conditions to be considered a GPT. Accordingly, it is reasonable to believe that, like previous GPTs, it will deliver major economic benefits. We concluded that it could raise productivity growth by as much as 1.5%-pts a year in the decade after widespread adoption – although we also cautioned that lags between the innovation of the technology and its diffusion throughout economies meant that most of these gains were likely to arrive in the 2030s rather than immediately.

What’s more, we argued that widespread concerns that AI would lead to mass unemployment were misplaced. The AI revolution will create huge dislocation in labour markets as the structure of economies is altered and jobs within certain sectors are lost. But while some roles will be lost, new ones will be created. And if the adoption of AI leads to faster economic growth, then the resulting boost to real incomes will generate additional spending and thus demand for labour. There is no reason to expect a surge in AI-induced unemployment – or the need to consider more radical policy proposals such as Universal Basic Income policies.

The upshot is that, while AI creates some substantial moral, social and political challenges, it also has the ability to transform the long-term growth outlook without creating the rise in joblessness that many fear.

Yet the potential gains from AI will not arrive, in the words of the economist Robert Solow, like “manna from heaven”. They will depend on the actions of policymakers.

Winning the global AI race

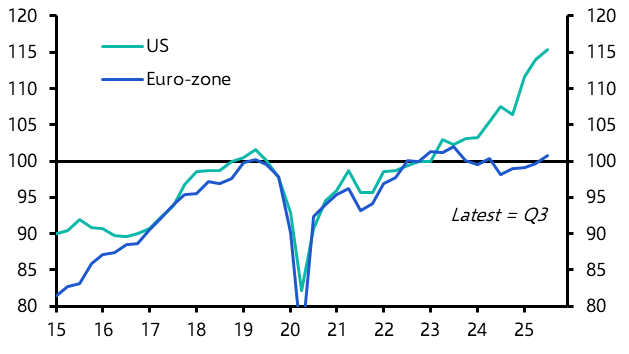

A key insight of our AI Economic Impact Index, which ranks countries according to their ability to innovate, diffuse and adapt to the technology, is that the US – and, perhaps surprisingly, the UK – rank higher than not only the major euro-zone economies but also China.

This is partly due to economic structure – the US and UK have large service sectors, which means AI will be more easily deployed. But it also reflects their greater economic flexibility (and thus ability to adapt to the dislocations caused by AI) and, in the case of the US, the economy’s long-standing ability to diffuse new technologies more quickly. This is one reason why we expect the economic outperformance of the US over Europe to accelerate – and why we are sceptical that China will overtake the US to become the world's largest economy when measured at market exchange rates.

What emerges is a more nuanced picture than the one that has been painted in some quarters over the past week. While AI has the potential to do great harm it also has the potential to transform our lives and livelihoods for the better. Yet the extent to which these economic benefits are realised will depend in large part on government policies.

It is encouraging that world leaders recognise the need to agree on a common set of principles for regulation against AI’s threats. But we need to hear much more about how they plan to harness the potential economic gains.

In case you missed it

Chief Markets Economist John Higgins discussed our financial markets forecasts in the wake of Friday’s “Goldilocks” employment report.

Sweden’s Riksbank, like many other central banks, is facing losses on its QE purchases. Chief Europe Economist Andrew Kenningham explains why its request for a capital injection to cover these could raise questions about both its independence and the broader crisis strategy of buying assets.

Temporary residents now account for a record 5.5% of the Canadian population. Stephen Brown, our Canada research head, warns their departure could turn a modest recession into a deeper one.