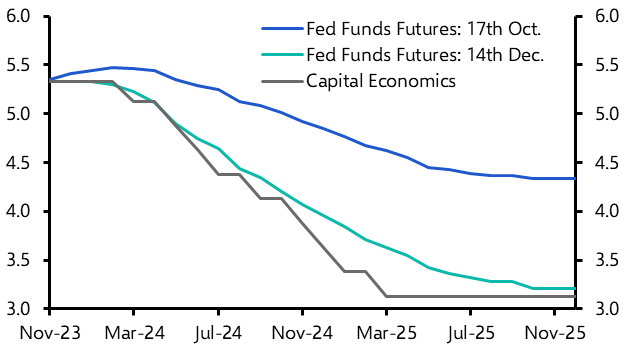

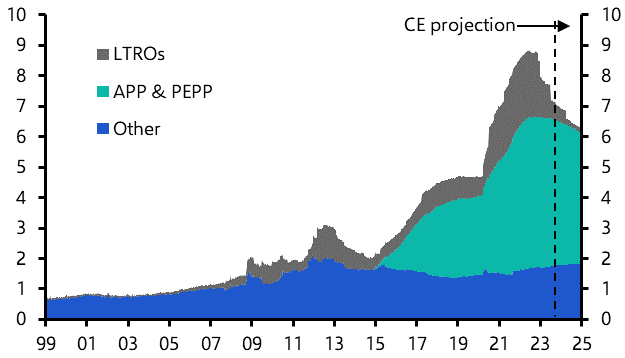

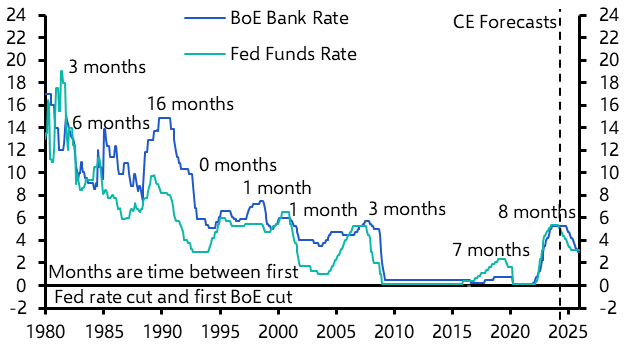

After the Fed supercharged the bond market’s recovery, Group Chief Economist Neil Shearing talks to David Wilder about issues around 2024’s flagged rate cuts, including the impact of loosening financial conditions as investors front-run policymakers, whether “team transitory” has been proved right, and why the ECB and Bank of England are still sounding decidedly hawkish.

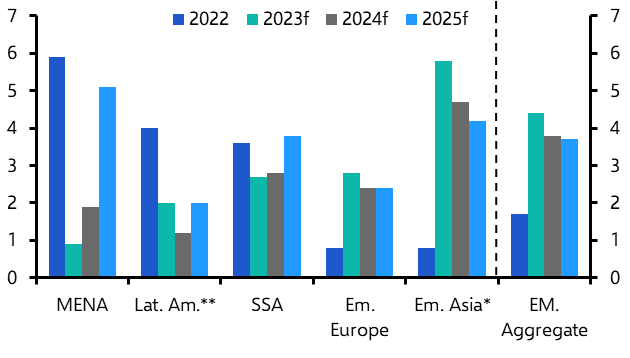

Plus, our EM team sees “unusually large” growth divergence coming for emerging market economies in 2024. Deputy Chief EM Economist Shilan Shah and Assistant Economist Leah Fahy highlight the key takeaways from our latest quarterly EM Economic Outlook – including how elections could shape these economies in the coming year.

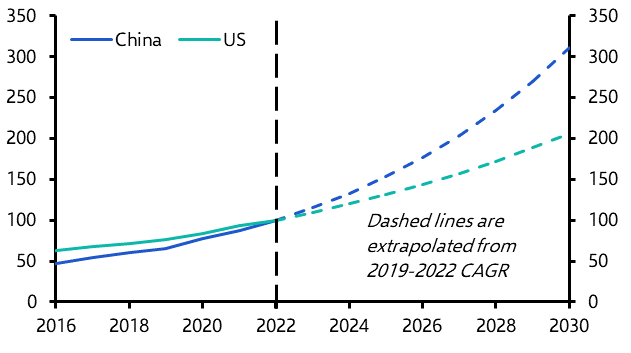

Finally, the agreement among participants of the UN Climate Conference in Dubai was described as “historic”, but what was actually achieved that will help meet climate goals? David Oxley, the head of our Climate Economics coverage, separates the reality from the hype to show why some of the cynicism around the deal isn’t entirely warranted, but also explains the challenges of building out renewables to meet COP28 commitments as well as the long-term impact of the green transition on the oil market.