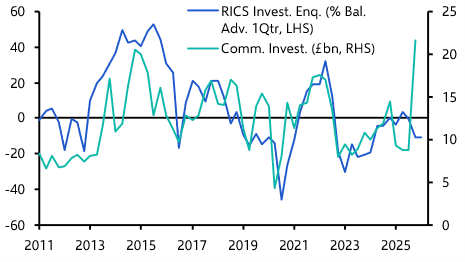

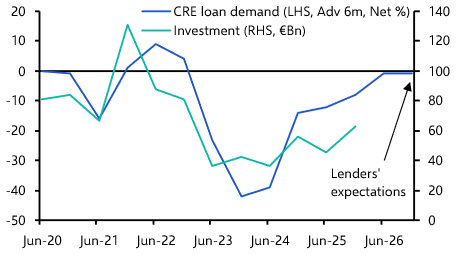

Global property markets have been recovering through the first half of 2025, with tariffs and other uncertainties showing only limited impact so far. But the recovery remains slow: REITs continue to trade at sizeable discounts to NAV, closed-end fund fundraising is muted, and in many markets buyers and sellers are still far apart on price. What’s behind the sluggish pace and what could accelerate it?

To answer client questions, our commercial real estate team hosted special online briefings, all about the state of the market and the outlook through the remainder of 2025 and beyond. This session includes focus on US, UK and European markets.

Start date: