US Commercial Property

Our US commercial real estate coverage provides detailed analysis, independent forecasts, and outlooks for the commercial property market across the US. We offer rapid responses to new data and developments, along with in-depth coverage of key themes, current trends, and future outlooks for commercial property values and market dynamics.

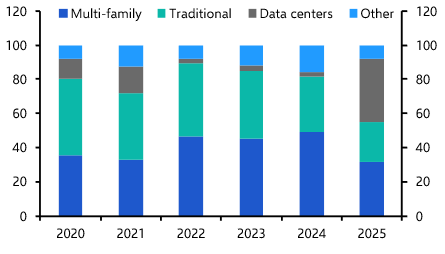

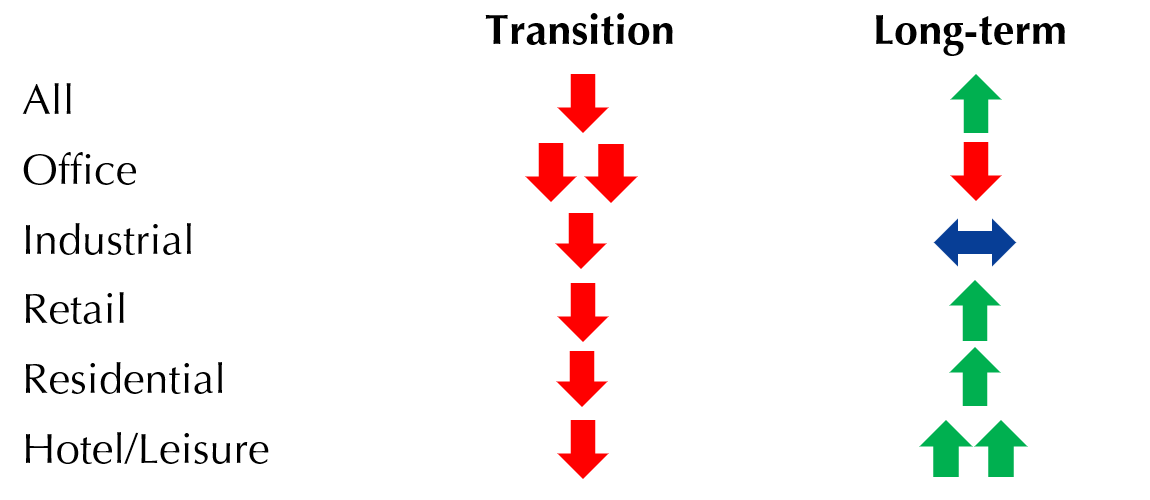

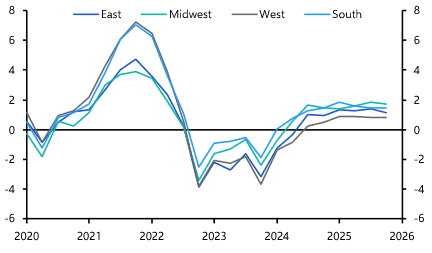

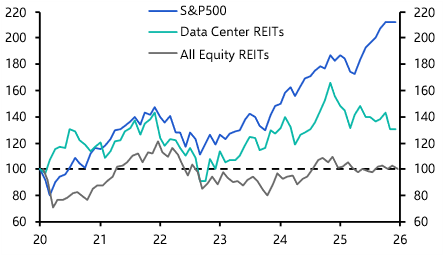

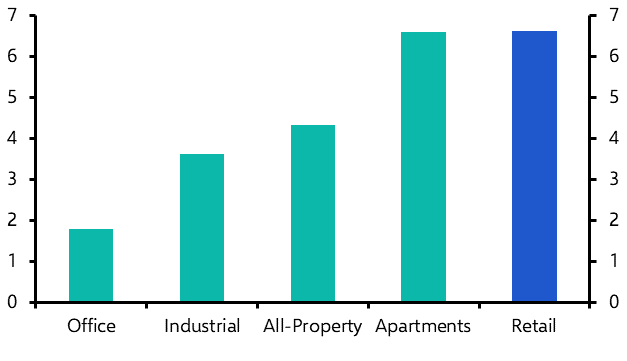

This service provides detailed analysis and independent forecasts for the US commercial property market, based on our view of the economic fundamentals. The subscription includes detailed five-year forecasts for the four key commercial property sub-sectors – office, apartments, retail and industrial – as well as for 17 major metros in both the office and apartments sectors. Our analysis focuses on highlighting future opportunities and challenges for investment and occupier markets.

This service is relevant to all stakeholders in US commercial real estate – from investors and developers to brokers and lenders.

The subscription to this service includes publications, access to our online research archive and our economists, and the opportunity to attend our conferences, forums and webinars.

- Timely, clear and concise research.

- Unique, independent forecasts.

- Rapid responses, concise summations and detailed analysis.

Explore US commercial property in data

We have recently launched our brand new interactive Dashboard that allows you to explore all of our forecasts and key data for US commercial property.

Read a sample of our US Commercial Property Outlook

This edition of our quarterly report includes two-year forecasts and concise insight into how the commercial property sector will fare. It addresses the key issues that will shape returns

Try for free

Experience the value that Capital Economics can deliver. With complimentary access to our subscription services, you can explore comprehensive economic insight, data and charting tools, and attend live virtual events hosted by our economists.

Featured Economists

-

Kiran Raichura

Chief Commercial Real Estate Economist

Kiran heads up our Commercial Real Estate Team, having spent more than 15 years analysing and forecasting global real estate markets, including five years running our European Commercial Property service. Prior to joining Capital Economics, Kiran spent four years at AXA Real Assets, a global fund manager, where he was the team’s macroeconomic lead and was responsible for the firm’s Nordic and Central European investment strategies. Prior to this role, Kiran spent four years at Colliers International in London, leading its UK Commercial Property forecasts. Kiran holds a Bachelor’s degree in Economics from The University of Warwick and a Masters in Real Estate Investment & Finance from Henley Business School & Reading University. He is a member and former chairperson of the Society of Property Researchers and is a member of the ULI.

-

Henry Chan

Commercial Real Estate Economist

Henry Chan joined Capital Economics as a Commercial Real Estate Economist in February 2025, currently covering Asia-Pacific and US Commercial Property. Before joining Capital Economics, he was a Manager of Asia Pacific Research at CBRE. Prior to that, Henry worked for a major Hong Kong developer and a family office real estate firm, as an economist and an investment analyst respectively. Henry holds a Master’s degree in Economics from The Chinese University of Hong Kong and a Bachelor’s degree in Economics and Finance from The University of Hong Kong.

-

Thomas Ryan

North America Economist

Thomas joined Capital Economics as an Economist in October 2023 and currently works on our North America service. Prior to joining Capital Economics, he worked as an Economic & Markets Analyst at Longview Economics, covering developed markets. Thomas holds a BSc in Economics from the University of Warwick and an MSc in Economics from Queen’s University Belfast.